Pre-Open Data

Key Data for the Week

Key economic data released this week:

- Tuesday – US – Retail Sales declined to 0.3% in October, from 1.6% in September, falling short of expectations.

- Wednesday – US – Housing Starts

Australian Market

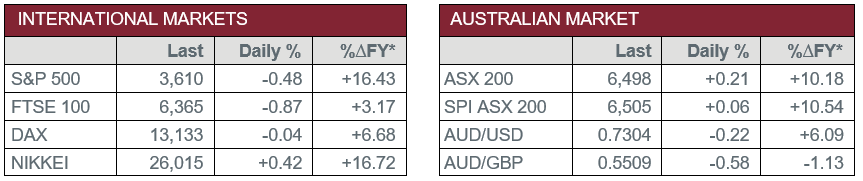

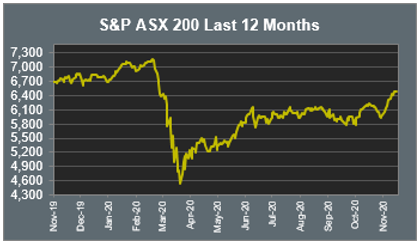

The Australian market lifted 0.2% yesterday as investors remained optimistic following COVID-19 vaccine developments by US company, Moderna. Trading was mixed; the Energy and Financials sectors led the gains, while the Utilities and Information Technology sectors fell over 1.9%.

The Energy sector advanced on Tuesday following a 3.0% lift in global oil prices. Beach Energy jumped 6.5% and Oil Search added 4.3%, while Woodside Petroleum and Santos both gained 3.4%.

Gains among the big four banks contributed to broader market improvements. ANZ climbed 2.5% and Westpac added 2.3%, while NAB and Commonwealth Bank rose 1.6% and 1.2% respectively. Insurers also enjoyed gains; QBE Insurance Group jumped 4.2%, while Insurance Group Australia lifted 1.9% and NIB closed up 1.7%.

The Information Technology sector extended its losses, down 2.8%. Buy-now-pay-later stocks were hardest hit, with Afterpay down 5.4%, despite an announcement at the company’s AGM that November global sales are on track to exceed October’s record figures. Sezzle slumped 3.0%, while Zip Co fell 0.7%. Software company Altium slipped 3.5%, while Appen lost 3.1%.

The Australian futures market points to a 0.06% rise today.

Overseas Markets

European sharemarkets slipped from eight-month highs overnight, as stricter COVID-19 restrictions across the continent diminished investor optimism of a swift economic rebound. Travel stocks were the weakest performers; International Airlines Group sunk 3.3% and Ryanair lost 2.2%, while easyJet fell 1.9% after the company recorded a £1.27 billion annual loss. The Industrials sector extended its gains; Eiffage added 1.0% and Vinci rose 0.4%, however, Veolia closed down 0.6%. By the close of trade, the UK FTSE 100 lost 0.9% and the STOXX Europe 600 slipped 0.2%, while the German DAX fell 0.1%.

US sharemarkets also fell on Tuesday as rapidly growing COVID-19 cases and fears of lockdowns weakened investor sentiment. Pharmacy owners CVS Health and Walgreens Boots Alliance slumped 8.6% and 9.6% respectively, after Amazon (+0.2%) launched its online pharmacy. The Information Technology sector was mixed; Spotify and Fortinet gained 1.9% and 1.5% respectively, while Facebook slid 1.4%, Microsoft fell 1.3% and Apple slipped 0.8%. By the close of trade, the Dow Jones fell 0.6% and the S&P 500 lost 0.5%, while the NASDAQ closed down 0.2%.

CNIS Perspective

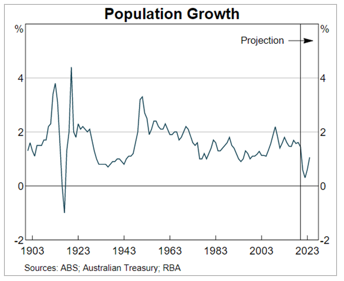

In a speech this week, the RBA Governor Philip Lowe discussed Australia’s extremely slow population growth experienced over 2020 and heading into 2021.

Over the past two decades, Australia's population grew at an average annual rate of 1.5%, in 2020/21 it is expected to increase by just 0.2%.

Why is population growth so important to our nation? In the words of Dr Lowe, “It has underpinned our relatively fast growth in GDP compared with other advanced economies”.

In real terms, Australia’s population growth has added between 0.5% and 1% of GDP growth per annum. Without this, Australia’s GDP growth rate would have been ~25% lower over the last 20 years!

Australia needs a constant influx of young skilled migrant workers to get the economy powering again post-COVID, along with slowing the rate of our ageing population.

The RBA is keeping one eye on the rebound in population growth. While it is hard to see population growth flatlining, if it remains noticeably slower in a post-COVID world, we would be in for a challenged economic recovery.

Should you wish to discuss this or any other investment related matter, please contact your Investment Services Team on (02) 4928 8500.

Disclaimer

The material contained in this publication is the nature of the general comment only, and neither purports, nor is intended to be advice on any particular matter. Persons should not act nor rely upon any information contained in or implied by this publication without seeking appropriate professional advice which relates specifically to his/her particular circumstances. Cutcher & Neale Investment Services Pty Limited expressly disclaim all and any liability to any person, whether a client of Cutcher & Neale Investment Services Pty Limited or not, who acts or fails to act as a consequence of reliance upon the whole or any part of this publication.

Cutcher & Neale Investment Services Pty Limited ABN 38 107 536 783 is a Corporate Authorised Representative of Cutcher & Neale Financial Services Pty Ltd ABN 22 160 682 879 AFSL 433814.

Smart investing for SMEs: The basics on how to get started and grow your business.

ATO updates: A quick guide on what business owners need to know.

Cutcher's Investment Lens | 24 - 28 March 2025

Is your current super fund holding you back? It might be time for an SMSF.

Cutcher's Investment Lens | 17 - 21 March 2025