Pre-Open Data

Key Data for the Week

- Thursday – AUS – Unemployment Rate fell to a 12-year low of 4.6% in July. However, analysts warn this should not be misconceived as economic strength, with less people seeking work and less actual hours worked due to recent COVID-19 lockdowns.

- Thursday – US – Initial Jobless Claims fell by 29,000 to a pandemic low of 348,000 last week, exceeding expectations of 364,000.

- Friday – UK – Retail Sales

Australian Market

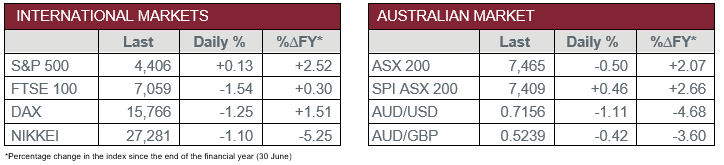

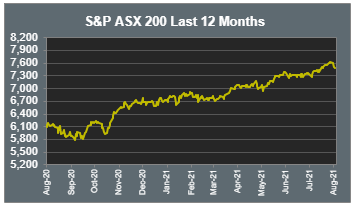

The Australian sharemarket slid 0.5% on Thursday, its fourth consecutive loss, again let down by major miners, as the price of iron ore plummeted a further 14.9%. BHP plunged further, down 6.4%, to total more than a 12.0% decline over the last two sessions, with the stock to trade ex-dividend on 2 September. Rio Tinto and Fortescue Metals Group also lost ground as they sank 5.7% and 6.2% respectively.

The Health Care sector led gains, up 2.0%, driven by behemoth CSL Limited (3.2%), as investors priced-in reported earnings from Wednesday. The company reported a 13.0% increase in net profit, which totalled $3.3 billion. Australian Clinical Labs was another major gainer, as it climbed 2.9%.

The Financials sector conceded some of yesterday’s gains, as it inched down 0.1%. ANZ closed flat, while Commonwealth Bank, Westpac and NAB all shed between 0.4%-0.6%. On the other hand, Macquarie Group strove ahead 0.8%, which represented a 6.1% monthly advance.

The Australian futures point to a 0.46% advance today.

Overseas Markets

European sharemarkets slipped on Thursday, as the German DAX, UK FTSE 100 and the STOXX Europe 600 lost between 1.3%-1.6%. Again, miners were unsurprisingly the major laggard, down 4.2%, as UK-listed Rio Tinto and BHP fell 2.7% and 2.5% respectively. Other key movers included meal-kit provider HelloFresh, which steamed ahead 2.8%, representing a 13.1% one-month price appreciation. Whereas aerospace provider, Airbus, fell 3.2%.

US sharemarkets closed flat yesterday, as the S&P 500 and NASDAQ both inched up 0.1%, while the Dow Jones shed 0.2%. Analysts suggest growth concerns, and the focus on the US central bank’s bond tapering program, caused the mixed session for investors. Energy, Materials and Financials were among the worst performing sectors, as they fell 2.7%, 0.9% and 0.8% respectively. Meanwhile, Technology rebounded, up 1.0%, joined by Real Estate and Consumer Staples, which both edged higher by 0.9%.

Key gainers included Technology stocks NVIDIA (4.0%) and Fortinet (1.1%), which recovered from yesterday’s loss, as well as Microsoft, which closed 2.1% higher. NVIDIA’s climb is being attributed to increased third-quarter earnings guidance above analyst expectations.

CNIS Perspective

China and the US have been switching rankings in recent times when it comes to the economic growth race. US Gross Domestic Product (GDP) rose 12.2% in the second quarter from a year earlier, outpacing China’s 7.9% gain.

In the short term, the difference is largely a result of the two nations’ responses to the COVID-19 pandemic. Although the US economy took longer to right itself than China’s, the US poured far more resources into a recovery. A combination of vaccinations, massive fiscal stimulus and near zero interest rates have pushed the US ahead of China in GDP growth. Stimulus measures have also helped US households accumulate more than US$2.6 trillion in household savings, nearly seven times as much as in China.

However, with four times as many people in China and decades of aggressive policy measures encouraging growth through investment, it would make sense for China to pull ahead of the US.

The recent reversal in GDP growth will likely delay China’s prospective economic ascendancy. Beijing is also facing significant problems, including a crackdown on the private sector, steep increases in government debt and an aging population.

Who ranks number one isn’t simply a matter of bragging rights. The world’s largest economy typically sets business and consumer trends globally.

Should you wish to discuss this or any other investment related matter, please contact your Investment Services Team on (02) 4928 8500.

Disclaimer

The material contained in this publication is the nature of the general comment only, and neither purports, nor is intended to be advice on any particular matter. Persons should not act nor rely upon any information contained in or implied by this publication without seeking appropriate professional advice which relates specifically to his/her particular circumstances. Cutcher & Neale Investment Services Pty Limited expressly disclaim all and any liability to any person, whether a client of Cutcher & Neale Investment Services Pty Limited or not, who acts or fails to act as a consequence of reliance upon the whole or any part of this publication.

Cutcher & Neale Investment Services Pty Limited ABN 38 107 536 783 is a Corporate Authorised Representative of Cutcher & Neale Financial Services Pty Ltd ABN 22 160 682 879 AFSL 433814.

Cutcher's Investment Lens | 7 - 11 April 2025

The failed $3 million super tax: Division 296 is done… or is it?

Cutcher's Investment Lens - Update on Trump & Tariffs | 31 March - 4 April 2025

Liberation Day - April 2025 Snapshot

Smart investing for SMEs: The basics on how to get started and grow your business.