Pre-Open Data

Key Data for the Week

- Monday – UK – Rightmove House Price Index

- Tuesday – US – Building Permits

- Tuesday – AUS – RBA Board Meeting Minutes

- Wednesday – AUS – Westpac Lending Index

- Thursday – US – Markit Manufacturing PMI

- Thursday – UK – BoE Interest Rate Decision

- Thursday – US – Existing Home Sales

- Friday – US – New Home Sales

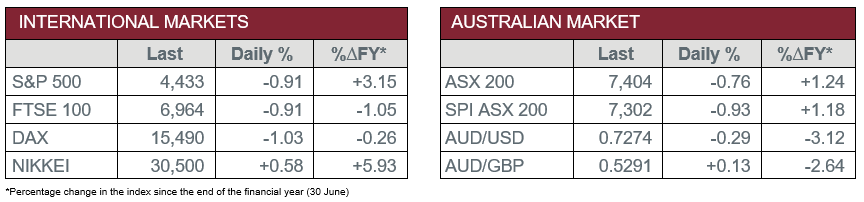

Australian Market

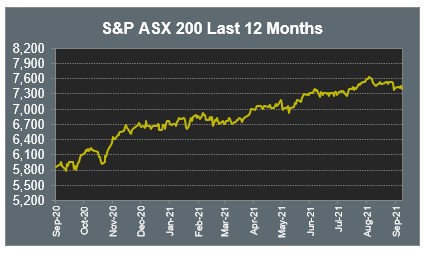

The Australian sharemarket slid 0.8% on Friday, weighed down by the Materials and Energy sectors, which lost 4.0% and 1.3% respectively. The Information Technology sector was the top performer, lifted by gains among buy-now-pay-later providers. Over the week, the local ASX 200 slipped less than 0.1%, lower for the second consecutive week.

Sharp declines in commodity prices heavily weighed on Materials stocks; Fortescue Metals tumbled 11.5% and Rio Tinto lost 4.7%, while BHP gave up 3.7%. Gold miners were also weaker; Evolution Mining fell 3.3% and Newcrest Mining slid 3.1%, while Northern Star Resources closed 2.8% lower.

The major banks were mostly weaker; NAB and ANZ fell 1.1% and 0.6% respectively, while Westpac slipped 0.5% and Commonwealth Bank added less than 0.1%. Fund managers were mixed; Magellan Financial Group slid 1.5% and Challenger lost 0.3%, while Australian Ethical Investment climbed 6.4%.

The Australian futures point to a 0.93% fall today.

Overseas Markets

European sharemarkets eased on Friday. The Materials sector was weaker; British mining company Anglo American lost 8.1% after receiving downgrades, while BHP and Rio Tinto fell 5.2% and 2.3% respectively. News that the UK would continue to ease travel restrictions boosted travel and leisure stocks; International Airlines Group added 5.0% and easyJet gained 3.9%, while InterContinental Hotels Group rose 2.2%. By the close of trade, the German DAX lost 1.0%, while the UK FTSE 100 and STOXX Europe 600 both gave up 0.9%.

US sharemarkets also weakened on Friday. The Information Technology sector was a main laggard, down 1.5%; Alphabet lost 2.0%, while Microsoft and Apple both gave up 1.8%. However, Spotify bucked the trend to close up 2.5%. Health Care was the only sector to advance; UnitedHealth Group added 0.8% and Danaher Corporation rose 0.2%, while Bristol-Myers Squibb lifted 0.1%. However, COVID-19 vaccine manufacturers Pfizer and Moderna fell 1.3% and 2.4% respectively ahead of the COVID-19 vaccine booster shot debate. By the close of trade, the Dow Jones slipped 0.5%, while the S&P 500 and NASDAQ both fell 0.9%.

CNIS Perspective

Canva, the Aussie tech start up launched in 2007 from Melanie Perkins’ mother’s living room in Perth is now valued at $54 billion, making it one of the world’s most valuable start-ups and moving the Canva founders into Australia’s top 10 rich list last week. Canva’s recent US$200 million capital raising values the company more than Telstra or Rio Tinto.

Today, Canva is being used to create 120 designs every second. The success of the graphic design tool is down to its ease of use, price point (using a freemium model to allow users to get started at no cost) and some brilliant timing with the launch of apps like Instagram and Twitter, allowing businesses to utilise Canva’s 800,000+ templates to reach customers. Canva expects to use the new funds to double headcount and possibly fuel acquisitions. The company is already profitable, has no plans to undergo an IPO and its head office is here in Surry Hills, Sydney, not Silicon Valley.

Interestingly, mining magnates Andrew Forrest and Gina Rinehart slipped a few rungs on Australia’s rich list last week, as the price of iron ore has almost halved in the past two months. The top two spots are now held by another Aussie tech success story, Atlassian, which prompts the question, are we doing enough to support our home-grown tech talent as we may one day run out of holes to dig and exhaust our natural resources. Former Prime Minister Malcolm Turnbull’s innovation nation launched in 2015 was well meaning but not well planned, and with no follow through and the required government spending, this promising policy dissipated.

Whilst Canva and many other successful tech entrepreneur start-ups prove that the talent is here and more unicorns (private companies valued at >US$1 billion) will be created, more assistance and funding could really accelerate Australia’s future away from the old-world economies.

Perkins by the way, plans to give away most of her shares to charity because, in her words, “if the whole thing was about building wealth, that would be the most uninspiring thing I could possibly imagine”.

Should you wish to discuss this or any other investment related matter, please contact your Investment Services Team on (02) 4928 8500.

Disclaimer

The material contained in this publication is the nature of the general comment only, and neither purports, nor is intended to be advice on any particular matter. Persons should not act nor rely upon any information contained in or implied by this publication without seeking appropriate professional advice which relates specifically to his/her particular circumstances. Cutcher & Neale Investment Services Pty Limited expressly disclaim all and any liability to any person, whether a client of Cutcher & Neale Investment Services Pty Limited or not, who acts or fails to act as a consequence of reliance upon the whole or any part of this publication.

Cutcher & Neale Investment Services Pty Limited ABN 38 107 536 783 is a Corporate Authorised Representative of Cutcher & Neale Financial Services Pty Ltd ABN 22 160 682 879 AFSL 433814.

Cutcher's Investment Lens | 7 - 11 April 2025

The failed $3 million super tax: Division 296 is done… or is it?

Cutcher's Investment Lens - Update on Trump & Tariffs | 31 March - 4 April 2025

Liberation Day - April 2025 Snapshot

Smart investing for SMEs: The basics on how to get started and grow your business.