Pre-Open Data

Key Data for the Week

- Monday – CHINA – Gross Domestic Product grew 0.2% in the September quarter, slowing from a 1.3% gain in the June quarter.

- Monday – UK – Rightmove House Prices Index rose 1.8% in October.

- Tuesday – US – Building Permits

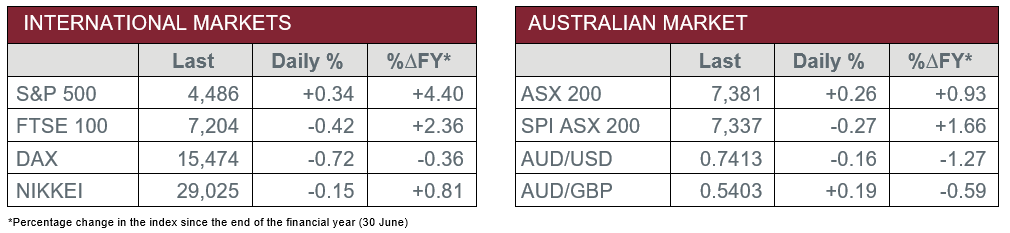

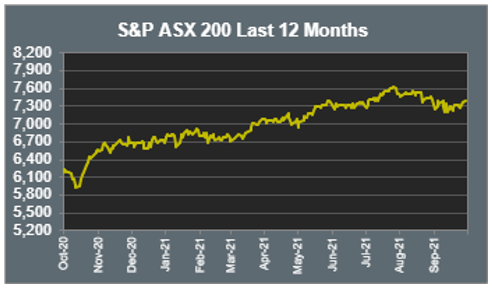

Australian Market

The Australian sharemarket added 0.3% yesterday, lifted by an upbeat start to the earnings season in the US. Third-quarter earnings season continues in the US, with more banks set to report their figures this week.

The Materials sector led the gains on the ASX yesterday, lifted by an increase in base metal prices and a slight reprieve in the price of iron ore. Rio Tinto was the best of the major miners, as it added 1.9%, while Fortescue Metals and BHP closed the session 1.0% and 0.9% higher respectively.

The ‘big four’ banks helped the Financials sector higher. Commonwealth Bank was the best performer in the sector, as it lifted 1.6%. ANZ was the next best, up 1.3%, while Westpac and NAB finished the session up 0.8% and 0.5% respectively.

The buy-now-pay-later providers lost ground; Afterpay shed 1.4% and Zip conceded 1.5%. This weakened the Information Technology sector, as it lost 1.2%. Accounting software provider, Xero dropped 1.9%, while WiseTech Global lost 2.9%.

The Australian futures market points to a 0.27% decline today.

Overseas Markets

European sharemarkets lost ground overnight as weaker-than-expected economic data from China dampened investor sentiment. These worries were caused by energy shortages and supply chain issues. Despite this, the Financials sector enjoyed gains, as Deutsche Bank lifted 0.3% and Barclays added 0.8%. By the close of trade, the UK’s FTSE 100 lost 0.4%, while the STOXX Europe 600 and German DAX fell 0.5% and 0.7% respectively.

US sharemarkets were mixed on Monday, as gains in the Information Technology sector lifted the NASDAQ and S&P 500 higher. Apple gained 1.2% after the company revealed their new Mac laptop, which has been built with a more powerful chip. Of the other Technology giants, Amazon gained 1.1%, Microsoft lifted 1.0% and Alphabet closed the session 0.9% higher.

By the close of trade, the NASDAQ added 0.8% and the S&P 500 gained 0.3%, while the Dow Jones closed 0.1% lower.

CNIS Perspective

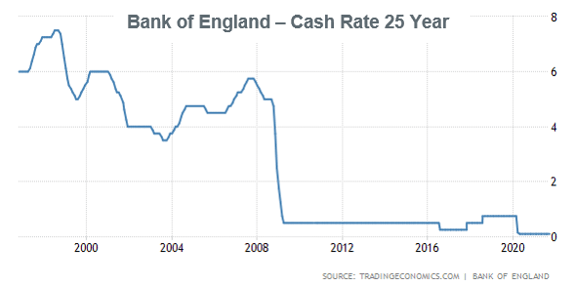

While central bankers around the world continue to debate when interest rates should rise, the tone out of England has become more definite.

The Bank of England (BoE) Governor Andrew Bailey has put the market on notice over the weekend, signalling they will likely become the first major economy to raise rates since the onset of the COVID-19 pandemic, as they are set to hike their cash rate at coming meetings.

The BoE Governor has stated we “have to act and must do so if we see a risk, particularly to medium-term inflation and to medium-term inflation expectations”.

The BoE has forecast that Britain's inflation rate will exceed 4% in the medium term, more than double its target, as the world economy reopens from its lockdowns, causing shortages of supplies, workers, and soaring energy prices.

The market is now fully pricing in a BoE rate hike by December and is a key reason why the US Federal Reserve rate hike pricing is also increasing, now at a 50% chance of a hike by June 2022 and 100% priced for September 2022.

Should you wish to discuss this or any other investment related matter, please contact your Investment Services Team on (02) 4928 8500.

Disclaimer

The material contained in this publication is the nature of the general comment only, and neither purports, nor is intended to be advice on any particular matter. Persons should not act nor rely upon any information contained in or implied by this publication without seeking appropriate professional advice which relates specifically to his/her particular circumstances. Cutcher & Neale Investment Services Pty Limited expressly disclaim all and any liability to any person, whether a client of Cutcher & Neale Investment Services Pty Limited or not, who acts or fails to act as a consequence of reliance upon the whole or any part of this publication.

Cutcher & Neale Investment Services Pty Limited ABN 38 107 536 783 is a Corporate Authorised Representative of Cutcher & Neale Financial Services Pty Ltd ABN 22 160 682 879 AFSL 433814.

Cutcher's Investment Lens | 7 - 11 April 2025

The failed $3 million super tax: Division 296 is done… or is it?

Cutcher's Investment Lens - Update on Trump & Tariffs | 31 March - 4 April 2025

Liberation Day - April 2025 Snapshot

Smart investing for SMEs: The basics on how to get started and grow your business.