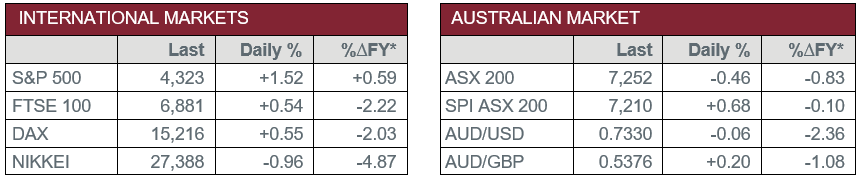

Pre-Open Data

Key Data for the Week

- Tuesday – AUS – RBA Meeting Minutes confirmed tapering bond purchases will commence in September, although this may be revised given recent COVID lockdowns.

- Wednesday - AUS - Retail Sales

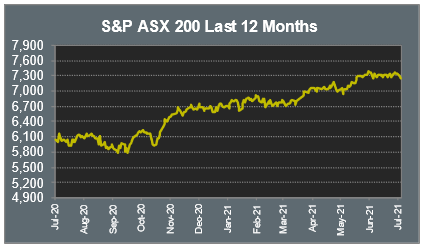

Australian Market

The Australian sharemarket fell for a second consecutive session yesterday, as concerns grew over the economic effect of additional COVID lockdowns. Despite a drop in cases in NSW yesterday, further lockdowns across the nation led to a decline in investor sentiment.

The Materials sector was the hardest hit and closed 1.8% lower. Mining heavyweights Fortescue Metals and Rio Tinto fell 1.0% and 2.7% respectively, while BHP slipped 2.5%. BHP was also weakened by a decrease in fourth quarter iron ore production.

Energy shares were again impacted by a drop in the price of oil after it was confirmed that OPEC agreed to increase supply. As a result, Woodside Petroleum conceded 1.9% and Santos fell 5.0%. Oil Search bucked the downward trend to jump 6.3%, as news was released that Santos is pursuing a takeover bid for the company.

The Information Technology sector closed 0.4% higher, led by gains in buy-now-pay-later providers, Afterpay and Zip, as they added 1.6% and 5.4% respectively. Accounting software provider, Xero, jumped 1.7%, while artificial intelligence producer, Appen, closed 0.6% lower.

The Australian futures point to a 0.68% rise today, driven by stronger overseas markets.

Overseas Markets

European sharemarkets rose overnight following their worst sell-off this year. The major miners, who were heavily weakened in the previous trading session, added 1.2%, as BHP lifted 1.9% and Glencore rose 2.0%. By the close of the session, the pan-European STOXX 600 index added 0.5%.

US sharemarkets also closed higher overnight, as positive earnings reports boosted investor confidence in the country, following recent worries regarding the spread of the Delta COVID variant. The Information Technology sector rose sharply, as Fortinet added 2.8%, Apple lifted 2.6% and Microsoft gained 0.8%. Netflix fell in after-hours trade as its earnings forecasts missed estimates, although has recovered since.

By the close of trade, the Dow Jones and the NASDAQ both rose 1.6%, while the S&P 500 gained 1.5%.

CNIS Perspective

Last year’s recession is hardly an outcome the Federal Government would be crowing about, particularly after Australia held an enviable record of over 26 years without one.

What would be even more demoralising for the Government is another recession this year, although extended lockdowns only increase the likelihood.

A four-week lockdown in NSW and two weeks in Victoria (a likely best-case scenario) is expected to result in a 0.7% cut to quarterly GDP, or $3.7 billion, which would virtually wipe out most of the growth in the quarter.

An eight-week NSW lockdown and four-week lockdown in Victoria (a worst-case scenario?) would slice 1.4% off quarterly GDP, or $7.5 billion, which would imply negative growth in the quarter.

Hopefully, the lockdowns are over before the end of the third quarter, and we see a rebound in the run up to Christmas, because a recession is defined as two consecutive quarters of negative growth.

The pressure is therefore on from an economic and political perspective, as well as health, to end the lockdowns as soon as practical.

This is probably not a bad thing.

Federal and state governments need to be highly motivated to increase the rate of vaccination through increased supply and participation and maintain the standard of health we are accustomed to, at the same time as, at least, ensuring economic stability, if not growth.

Should you wish to discuss this or any other investment related matter, please contact your Investment Services Team on (02) 4928 8500.

Disclaimer

The material contained in this publication is the nature of the general comment only, and neither purports, nor is intended to be advice on any particular matter. Persons should not act nor rely upon any information contained in or implied by this publication without seeking appropriate professional advice which relates specifically to his/her particular circumstances. Cutcher & Neale Investment Services Pty Limited expressly disclaim all and any liability to any person, whether a client of Cutcher & Neale Investment Services Pty Limited or not, who acts or fails to act as a consequence of reliance upon the whole or any part of this publication.

Cutcher & Neale Investment Services Pty Limited ABN 38 107 536 783 is a Corporate Authorised Representative of Cutcher & Neale Financial Services Pty Ltd ABN 22 160 682 879 AFSL 433814.

Cutcher's Investment Lens | 7 - 11 April 2025

The failed $3 million super tax: Division 296 is done… or is it?

Cutcher's Investment Lens - Update on Trump & Tariffs | 31 March - 4 April 2025

Liberation Day - April 2025 Snapshot

Smart investing for SMEs: The basics on how to get started and grow your business.