Pre-Open Data

Key Data for the Week

- Monday – US – Housing Market Index

- Tuesday – AUS – RBA Meeting Minutes

- Tuesday – US – Building Permits

- Wednesday – AUS – Retail Sales

- Thursday – AUS – NAB Business Confidence Index

- Thursday – EUR – ECB Monetary Policy

- Thursday – EUR – Consumer Confidence

- Friday – US – Markit Manufacturing PMI

- Friday – UK – Retail Sales

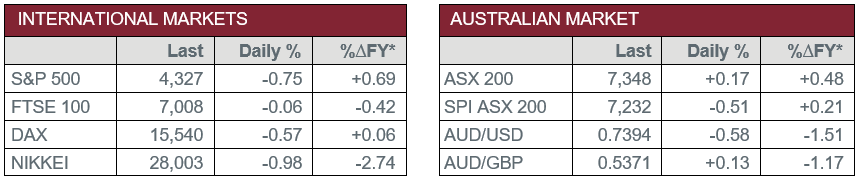

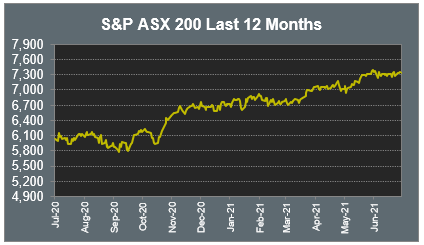

Australian Market

The Australian sharemarket rose 0.2% on Friday, to close up 1.0% for the week despite continued lockdowns and increased coronavirus outbreaks.

The Consumer Discretionary and Health Care sectors led the gains; Super Retail Group climbed 2.4% and Wesfarmers lifted 0.9%, while CSL and Sonic Healthcare both added 0.9%.

The Financials sector closed flat, while the big four banks all closed down between 0.2% and 0.3%.

Ingenia Communities gained 0.9% after the company raised its FY21 guidance. The group expects earnings before interest and tax to rise 30% versus previous guidance of 15%-20%.

The Materials sector was mixed; BHP rose 0.7% to close at a record high, while Rio Tinto slipped 0.4% after the miner announced lower than expected iron ore production in the second quarter.

The Australian futures point to a 0.5% fall today, driven by weaker overseas markets on Friday and increased lockdown measures implemented in Sydney over the weekend.

Overseas Markets

European sharemarkets were weaker on Friday as concerns grow over what effect the Delta variant may have on the region’s economic outlook with relaxed UK restrictions. Waste management and water services companies outperformed; United Utilities and Veolia Environnement added 1.7% and 1.5% respectively. German real estate company, Vonovia, rose 1.2%, while Tesco also bucked the trend to add 0.8%. The Financials sector weighed on the market; Barclays fell 2.2%, Deutsche Bank lost 2.1% and Société Générale slumped 2.5%.

US sharemarkets also closed lower on Friday, to end the week down after three straight weeks of gains. Technology stocks were amongst the weakest performers; NVIDIA slumped 4.3%, Amazon lost 1.6% and Apple fell 1.4%. Cloud computing and cybersecurity companies bucked the trend; Fastly gained 1.8%, while Fortinet rose 0.8% and CrowdStrike added 0.3%. Over the course of the week, the Dow Jones slipped 0.5%, the S&P 500 lost 1.0% and the NASDAQ fell 1.9%.

Companies set to report this week include Johnson & Johnson, AT&T, NextEra Energy and Roper Technologies.

CNIS Perspective

Credit rating agencies such as Standard & Poor’s, Fitch and Moody’s have moved promptly during the pandemic, in comparison to the GFC in 2008, where they were heavily criticised for handing out ‘squeaky clean’ credit ratings for bonds that eventually defaulted. At the start of the pandemic, in March 2020, US$1 trillion of investment grade debt was downgraded as they considered the damage to economies from the unprecedented disruption as US GDP contracted 3.5% last year.

Surprisingly, the number of companies that went bankrupt last year dropped sharply. Forecasts for a US GDP growth rate of 6.6% in 2021 have now enabled the ratings agencies to upgrade corporate debt/bonds. Through significant progress in vaccine rollouts across most Western countries, along with central banks’ ultra-loose monetary policy stances, profits from companies in the S&P 500 are expected to be 60% higher for the second quarter of 2021 compared to 2020. As a result, corporate debt is deemed to be manageable.

Approximately one third of the US$1 trillion investment grade debt that was downgraded last year has been re-rated higher in the first half on this year. Prospects are also improving for the riskier ‘junk bonds’, with predictions US$200 billion will revert back to investment grade by the end of 2021. The abundance of liquidity and low borrowing costs continue to improve bond prices and repayment prospects, as the risk of company defaults begins to abate.

Should you wish to discuss this or any other investment related matter, please contact your Investment Services Team on (02) 4928 8500.

Disclaimer

The material contained in this publication is the nature of the general comment only, and neither purports, nor is intended to be advice on any particular matter. Persons should not act nor rely upon any information contained in or implied by this publication without seeking appropriate professional advice which relates specifically to his/her particular circumstances. Cutcher & Neale Investment Services Pty Limited expressly disclaim all and any liability to any person, whether a client of Cutcher & Neale Investment Services Pty Limited or not, who acts or fails to act as a consequence of reliance upon the whole or any part of this publication.

Cutcher & Neale Investment Services Pty Limited ABN 38 107 536 783 is a Corporate Authorised Representative of Cutcher & Neale Financial Services Pty Ltd ABN 22 160 682 879 AFSL 433814.

Cutcher's Investment Lens | 7 - 11 April 2025

The failed $3 million super tax: Division 296 is done… or is it?

Cutcher's Investment Lens - Update on Trump & Tariffs | 31 March - 4 April 2025

Liberation Day - April 2025 Snapshot

Smart investing for SMEs: The basics on how to get started and grow your business.