Pre-Open Data

Key Data for the Week

Key economic data released this week:

- Monday – AUS – Building Permits

- Monday – US – Markit Manufacturing PMI

- Tuesday – AUS – RBA Interest Rate Decision

- Wednesday – AUS – Retail Sales

- Wednesday – US – Presidential Election Result

- Thursday – UK – BoE Interest Rate Decision

- Thursday – US – Fed Interest Rate Decision

- Friday – US – Unemployment Rate

Australian Market

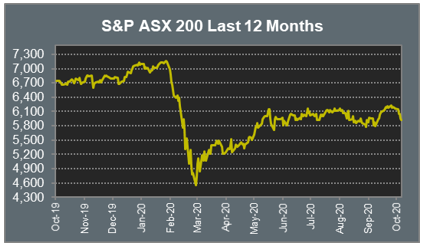

The Australian sharemarket closed 0.55% lower on Friday, following a sharp sell-off late in the session. The loss added to a difficult week for the local ASX 200, which posted its worst weekly decline since late April.

Wealth manager AMP was the standout performer on the market, up 19.5%, after it received an acquisition offer from US investment firm Ares Management Corporation. Negotiations are in the preliminary stage, with AMP in the process of conducting its portfolio review. The big four banks were mixed; with Commonwealth Bank and ANZ closing up 1.3% and 0.6% respectively, while Westpac slipped 0.2%.

Resmed rose 9.5%, after the sleep apnea maker announced 1Q21 sales rose 10% to US$751.9 million, boosted by demand for the company’s ventilators and masks during the coronavirus pandemic.

Fortescue Metals gained 4.5% after the company received several broker upgrades, while mining heavyweights BHP (-0.7%) and Rio Tinto (+1.6%) were mixed.

The Australian futures market points to a 0.88% rise today.

Overseas Markets

European sharemarkets were mixed on Friday, as some strong company earnings results were offset by ongoing concerns about fresh lockdowns across the region. French oil and gas producer Total climbed 2.8%, after the company maintained its dividend, despite a sharp fall in third quarter net profit. The broad based STOXX Europe 600 rose 0.2%, however the German DAX and UK FTSE 100 eased 0.4% and 0.1% respectively.

US sharemarkets fell on Friday, weighed down by Technology stocks. Heavyweight names Amazon (-5.5%), Apple (-5.6%), Facebook (-6.3%), Spotify (-10.1%) and Twitter (-21.1%) all closed lower. However, Alphabet lifted 3.8%, boosted by an increase in advertiser spend in Search and YouTube, along with continued strength in Google Cloud and Play. By the close of trade, the Dow Jones slid 0.6%, the S&P 500 fell 1.2% and the NASDAQ dropped 2.5%.

CNIS Perspective

The big US tech companies with a combined market value of US$7 trillion reported their latest earnings late last week, taking the blame for market softness even though the group exceeded revenue expectations.

Amazon’s quarterly profit nearly tripled, to US$6.3 billion. The company also added almost 250,000 employees in the period, surpassing more than a million workers for the first time.

Users across Facebook’s app family (Facebook, Instagram, WhatsApp and Messenger) rose 15% during the quarter. Despite a wide-ranging boycott by advertisers, the company’s revenue and profit both surpassed expectations.

One of the stars of Alphabet’s positive numbers came from record advertising revenue from its YouTube unit, which rose 30%, bolstered by stay-at-home viewing. Apple’s revenue rose 1%, beating expectations, however, the markets anticipates a delayed release of the new iPhone, which added market pressure.

Microsoft saw a surge in demand for its cloud computing services and steep rise in video game usage saw revenue jump 12% for the quarter. However, the company hinted profit margins might come under pressure as it plans to continue to invest heavily into its cloud platform Azure.

These big tech names are built to excel in situations like pandemic’s as we are forced to adapt more and more rapidly to a digital world. With Europe largely into its second lockdown and the US posting their worst week for new cases, there does not seem to be any meaningful shift in the very upbeat fundamental and secular growth narratives.

Should you wish to discuss this or any other investment related matter, please contact your Investment Services Team on (02) 4928 8500.

Disclaimer

The material contained in this publication is the nature of the general comment only, and neither purports, nor is intended to be advice on any particular matter. Persons should not act nor rely upon any information contained in or implied by this publication without seeking appropriate professional advice which relates specifically to his/her particular circumstances. Cutcher & Neale Investment Services Pty Limited expressly disclaim all and any liability to any person, whether a client of Cutcher & Neale Investment Services Pty Limited or not, who acts or fails to act as a consequence of reliance upon the whole or any part of this publication.

Cutcher & Neale Investment Services Pty Limited ABN 38 107 536 783 is a Corporate Authorised Representative of Cutcher & Neale Financial Services Pty Ltd ABN 22 160 682 879 AFSL 433814.

Cutcher's Investment Lens | 17 - 21 March 2025

Put your hard-earned dollars to work: Smart investing for doctors.

Fringe Benefits Tax year-end: Important updates and insights.

Cutcher's Investment Lens | 10 - 14 March 2025

Cutcher's Investment Lens | 3 - 7 March 2025