Pre-Open Data

Key Data for the Week

- Wednesday – EUR – Consumer Confidence plunged to -27 in July, the lowest level on record.

- Wednesday – UK – Consumer Price Index reached a new 40-year high of 9.4% in June, year on year, higher than the expected 9.2%.

- Thursday – EUR – ECB Policy Decision

Australian Market

The Australian sharemarket experienced widespread gains on Wednesday, to finish 1.7% higher, after all industry sectors advanced for the tenth time this calendar year. All sectors added over 1.2%, except the Consumer Staples sector, which edged up just 0.4%. The Information Technology (3.8%) and Materials (2.5%) sectors were the key performers in the session.

Notable contributors to yesterday’s performance included Technology heavyweights WiseTech Global (5.6%), Xero (5.9%) and Block Inc (4.4%), alongside major miners Fortescue Metals Group (5.2%) and Rio Tinto (2.2%).

In company news, Megaport’s share price surged 23.0%, to be the top performer for the day, after it released a quarterly update. The company update reported double digit revenue growth, more than $80 million in cash reserves and revealed it would deliver a profit for the first time.

Northern Star Resources also provided a quarterly update, which stated gold sales fell 2% in FY2022, and that costs were in the upper end of its guidance range. Despite this, the company’s share price rose 2.1%, after it fell as much as 2.4% early in the trade session.

The Australian futures market points to a 0.5% decline today.

Overseas Markets

European sharemarkets edged lower on Wednesday, as record high inflation data and poor consumer confidence added to recession concerns. Furthermore, investors remained cautious given uncertainty around Russian gas supplies to the region and the European Central Bank meeting on Thursday. Industry sector performance was mixed, as the Banks and Health Care sectors both broadly lost 0.8%, while the Energy sector added 0.5% and the Materials sector was flat. Notable detractors in the session included HelloFresh (-9.4%), Airbus (-1.1%), Tesco (-1.0%) and HSBC Holdings (-2.0%). By the close of trade, the STOXX Europe 600, German DAX and the UK FTSE 100 all conceded between 0.2%-0.5%.

US sharemarkets improved on Wednesday, after positive company reports seemed to reinforce investor sentiment. Most notably, Netflix jumped 7.4%, after it reported better than expected earnings and provided guidance around achieving customer growth in the September quarter. Meanwhile, NVIDIA added 4.8%, after the US Senate brought forward a US$50 billion bill to boost domestic chip manufacturing. Seven out of eleven industry sectors advanced, led by the Consumer Discretionary (1.8%) and Information Technology (1.6%) sectors. Other key contributors included Shopify (12.0%), Spotify (4.2%), Meta Platforms (4.2%) and Amazon (3.9%). By the close of trade, the S&P 500 and Dow Jones rose 0.6% and 0.2% respectively, while the NASDAQ added 1.6%.

CNIS Perspective

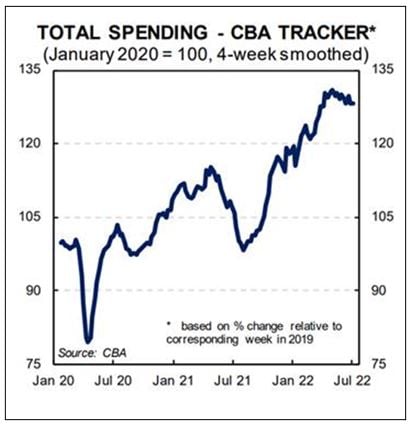

Commonwealth Bank has released its credit card spending data and it confirms consumer spending is slowing and may well have peaked in May.

Since then there has been a 2% fall in credit card spending, which is centred on discretionary spending.

Interestingly, food and alcohol is holding up reasonably well, whereas household furnishings and equipment and clothing and footwear have slowed.

Consumer spending is a key factor in economic growth and clearly higher interest rates are working to slow things down.

Should you wish to discuss this or any other investment related matter, please contact your Wealth Management Team on (02) 4928 8500.

Disclaimer

The material contained in this publication is the nature of the general comment only, and neither purports, nor is intended to be advice on any particular matter. Persons should not act nor rely upon any information contained in or implied by this publication without seeking appropriate professional advice which relates specifically to his/her particular circumstances. Cutcher & Neale Investment Services Pty Limited expressly disclaim all and any liability to any person, whether a client of Cutcher & Neale Investment Services Pty Limited or not, who acts or fails to act as a consequence of reliance upon the whole or any part of this publication.

Cutcher & Neale Investment Services Pty Limited ABN 38 107 536 783 is a Corporate Authorised Representative of Cutcher & Neale Financial Services Pty Ltd ABN 22 160 682 879 AFSL 433814.

Smart investing for SMEs: The basics on how to get started and grow your business.

ATO updates: A quick guide on what business owners need to know.

Cutcher's Investment Lens | 24 - 28 March 2025

Is your current super fund holding you back? It might be time for an SMSF.

Cutcher's Investment Lens | 17 - 21 March 2025