Pre-Open Data

Key Data for the Week

- Monday – AUS – TD Securities Inflation

- Tuesday – AUS – RBA Interest Rate Decision

- Tuesday – EUR – Producer Price Index

- Wednesday – AUS – Retail Sales

- Thursday – AUS – Trade Balance

- Thursday – UK – BoE Interest Rate Decision

- Thursday – US – Initial Jobless Claims

- Friday – US – Unemployment Rate

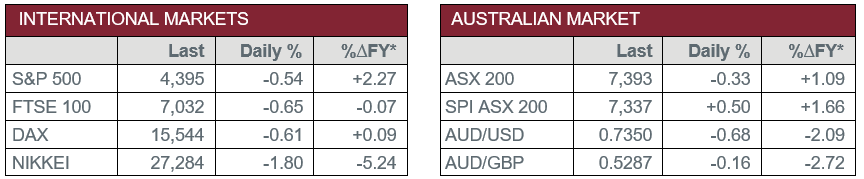

Australian Market

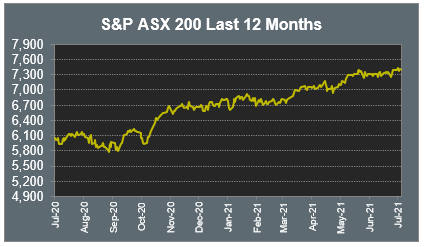

The Australian sharemarket eased 0.3% on Friday, as most sectors finished weaker. The Information Technology sector led the declines, down 2.5%, followed by the Utilities sector, which fell 1.7%. Despite Friday’s losses, the local ASX 200 finished up 1.1% for the month of July, its tenth consecutive month of gains.

Sharp losses among buy-now-pay-later providers weighed on the Information Technology sector. Zip Co gave up 4.3% and Afterpay shed 5.3%, while Sezzle tumbled 11.0%. Artificial intelligence company Appen lost 3.7%, while accounting software provider Xero slipped 0.5%.

Mining heavyweights were mixed, following a 3.1% fall in the price of iron ore last Thursday; Fortescue Metals slumped 5.3% and Rio Tinto gave up 0.6%, while BHP rose 0.3%. Gold miners were also mixed; Northern Star Resources added 0.9% and Newcrest Mining gained 0.3%, while Evolution Mining closed down 1.0%.

Property stocks were the strongest performers; Stockland lifted 1.6% and Cromwell Property Group added 1.2%, while Goodman Group and Ingenia Communities Group gained 0.6% and 0.5% respectively.

The Australian futures point to a 0.5% rise today.

Overseas Markets

European sharemarkets were weaker on Friday. Travel and leisure stocks declined; Ryanair gave up 1.8% and easyJet lost 4.0%, while International Airlines Group shed 7.5% after the company stated that its summer capacity would rise to 45% of pre-pandemic levels, however, warned that uncertainty remains. Mining stocks also closed weaker; BHP fell 1.9% and Rio Tinto closed down 2.9%, while Anglo American lost 3.1%.

By the close of trade, the STOXX Europe 600 fell 0.5%, while the German DAX and UK FTSE 100 lost 0.6% and 0.7% respectively.

US sharemarkets also declined on Friday. The Consumer Discretionary sector was the main laggard, weighed down by Amazon, which slid 7.6% after the company’s earnings and sales guidance missed expectations. The Information Technology sector was also weaker; Alphabet lost 1.0%, while Facebook and Microsoft both fell 0.6%. However, Spotify and Apple bucked the trend to close up 1.5% and 0.2% respectively. By the close of trade, the NASDAQ closed down 0.7%, while the S&P 500 and Dow Jones slipped 0.5% and 0.4% respectively.

CNIS Perspective

With half of the Australian population currently in lockdown in attempt to slow the spread of the highly contagious Delta variant of COVID-19, the Tokyo Olympics has provided a welcome distraction. While Australia may currently sit 4th on the medal tally, spare a thought for Japan, of whom 83% of the 126 million population expressed a desire not to host the Games due to their own concerns and burden around the pandemic, which is set to claim the record for the most expensive Olympics ever.

The Tokyo Olympics original budget estimates of US$7.4 billion are expected to blow out over US$20 billion as the three major revenue streams, ticket sales, tourism, and sponsors have been crushed for Tokyo 2020 by the coronavirus. The other main revenue source, TV rights, has also taken a hit as the International Olympic Committee (IOC) is taking a larger slice of the TV revenue (4% in the 1990s vs. 70% from Rio 2016). Despite these tremendous hits, the Tokyo Olympics should avert the financial disaster of the 1976 Montreal Summer Games, which went over budget by seven times, with the city spending 30 years paying down the extra debt.

The international recognition of hosting the Olympics seems less and less appealing, as fewer cities are even bidding for the event, with the summer 2004 games seeing 12 cities bid, while only 5 cities bid for the 2020 games. Hopefully Paris in 2024 avoids Tokyo’s record US$20 billion price tag blow out.

Should you wish to discuss this or any other investment related matter, please contact your Investment Services Team on (02) 4928 8500.

Disclaimer

The material contained in this publication is the nature of the general comment only, and neither purports, nor is intended to be advice on any particular matter. Persons should not act nor rely upon any information contained in or implied by this publication without seeking appropriate professional advice which relates specifically to his/her particular circumstances. Cutcher & Neale Investment Services Pty Limited expressly disclaim all and any liability to any person, whether a client of Cutcher & Neale Investment Services Pty Limited or not, who acts or fails to act as a consequence of reliance upon the whole or any part of this publication.

Cutcher & Neale Investment Services Pty Limited ABN 38 107 536 783 is a Corporate Authorised Representative of Cutcher & Neale Financial Services Pty Ltd ABN 22 160 682 879 AFSL 433814.

Cutcher's Investment Lens | 7 - 11 April 2025

The failed $3 million super tax: Division 296 is done… or is it?

Cutcher's Investment Lens - Update on Trump & Tariffs | 31 March - 4 April 2025

Liberation Day - April 2025 Snapshot

Smart investing for SMEs: The basics on how to get started and grow your business.