Pre-Open Data

Key Data for the Week

- Wednesday – EUR – Consumer Price Index was at 4.1% in October, up from 3.4% in September. Core inflation reached 2.0%.

- Wednesday – US – Building Permits rose 4.0% in October.

- Thursday – US – Initial Jobless Claims

- Thursday – UK – Retail Sales

Australian Market

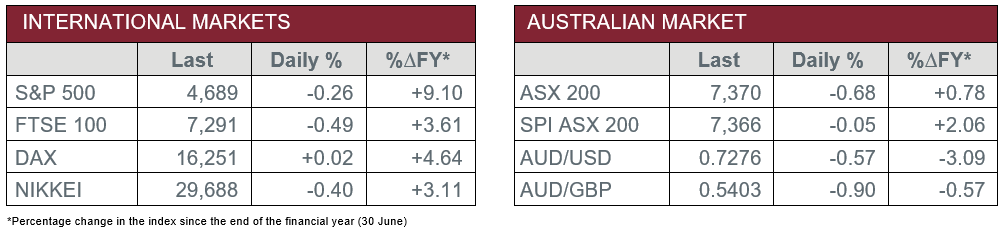

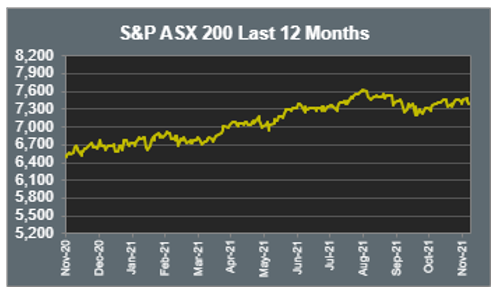

The Australian sharemarket dropped 0.7% on Wednesday, as the Financials sector closed the session 2.7% lower.

Commonwealth Bank fell 8.1% during yesterday’s trade after releasing their earnings report. The share price was weakened by tighter net interest margins given recent low interest rates. Of the other banks, NAB lost 1.1%, Westpac conceded 1.7% and ANZ shed 2.0%.

The major miners also closed the session in the red. Fortescue Metals was the hardest hit, down 1.9%, while BHP and Rio Tinto lost 1.5% and 1.0% respectively. Gold miners also lost ground; Evolution Mining dropped 2.9% and Northern Star Resources shed 1.3%.

The Information Technology sector was the best performer on the market yesterday, as it added 1.7%. Gains were led by artificial intelligence provider, Appen, which jumped 4.5%. Among the other Information Technology stocks, WiseTech Global jumped 3.0% and Xero lifted 1.4%, while buy-now-pay-later providers, Afterpay and Zip, added 2.1% and 1.9% respectively.

The Australian futures market points to a relatively flat open today.

Overseas Markets

European sharemarkets closed at record highs on Wednesday, as positive earnings reports outweighed worries regarding inflationary pressures caused by increased petrol prices. Despite the increased prices, major oil providers lost ground; BP shed 0.9% and Royal Dutch Shell lost less than 0.1%.

By the close of trade, the German DAX eked out a 0.1% gain and the STOXX Europe 600 rose 0.2%, while the UK FTSE 100 closed 0.5% lower.

US sharemarkets closed lower overnight, as investors prepare for interest rates to rise sooner than expected. Target was the latest retailer to post results. The company beat profit expectations and raised forecasts, although shares closed 4.8% lower due to ongoing supply chain issues.

By the close of trade, the Dow Jones conceded 0.6%, while the S&P 500 and the NASDAQ both dropped 0.3%.

CNIS Perspective

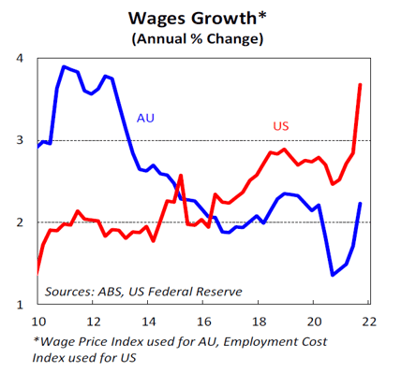

The correlation between benign wages growth and low inflation has been in place for over ten years and with attention now well and truly focussed on rising inflation, the latest wages data also draws a fair share of interest.

Australia’s September quarter wages growth data shows annual growth at a 2-year high and back to pre-pandemic levels.

The lift in wages growth in Australia is subdued relative to other major economies such as the US and UK, which partly reflects labour force participation rates remaining well under pre-pandemic levels in these other countries.

As noted yesterday, the RBA suggests wages growth will need to be over 3% to get inflation sustainably back in the target band. We are still some way from that level.

Markets are pricing in a cash rate hike for as early as mid-next year, but yesterday’s data backs the RBA’s view that a rate hike may not materialise until 2023.

Should you wish to discuss this or any other investment related matter, please contact your Investment Services Team on (02) 4928 8500.

Disclaimer

The material contained in this publication is the nature of the general comment only, and neither purports, nor is intended to be advice on any particular matter. Persons should not act nor rely upon any information contained in or implied by this publication without seeking appropriate professional advice which relates specifically to his/her particular circumstances. Cutcher & Neale Investment Services Pty Limited expressly disclaim all and any liability to any person, whether a client of Cutcher & Neale Investment Services Pty Limited or not, who acts or fails to act as a consequence of reliance upon the whole or any part of this publication.

Cutcher & Neale Investment Services Pty Limited ABN 38 107 536 783 is a Corporate Authorised Representative of Cutcher & Neale Financial Services Pty Ltd ABN 22 160 682 879 AFSL 433814.

Cutcher's Investment Lens | 14-18 April 2025

Cutcher's Investment Lens | 7 - 11 April 2025

The failed $3 million super tax: Division 296 is done… or is it?

Cutcher's Investment Lens - Update on Trump & Tariffs | 31 March - 4 April 2025

Liberation Day - April 2025 Snapshot