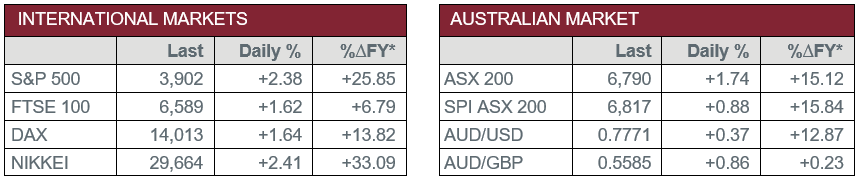

Pre-Open Data

Key Data for the Week

Key economic data released this week:

- Monday – AUS – TD Securities Inflation fell to 0.1% in February, from 0.2% in January.

- Monday – UK – Markit Manufacturing PMI rose to 55.1 in February, from 54.9 in January.

- Tuesday – AUS – RBA Interest Rate Decision

- Tuesday – EUR – Consumer Price Index

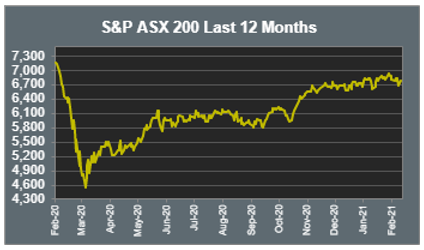

Australian Market

The Australian sharemarket rebounded from last week’s losses to close 1.7% higher on Monday. An announcement from the RBA that it would raise bond purchases from $2 billion to $4 billion boosted investor confidence. Gains were broad based, with the Information Technology and REITs sectors up 3.0% and 3.3% respectively.

Property stocks enjoyed strong gains yesterday as Australian home prices climbed 2.1% in February. Stockland jumped 5.5% and Goodman Group added 4.1%, while GPT Group and Cromwell Property Group lifted 2.3% and 1.3% respectively.

The Financials sector was lifted by gains amongst the major banks. Commonwealth Bank rose 3.1% and NAB added 2.0%, while ANZ and Westpac both closed 1.6% higher. Fund Managers also outperformed; Magellan Financial Group gained 3.6%, while Australian Ethical Investment lifted 2.3%.

The Information Technology sector was boosted by strong gains among buy-now-pay-later providers. Afterpay jumped 5.1% yesterday, following a 21% loss last week, while Zip Co lifted 5.5%. Accounting software platform Xero added 3.5%, while software company WiseTech Global rose 1.3%.

The Australian futures market points to a 0.88% rise today, driven by stronger overseas markets.

Overseas Markets

European sharemarkets advanced on Monday, as the broad based STOXX Europe 600 gained 1.8%, its strongest day in nearly four months. Travel and leisure stocks led the gains; British Airways owner International Airlines Group jumped 7.0% following price target upgrades, while Airbus lifted 5.0%. Renewable energy stocks also outperformed; solar energy company Enphase Energy climbed 5.9% and NextEra Energy added 3.3%, while Vesta Wind Systems closed 1.7% higher.

US sharemarkets rallied overnight, after the US House of Representatives passed a US$1.9 trillion COVID-19 relief package on Saturday. The Information Technology sector rebounded from last week’s losses; Apple and Spotify lifted 5.4% and 4.5% respectively, while Facebook added 2.8% and Alphabet rose 2.2%. Financial services also outperformed; Brazilian online payments company PagSeguro jumped 6.3% and PayPal rallied 5.3%, while MasterCard and Visa lifted 2.6% and 2.0% respectively.

By the close of trade, the Dow Jones gained 2.0% and the S&P 500 rose 2.4%, while the NASDAQ rallied 3.0%.

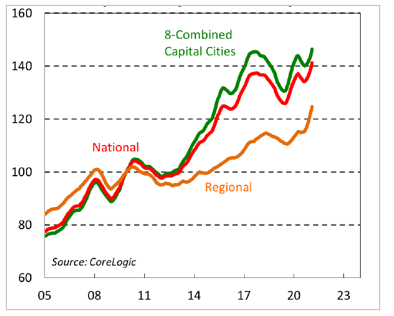

CNIS Perspective

Currently we have the perfect ingredients for rising house prices:

• Mortgage rates are at record lows

• Government incentives are supporting first home buyers

• Unemployment is declining

• Consumers are feeling more confident about the outlook, and

• Housing supply is constrained

So much so, that dwelling prices increased 2.1% nationally in February, recording the fastest month on month increase since 2003, which took prices to a record high.

It’s unlikely we’ll see this trend reverse any time soon.

Interest rates will remain low for even longer, employment should continue to improve and more heat will hit the market when borders re-open and immigration resumes.

Should you wish to discuss this or any other investment related matter, please contact your Investment Services Team on (02) 4928 8500.

Disclaimer

The material contained in this publication is the nature of the general comment only, and neither purports, nor is intended to be advice on any particular matter. Persons should not act nor rely upon any information contained in or implied by this publication without seeking appropriate professional advice which relates specifically to his/her particular circumstances. Cutcher & Neale Investment Services Pty Limited expressly disclaim all and any liability to any person, whether a client of Cutcher & Neale Investment Services Pty Limited or not, who acts or fails to act as a consequence of reliance upon the whole or any part of this publication.

Cutcher & Neale Investment Services Pty Limited ABN 38 107 536 783 is a Corporate Authorised Representative of Cutcher & Neale Financial Services Pty Ltd ABN 22 160 682 879 AFSL 433814.

Smart investing for SMEs: The basics on how to get started and grow your business.

ATO updates: A quick guide on what business owners need to know.

Cutcher's Investment Lens | 24 - 28 March 2025

Is your current super fund holding you back? It might be time for an SMSF.

Cutcher's Investment Lens | 17 - 21 March 2025