Pre-Open Data

Key Data for the Week

Key economic data released this week:

- Monday – CHINA – PBoC Interest Rate Decision

- Monday – EUR – Consumer Confidence

- Monday – US – Chicago Fed National Activity Index

- Tuesday – AUS – Retail Sales

- Tuesday – UK – Gross Domestic Product

- Tuesday – US – Gross Domestic Product

- Wednesday – AUS – Trade Balance

- Wednesday – US – Durable Goods Orders

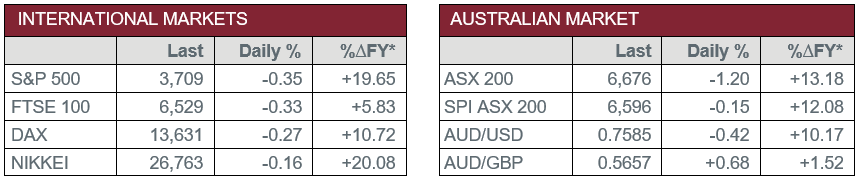

Australian Market

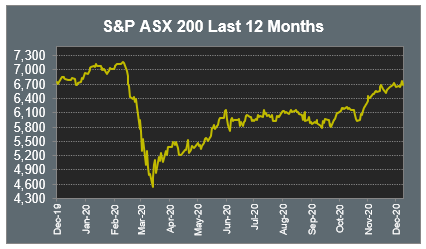

The Australian sharemarket closed down 1.2% on Friday, weighed down by a fresh coronavirus cluster in the Northern Beaches of Sydney. Most sectors ended the session weaker, with Information Technology and REITs sectors the worst performers. Despite Friday’s losses, the local ASX 200 closed higher for a seventh consecutive week, boosted by increased optimism overseas and better than expected domestic jobs figures on Thursday.

QBE Insurance dropped 12.5% on Friday after the insurer announced it expects a US$1.5 billion statutory net loss in FY20, impacted by a US$520 million goodwill write-down of its North American business and COVID-19 costs that are anticipated to total US$470 million. The weakness in the Financials sector was also contributed to by the big four banks, which all gave up between 1.4% and 2.0%, with NAB the worst performer.

A2 Milk Company fell 23.6% after the company downgraded its 1H21 and FY21 earnings expectations, with the impact of COVID-19 on its daigou market cited more significant than originally estimated.

The Australian futures market points to a 0.15% fall today, led by weaker global markets on Friday.

Overseas Markets

European sharemarkets closed lower on Friday, as investor sentiment towards the potential for a post-Brexit trade deal and a stimulus package in the United States weakened. British Airways owner IAG fell 2.1% following a report that revealed the company had agreed to buy Spanish carrier Air Europa for €500 million. HelloFresh rose a further 5.9%, as the company continues to benefit from a renewal of lockdown restrictions throughout the region. Friday’s losses capped a four-day rally for the broad based STOXX Europe 600, which ended the session down 0.4%, while the German DAX and the UK FTSE 100 both slipped 0.3%.

US sharemarkets also fell on Friday in a quiet session of trade. Technology stocks were among the better performers, though Apple and Microsoft slid 1.6% and 0.4% respectively. Tesla gained 6.0% as it joined the S&P 500 this week, with index-tracking funds required to purchase over US$80 billion of the company’s shares by close of trade Friday. Tesla will be the sixth largest company on the index, the biggest to have been added and the second largest in the Consumer Discretionary space behind Amazon. By the close of trade, the Dow Jones slipped 0.4%, the S&P 500 dropped 0.3% and the NASDAQ gave up 0.1%.

CNIS Perspective

As the calendar year comes to an end many market pundits begin to make forecasts for future investment trends for the coming year. Most forecasters agree, AI's (artificial intelligence) time has arrived. The global AI software market is forecast to grow rapidly in the coming years, currently pegged at US$35 billion in 2020 and expected to reach US$126 billion by 2025.

Artificial intelligence refers to the capability of a machine to replicate or simulate intelligent human behaviours such as analysing and making judgments and decisions. Cases of use can now be found in all corners of our society, from the digital voice assistants that reside in our smartphones or smart speakers to customer support chatbots, as well as industrial robots.

There are thousands of cases of use for AI, however, the COVID-19 pandemic has rapidly accelerated its impact on drug discovery. Big pharmaceutical companies are analysing human genome sequences to guide vaccine research. Drug trials will produce huge amounts of data, as hundreds of experiments are analysed with AI algorithms, processing at speeds that have enabled the numerous vaccines for the coronavirus to be produced at light speed in comparison to previous drug development. AI's impact on drug discovery is anticipated to be big news in the next year.

Should you wish to discuss this or any other investment related matter, please contact your Investment Services Team on (02) 4928 8500.

Disclaimer

The material contained in this publication is the nature of the general comment only, and neither purports, nor is intended to be advice on any particular matter. Persons should not act nor rely upon any information contained in or implied by this publication without seeking appropriate professional advice which relates specifically to his/her particular circumstances. Cutcher & Neale Investment Services Pty Limited expressly disclaim all and any liability to any person, whether a client of Cutcher & Neale Investment Services Pty Limited or not, who acts or fails to act as a consequence of reliance upon the whole or any part of this publication.

Cutcher & Neale Investment Services Pty Limited ABN 38 107 536 783 is a Corporate Authorised Representative of Cutcher & Neale Financial Services Pty Ltd ABN 22 160 682 879 AFSL 433814.

Smart investing for SMEs: The basics on how to get started and grow your business.

ATO updates: A quick guide on what business owners need to know.

Cutcher's Investment Lens | 24 - 28 March 2025

Is your current super fund holding you back? It might be time for an SMSF.

Cutcher's Investment Lens | 17 - 21 March 2025