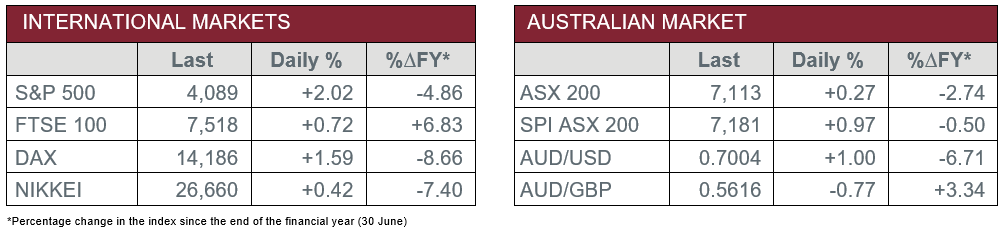

Pre-Open Data

Key Data for the Week

- Tuesday – EUR – Gross Domestic Product grew 0.3%, after a 0.2% increase last quarter.

- Tuesday – UK – ILO Unemployment Rate fell to 3.7% in March, from 3.8% in the month prior.

- Wednesday – AUS – Wage Price Index

- Wednesday – EUR – Consumer Price Index

- Wednesday – UK – Consumer Price Index

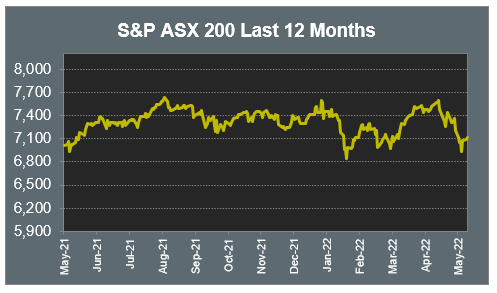

Australian Market

The Australian sharemarket enjoyed further gains yesterday, as it added 0.3%. This comes as the price of oil and iron ore rose upon rumours China would begin to ease their strict COVID lockdown measures later this week.

The Energy sector was the best performer on the market, up 2.1%, as the price of oil increased to ~US$113 per barrel. As a result, Woodside Petroleum and Santos both lifted 2.0%, while Beach Energy closed the session 6.1% higher.

The major miners lifted the Materials sector, as the potential easing of Chinese lockdowns is expected to see the demand for iron ore increase. BHP added 0.6% and Rio Tinto rose 2.2%, while Fortescue Metals was up 2.3%. Lithium miners also enjoyed gains; Allkem lifted 5.5%, Core Lithium jumped 9.3% and Pilbara Minerals closed the session up 5.0%.

All four major banks extended their recent run of gains; Commonwealth Bank added 1.7%, while NAB, Westpac and ANZ all rose between 0.1% and 0.5%. Among the other banks, Macquarie Group lifted 0.5% and Suncorp added 1.1%, while Bank of Queensland dropped 0.1%.

The Australian futures market points to a 0.97% rise today, led higher by overseas sharemarkets.

Overseas Markets

European sharemarkets closed higher on Tuesday, also buoyed by gains in the Energy and Materials sectors. The oil majors rose; BP added 1.5% and TotalEnergies rose 1.2%, while Royal Dutch Shell lifted 0.5%. In the Materials sector, Glencore led the gains and increased 3.1%, while London-listed Rio Tinto was up 2.5%. By the close of trade, the STOXX Europe 600 added 1.2% and the German DAX lifted 1.6%, while the UK’s FTSE 100 gained 0.7%.

US sharemarkets also rose overnight, led by a rally in the Information Technology sector. Most sectors finished the session higher, as they were aided by the news of COVID restrictions easing in Shanghai. NVIDIA led the gains, up 5.3%, while Amazon and Apple rose 4.1% and 2.5% respectively. Cybersecurity providers also gained; Fortinet added 2.6% and CrowdStrike Holdings lifted 0.6%.

By the close of trade, the S&P 500 added 2.0% and the Dow Jones lifted 1.3%, while the NASDAQ rose 2.8%.

CNIS Perspective

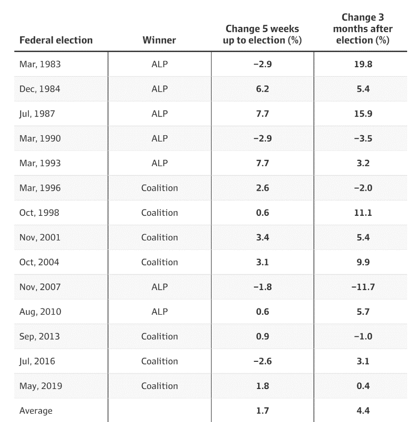

As we head to the polls this Saturday, the question on everyone’s mind is what impact will the election outcome have on the Australian sharemarket?

While federal elections throw up uncertainties, investors typically look beyond the campaign promises.

As shown in the table below, on average, the ASX performs well in both the lead up to, and post-election.

The most impressive post-election returns of 1983 and 1987 occurred during periods of significant economic reform, where productivity enhancing policies fundamentally changed the trajectory of the outlook for Australia.

The Australian economy has been quite resilient post-pandemic, and as we enter a new economic cycle of higher inflation and higher interest rates, there is considerable focus on economic reforms to structurally reduce the cost of living over this next term of office.

Should you wish to discuss this or any other investment related matter, please contact your Wealth Management Team on (02) 4928 8500.

Disclaimer

The material contained in this publication is the nature of the general comment only, and neither purports, nor is intended to be advice on any particular matter. Persons should not act nor rely upon any information contained in or implied by this publication without seeking appropriate professional advice which relates specifically to his/her particular circumstances. Cutcher & Neale Investment Services Pty Limited expressly disclaim all and any liability to any person, whether a client of Cutcher & Neale Investment Services Pty Limited or not, who acts or fails to act as a consequence of reliance upon the whole or any part of this publication.

Cutcher & Neale Investment Services Pty Limited ABN 38 107 536 783 is a Corporate Authorised Representative of Cutcher & Neale Financial Services Pty Ltd ABN 22 160 682 879 AFSL 433814.

Smart investing for SMEs: The basics on how to get started and grow your business.

ATO updates: A quick guide on what business owners need to know.

Cutcher's Investment Lens | 24 - 28 March 2025

Is your current super fund holding you back? It might be time for an SMSF.

Cutcher's Investment Lens | 17 - 21 March 2025