Pre-Open Data

Key Data for the Week

- Monday – UK – Rightmove House Prices

- Tuesday – AUS – RBA Board Meeting Minutes

- Tuesday – EUR – Consumer Confidence

- Wednesday – US – Gross Domestic Product

- Wednesday – US – Existing Home Sales

- Wednesday – UK – Gross Domestic Product

- Thursday – US – New Home Sales

- Friday – JAPAN – Consumer Price Index

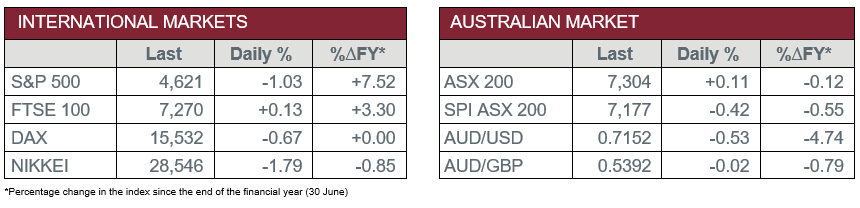

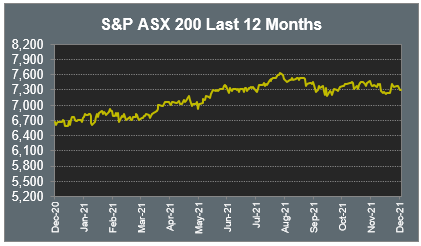

Australian Market

The Australian sharemarket lifted 0.1% on Friday. Gains among the Materials, Energy and Utilities sectors were offset by weakness in the Information Technology sector, which lost 3.9%. Over the week, the local ASX 200 gave up 0.7%.

The Financials sector rose 0.8% on Friday, as all major banks closed higher; Commonwealth Bank led the gains, up 2.3%, followed by ANZ which added 0.7%, while NAB and ANZ both lifted 0.3%. Fund managers were mixed; Australian Ethical Investment rose 0.4% and Challenger lost 2.4%, while Magellan Financial Group was placed into a trading halt pending a market announcement relating to the termination of a material contract.

The Materials sector was the strongest performer on Friday. Mining heavyweights BHP and Fortescue Metals rose 1.8% and 1.0% respectively, while Rio Tinto finished the session flat. Stronger gold prices lifted gold miners; Northern Star Resources jumped 5.6% and Evolution Mining added 1.3%, while Newcrest Mining gained 3.7%.

The Australian futures market points to a 0.42% fall today.

Overseas Markets

European sharemarkets were mixed on Friday. Travel stocks led the gains; International Airlines Group added 4.0% and easyJet lifted 2.7%, while Airbus and Ryanair closed up 1.7% and 1.6% respectively. Banking stocks were weaker; Lloyds Bank and HSBC slipped 0.1% and 0.6% respectively, while Barclays gave up 0.7% and Deutsche Bank lost 1.2%. By the close of trade, the German DAX fell 0.7% and the STOXX Europe 600 lost 0.6%, while the UK FTSE 100 eked out a 0.1% gain.

US sharemarkets were weaker on Friday, as all sectors finished the session lower. The Financials sector was the worst performer; JP Morgan Chase lost 2.3%, while Bank of America and Citigroup both fell 2.5%. Financial services stocks also declined; investment management company BlackRock slipped 0.9% and MasterCard fell 1.0%, while Visa and PayPal gave up 1.2% and 1.4% respectively.

The Information Technology sector closed down 0.6%; NVIDIA shed 2.1% and Alphabet slid 1.4%, while Apple and Microsoft lost 0.7% and 0.3% respectively. However, Spotify bucked the trend to gain 3.9%. By the close of trade, the NASDAQ slipped 0.1% and the S&P 500 fell 1.0%, while the Dow Jones closed 1.5% lower.

CNIS Perspective

Ben Bernanke was the first US Federal Reserve Chair to utilise the mechanism to buy bonds in order to bolster the economy. In 2013, when Bernanke announced the US Fed would stop buying bonds and remove this stimulus it sent the stock market south. The stock sell-off was dubbed the “taper tantrum”. At the time there were little signs of inflation, yet the consensus was that it was coming.

Fast forward to 2021 and inflation is nearing 7% to near four-decade highs after global central banks have injected US$32 trillion into financial markets, or the equivalent to buying US$800 million of financial assets every hour of the past 20 months during the pandemic, according to Bank of America. During this period global equity market capitalisation has soared US$60 trillion. Unsurprisingly, inflation has risen, finally forcing the US Federal Reserve last week to announce its bond purchases will come to an end in March, with three interest rate rises likely next year.

However, unlike 2013, this time the Fed’s taper came without tears; in fact, stocks rallied after the announcement. Despite the rising inflation, bond yields remain low, with the US 10-year Treasury note yielding less than half of what it was in 2013. The underlying reason for the steep rise in inflation is that global demand is currently exceeding the world’s capacity to supply goods and services. If supply chains return to their past efficiencies and the spending spree dissipates as stimulus is removed, then the longer term bond market might be calling it correctly, that is, current high inflation will pass and interest rates will rise, but remain low for many years to come.

Should you wish to discuss this or any other investment related matter, please contact your Investment Services Team on (02) 4928 8500.

Disclaimer

The material contained in this publication is the nature of the general comment only, and neither purports, nor is intended to be advice on any particular matter. Persons should not act nor rely upon any information contained in or implied by this publication without seeking appropriate professional advice which relates specifically to his/her particular circumstances. Cutcher & Neale Investment Services Pty Limited expressly disclaim all and any liability to any person, whether a client of Cutcher & Neale Investment Services Pty Limited or not, who acts or fails to act as a consequence of reliance upon the whole or any part of this publication.

Cutcher & Neale Investment Services Pty Limited ABN 38 107 536 783 is a Corporate Authorised Representative of Cutcher & Neale Financial Services Pty Ltd ABN 22 160 682 879 AFSL 433814.

Cutcher's Investment Lens | 7 - 11 April 2025

The failed $3 million super tax: Division 296 is done… or is it?

Cutcher's Investment Lens - Update on Trump & Tariffs | 31 March - 4 April 2025

Liberation Day - April 2025 Snapshot

Smart investing for SMEs: The basics on how to get started and grow your business.