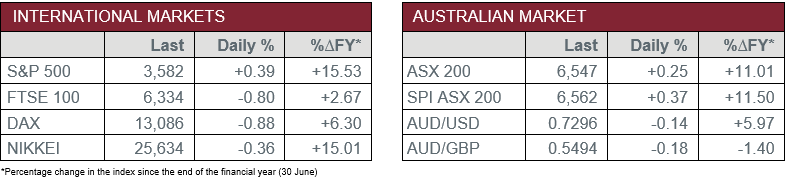

Pre-Open Data

Key Data for the Week

Key economic data released this week:

- Thursday – AUS – Unemployment Rate rose to 7.0% in October, from 6.9% in September. A rise in the participation rate to 65.8% from 64.9% over the same period led to the rise in the unemployment rate, while 178,800 jobs were created in October, above expectations for a fall.

- Friday – AUS – Retail Sales

- Friday – UK – Retail Sales

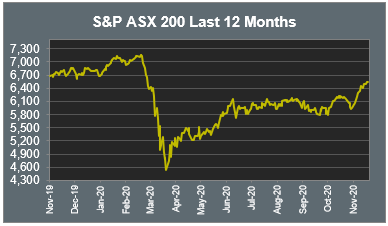

Australian Market

The Australian sharemarket rose 0.25% yesterday after October’s employment figures showed a jump in the number of jobs created, despite the unemployment rate rising. The Financials sector was again the best performer, as the big four banks all rose between 1.7% and 2.3%.

Insurance companies underperformed after the Insurance Council of Australia rejected their legal challenge over whether business interruption insurance covers COVID-19 related losses; Suncorp Group fell 3.0% and QBE Insurance lost 3.9%, while Insurance Australia Group entered a trading halt.

The Health Care sector was amongst the weakest performers; CSL slipped 0.7%, Sonic Healthcare fell 1.0% and Cochlear lost 2.1%. The Materials sector also underperformed, dragged lower by BHP, down 0.9%, while James Hardie Industries rose 1.1%.

Toll road operators Atlas Arteria and Transurban fell 0.7% and 0.1% respectively, while airliner Qantas added 0.8% and Sydney Airport rose 0.2%.

The Australian futures market points to a 0.37% rise today.

Overseas Markets

European sharemarkets were weaker on Thursday as investor sentiment weakened as coronavirus case numbers continued to soar. Industrials stocks were amongst the worst performers; Veolia fell 2.4%, CRH lost 1.8%, Eiffage lowered 1.1% and Vinci slipped 0.5%. Financials also weakened; Barclays, Deutsche Bank and Société Générale all lost between 1.3% and 1.9%. Consumer stocks bucked the trend as Tesco added 1.2% and HelloFresh rose 6.6%. By the close of trade, the broad based STOXX Europe 600 fell 0.8%.

US sharemarkets closed higher overnight, after two-straight negative sessions. Technology and consumer stocks outperformed; Alphabet, Apple and Microsoft all rose between 0.5% and 1.0%, while Amazon and Alibaba added 0.4% and 1.6% respectively. Switchback Energy climbed 25.5% as the company nears its reverse merger with ChargePoint, the manufacturer of electric vehicle charging stations. SolarEdge Technologies and Enphase Energy added 4.8% and 3.2% respectively.

By the close of trade, the Dow Jones added 0.2%, the S&P 500 rose 0.4% and the NASDAQ gained 0.9%.

CNIS Perspective

Tourism has clearly been one of the hardest hit industries throughout COVID-19, with the World Travel and Tourism Council noting 174 million tourism-related jobs have likely been lost around the globe in 2020. The Council calculated the decline in travel could cost the world economy US$4.7 trillion this year, approximately 5.2% of global GDP. With vaccines unlikely to be widely available until well into 2021, countries are going to great lengths to look for safe ways to re-open their borders.

From this Sunday, 22 November, specially designated ‘air travel bubble’ flights between Hong Kong and Singapore are due to begin, allowing travel between both cities without quarantine. Anyone who has stayed 14 days in either city, regardless of age or nationality, will be eligible to travel freely. However, it won’t be a hassle-free trip, with COVID testing and long waits among precautionary measures required at either end. Whilst some other countries have attempted ‘bubbles’, including Australia and New Zealand, this will be the first comprehensive attempt at a quarantine-free, inter-country, flight bubble.

Given Europe is currently suffering its third wave of COVID-19, likely in part from a summer where ‘green zones’ allowed travel between countries, including the US. As open state borders have likely contributed to the rising infection rate, the rest of the world will be watching the Hong Kong and Singapore bubble very closely. Whilst Asian COVID numbers remain low and the economic benefits of re-introducing travel are clear, any indication that one country has imported infections from abroad could cause some serious political tensions.

Should you wish to discuss this or any other investment related matter, please contact your Investment Services Team on (02) 4928 8500.

Disclaimer

The material contained in this publication is the nature of the general comment only, and neither purports, nor is intended to be advice on any particular matter. Persons should not act nor rely upon any information contained in or implied by this publication without seeking appropriate professional advice which relates specifically to his/her particular circumstances. Cutcher & Neale Investment Services Pty Limited expressly disclaim all and any liability to any person, whether a client of Cutcher & Neale Investment Services Pty Limited or not, who acts or fails to act as a consequence of reliance upon the whole or any part of this publication.

Cutcher & Neale Investment Services Pty Limited ABN 38 107 536 783 is a Corporate Authorised Representative of Cutcher & Neale Financial Services Pty Ltd ABN 22 160 682 879 AFSL 433814.

Smart investing for SMEs: The basics on how to get started and grow your business.

ATO updates: A quick guide on what business owners need to know.

Cutcher's Investment Lens | 24 - 28 March 2025

Is your current super fund holding you back? It might be time for an SMSF.

Cutcher's Investment Lens | 17 - 21 March 2025