Pre-Open Data

Key Data for the Week

- Thursday – AUS – Unemployment Rate fell by 0.1% to 4.5% in August, while hours worked slipped 3.7%.

- Friday – UK – Retail Sales

- Friday – EUR – Consumer Price Index

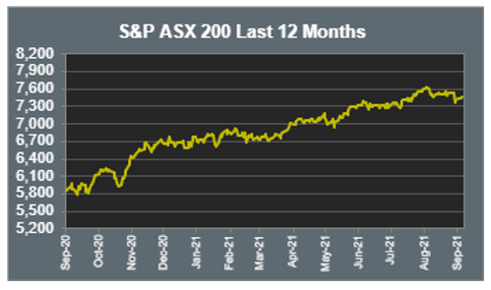

Australian Market

The Australian sharemarket rose 0.6% on Thursday, as most sectors closed ahead. The local market mimicked the US, as the broad rally was supported by a strong performance from the Energy sector (1.3%). The Financials and Health Care sectors also performed well, as both closed ahead 0.9%.

Commodity prices have dictated much of the market’s movement lately, as the demand for iron ore weakens, and the supply of oil dries up. The Energy sector’s strong performance followed as investors factored in higher global oil prices. Key performers included Woodside Petroleum (2.5%), Oil Search (2.1%) and Santos (2.2%). Meanwhile, the price of iron ore extended its rout as China’s steel production fell again in August. This led to a mixed session for the Materials sector, as Fortescue Metals conceded 3.2% and Rio Tinto slipped 0.9%, while BHP rose 1.0%.

News of Australia’s interest in making nuclear-powered submarines provided a boost to uranium, which further enhanced the upside potential of its primary producer, Paladin Energy, which has experienced significant growth in the last few weeks.

The major banks all solidified following yesterday’s mixed session. Commonwealth Bank led gains, up 1.4%, while ANZ, Westpac and NAB advanced 0.9%, 0.8% and 0.2% respectively. Other financial stocks of note included Australian Ethical Investment (1.6%), Liberty Financial Group (1.3%), and Macquarie Group (1.0%).

The Australian futures point to a 0.24% decrease today.

Overseas Markets

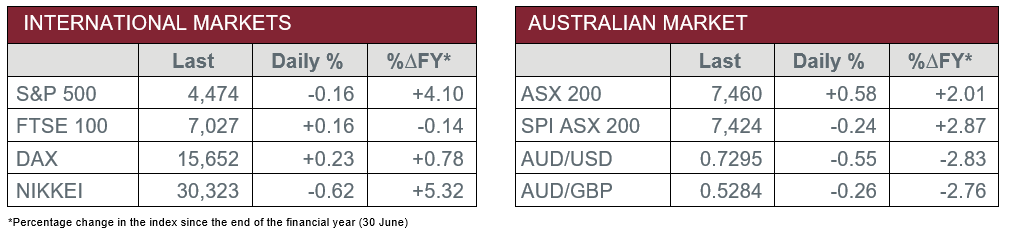

European sharemarkets recovered on Thursday, as the STOXX Europe 600 rose 0.4%, while both the German DAX and the UK FTSE 100 edged 0.2% higher. The spot iron ore price fell further, which resulted in London-listed BHP and Rio Tinto down 3.4% and 4.0%. Meanwhile, the better performers included travel and leisure (1.6%) and automaker (1.2%) stocks. The Utilities sector (0.2%) firmed, despite yesterday’s ~3.0% tumble, however, remains under pressure from recent energy bill regulations.

US sharemarkets were mixed on Thursday, as investors considered the quarterly expiration of options and futures on Friday, which typically brings greater volatility and trade volumes. The S&P 500 and Dow Jones both shed 0.2%, while the NASDAQ added 0.1%. Most sectors closed in the red, with Consumer Discretionary being the primary gainer, up 0.4%. The Information Technology sector closed relatively flat, up 0.1%, however included key movers for the day, CrowdStrike and Fortinet, which were ahead 2.0% and 0.8% respectively.

CNIS Perspective

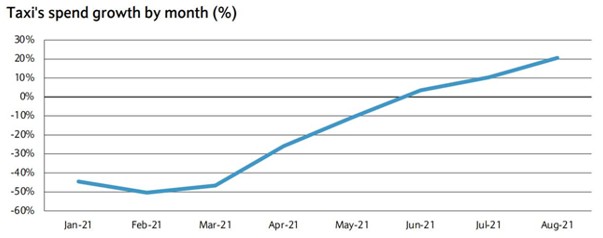

COVID has obviously had an impact on the health of populations around the world, but if the UK experience is anything to go by, the post-COVID lifestyle may also have an adverse impact on health, but in an entirely different manner.

The UK’s ‘Freedom Day’ was two months ago and spending habits recorded on Barclays credit cards suggest that life changes quite dramatically post lockdowns.

Total spending on services in the UK has been positive since April 2021 and significantly stronger relative to 2019. Drivers of the growth included an acceleration in spending in pubs and bars (43%), eating and drinking (44%) and entertainment (24%), from August 2019 levels.

Another key trend following the easing of restrictions has been the rising spend on Taxi services, jumping 20.6% in August.

Interestingly, the death rate is well below the warnings of health experts at the time of ‘Freedom Day’.

The question is whether Australia will party as hard as the UK have post lockdown?

Should you wish to discuss this or any other investment related matter, please contact your Investment Services Team on (02) 4928 8500.

Disclaimer

The material contained in this publication is the nature of the general comment only, and neither purports, nor is intended to be advice on any particular matter. Persons should not act nor rely upon any information contained in or implied by this publication without seeking appropriate professional advice which relates specifically to his/her particular circumstances. Cutcher & Neale Investment Services Pty Limited expressly disclaim all and any liability to any person, whether a client of Cutcher & Neale Investment Services Pty Limited or not, who acts or fails to act as a consequence of reliance upon the whole or any part of this publication.

Cutcher & Neale Investment Services Pty Limited ABN 38 107 536 783 is a Corporate Authorised Representative of Cutcher & Neale Financial Services Pty Ltd ABN 22 160 682 879 AFSL 433814.

Cutcher's Investment Lens | 7 - 11 April 2025

The failed $3 million super tax: Division 296 is done… or is it?

Cutcher's Investment Lens - Update on Trump & Tariffs | 31 March - 4 April 2025

Liberation Day - April 2025 Snapshot

Smart investing for SMEs: The basics on how to get started and grow your business.