Pre-Open Data

Key Data for the Week

- Wednesday – EUR – Consumer Price Index – Inflation was 2.2% in the year to July.

- Wednesday – AUS – Wage Price Index – Wages grew 0.4% in the quarter, to total 1.7% for the year.

- Thursday – AUS – Unemployment Rate

- Thursday – US – Initial Jobless Claim

Australian Market

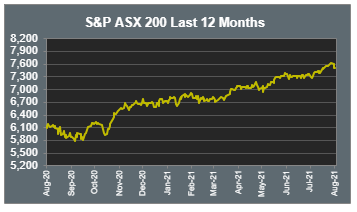

The Australian sharemarket shed 0.1% yesterday, dragged down by the Materials sector, which fell 3.0%. This came as commodity prices continue to weaken, with iron ore, copper and aluminum down 4.0%, 2.2% and 1.7%, respectively.

Index heavyweight BHP pulled the market down, as it declined 7.1%, representing the company’s worst one-day loss since the lows experienced in early 2020. It continued to fall as investors digest news that BHP and Woodside Petroleum are set to merge their respective oil and gas portfolios, with shareholders having a 48:52 (BHP:WPL) interest. Woodside Petroleum also fell 2.1%, dragging the Energy Sector down 0.5%.

The Real Estate sector was the top performer on Wednesday, as it climbed ahead 1.8%. Asset manager of large format retail centres, Aventus Group (3.5%), led the sector after it reported strong FY21 earnings, outperforming estimates. Dexus, the office and industrial property manager, was another top performer, up 1.8%.

The Financials sector rebounded slightly yesterday, gaining 0.7%, as most major banks edged ahead. Westpac was the leader, up 1.4%, while Commonwealth Bank, ANZ and NAB all rose between 0.2%-0.8%.

The Australian futures point to a 0.66% decline today.

Overseas Markets

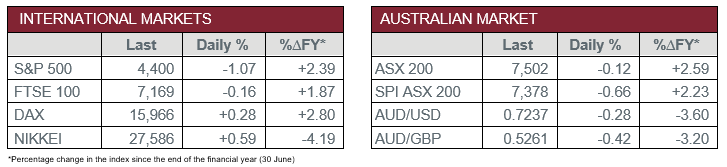

European sharemarkets were steady on Wednesday, as the German DAX rose 0.3%, while the UK FTSE 100 trimmed 0.2%. Meanwhile, the STOXX Europe 600 crept up 0.1%. European investors seemed to favor defensive Utilities and Healthcare stocks, over more cyclical sectors, amid concern over a spike in global COVID-19 cases.

US sharemarkets declined overnight, as the S&P 500, Dow Jones and NASDAQ all conceded ~1.0%. Energy, Healthcare and Technology were among the worst performing sectors, as they fell 2.4%, 1.5% and 1.4% respectively. Consumer Discretionary was the only sector to close ahead, up 0.2%.

Key losers included Technology stocks NVIDIA (2.2%), Apple (2.6%) and Fortinet (2.0%).

CNIS Perspective

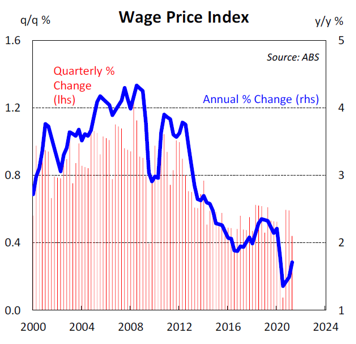

After years of massive amounts of stimulus and falling unemployment, the economic textbook suggests inflation should have already started to make its presence felt and interest rates should be rising as a result.

However, the correlation between low wages growth and low inflation, which has developed over the past decade or so, continues to hold true and it seems yesterday’s soft wages data will once again foreshadow low inflation.

Wages growth in the June quarter remained subdued, rising just 0.4% and producing an annual growth rate of 1.7% over the year to June.

The RBA has emphasised that unemployment and spare capacity in the labour market will need to reduce further before a meaningful increase in wages will be seen and subsequently drive inflation back within the RBA’s inflation band of 2-3%.

Yesterday’s data suggests inflation is still some time away, even after years of massive economic stimulus.

Should you wish to discuss this or any other investment related matter, please contact your Investment Services Team on (02) 4928 8500.

Disclaimer

The material contained in this publication is the nature of the general comment only, and neither purports, nor is intended to be advice on any particular matter. Persons should not act nor rely upon any information contained in or implied by this publication without seeking appropriate professional advice which relates specifically to his/her particular circumstances. Cutcher & Neale Investment Services Pty Limited expressly disclaim all and any liability to any person, whether a client of Cutcher & Neale Investment Services Pty Limited or not, who acts or fails to act as a consequence of reliance upon the whole or any part of this publication.

Cutcher & Neale Investment Services Pty Limited ABN 38 107 536 783 is a Corporate Authorised Representative of Cutcher & Neale Financial Services Pty Ltd ABN 22 160 682 879 AFSL 433814.

Cutcher's Investment Lens | 7 - 11 April 2025

The failed $3 million super tax: Division 296 is done… or is it?

Cutcher's Investment Lens - Update on Trump & Tariffs | 31 March - 4 April 2025

Liberation Day - April 2025 Snapshot

Smart investing for SMEs: The basics on how to get started and grow your business.