Pre-Open Data

Key Data for the Week

- Wednesday – AUS – Wage Price Index – Wages grew 0.6% in the March Quarter, taking annual growth to 1.5%.

- Wednesday – UK – Consumer Price Index rose 0.6% in April, following a 0.3% increase in March.

- Thursday – AUS – Unemployment Rate

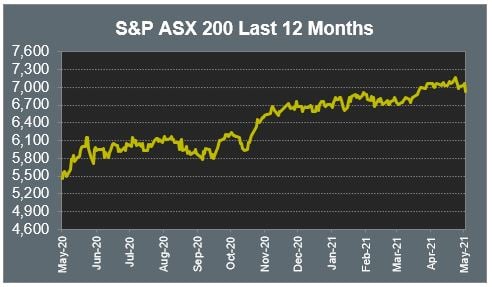

Australian Market

The Australian sharemarket suffered its biggest daily loss since February, falling 1.9%. All sectors ended the session lower, with the Materials, Industrials and Energy sectors all conceding between 2.0% and 4.0%.

The mining giants led the losses in the Materials sector as Fortescue Metals conceded 3.1%, BHP fell 3.4% and Rio Tinto dropped 3.8%. This decline in investor sentiment was also felt in the gold mining industry; Evolution Mining and Northern Star Resources shed 3.4% and 3.5% respectively.

Rumours of an increase in the supply of Iranian oil sent the Energy sector 2.8% lower. Sector heavyweight, Woodside Petroleum lost 2.6%, while Oil Search weakened 4.1%. Whitehaven Coal led the losses in the coal mining industry as it slumped 6.2%.

The Information Technology was not immune to the day’s losses, falling 1.6%. EML Payments suffered a 45.6% fall after concerns were raised regarding its Irish subsidiary’s anti-money laundering controls. Ireland’s central bank has now flagged some significant concerns regarding these measures.

Commonwealth Bank was the worst performer of the big four, closing 2.5% lower.

The Australian futures market points to a 0.06% rise today.

Overseas Markets

European sharemarkets closed lower on Wednesday, weakened by inflationary fears and an increase in long-term bond yields. The Materials sector was among the worst performers, led lower by the mining giants as Glencore lost 3.3% and London-listed BHP dropped 4.6%. The rise in bond yields aided the Financials sector as it posted the smallest decline; ING fell 1.9%, while HSBC bucked the downward trend to close 0.2% higher. The broad-based pan-European STOXX 600 gave up 1.5%.

US sharemarkets were also weaker on Wednesday as discussions regarding the Federal Reserve’s bond-buying program sparked fresh inflationary fears. Wednesday’s trade also saw a steep decline in all major crypto currencies. As a result, crypto currency exchange, Coinbase Global, fell 5.9%, while Bitcoin miners, Marathon Digital and Bitfarms lost 5.6% and 4.5% respectively.

By the close of trade, the Dow Jones lost 0.5%, the S&P 500 shed 0.3% and the NASDAQ gave up less than 0.1%.

CNIS Perspective

The long-term relationship between wages growth and inflation is too strong to ignore and yesterday’s wages data suggests inflation remains a fair way off.

Wages growth picked up slightly in the March quarter, up 0.6%, coming off a record low in the December quarter. There is still a lot of spare capacity in the labour market and wages growth remains weak.

The strongest growth in the quarter was in accommodation and food services (1.2%). The main driver of this rise was in award jobs, a result of the Fair Work Commission’s Annual Wage Review.

There have been reports of labour shortages in pockets of the economy, particularly for sectors which rely on foreign workers. Inactivity in wage-setting practices means it could be slow for such pressures to flow through to the data.

The RBA has suggested we need to see wages growth at, or above 3%, to get inflation sustainably back into the central bank’s target band. We are still a long way from this with annual growth of 1.5% in the March quarter. For now, a material pick-up in wages growth, and therefore inflation, still looks to be some way off.

Should you wish to discuss this or any other investment related matter, please contact your Investment Services Team on (02) 4928 8500.

Disclaimer

The material contained in this publication is the nature of the general comment only, and neither purports, nor is intended to be advice on any particular matter. Persons should not act nor rely upon any information contained in or implied by this publication without seeking appropriate professional advice which relates specifically to his/her particular circumstances. Cutcher & Neale Investment Services Pty Limited expressly disclaim all and any liability to any person, whether a client of Cutcher & Neale Investment Services Pty Limited or not, who acts or fails to act as a consequence of reliance upon the whole or any part of this publication.

Cutcher & Neale Investment Services Pty Limited ABN 38 107 536 783 is a Corporate Authorised Representative of Cutcher & Neale Financial Services Pty Ltd ABN 22 160 682 879 AFSL 433814.

Cutcher's Investment Lens | 7 - 11 April 2025

The failed $3 million super tax: Division 296 is done… or is it?

Cutcher's Investment Lens - Update on Trump & Tariffs | 31 March - 4 April 2025

Liberation Day - April 2025 Snapshot

Smart investing for SMEs: The basics on how to get started and grow your business.