Pre-Open Data

Key Data for the Week

- Monday – UK – Rightmove House Price Index rose 0.3% in September.

- Tuesday – US – Building Permits

- Tuesday – AUS – RBA Board Meeting Minutes

Australian Market

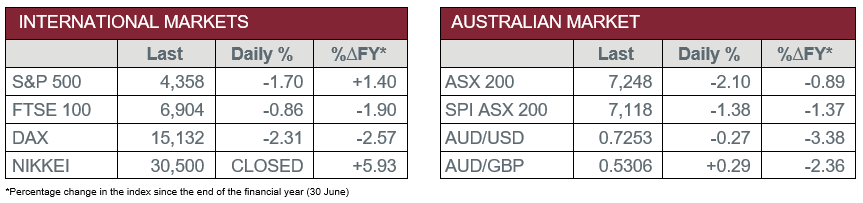

The Australian sharemarket slumped to its worst performance since February, as the price of iron ore continued its downward trajectory. Markets were also weakened by fears of a potential collapse of Chinese property developer, Evergrande. The ASX 200 closed the session 2.1% lower.

The Materials sector was the hardest hit, as it fell 3.7%, with the price of iron ore currently sitting at ~US$120 per tonne. Rio Tinto dropped 3.6% during the day’s trade, while Fortescue Metals and BHP lost 3.7% and 4.2% respectively.

The major oil providers were heavily weakened, resulting in a 3.0% fall in the Energy sector. Santos fell 3.3%, while Woodside Petroleum and Beach Energy slipped 2.5% and 1.4% respectively. Coal miners also weakened the Energy sector, as Whitehaven Coal shed 4.8%.

The big four banks all closed the session lower, as ANZ, NAB and Commonwealth Bank all fell 2.0%. Westpac was the worst performer, down 2.2%. Fund Managers also lost ground; Australian Ethical Investment shed 0.8%, while Magellan Financial Group conceded 2.1%.

The Australian futures point to a 1.38% fall today.

Overseas Markets

European sharemarkets lost ground overnight, as concerns remain over solvency issues surrounding Chinese property group, Evergrande. Mining stocks fell 3.6% on the back of weak iron ore prices; Glencore shed 3.8% and BHP lost 1.6%. The German market in particular lost ground, as a bigger-than-expected jump in producer prices reduced investor optimism.

By the close of the session, the German DAX lost 2.3%, while the UK FTSE 100 fell 0.9% and the STOXX Europe 600 gave up 1.7%.

US sharemarkets were subject to a broad sell-off with markets suffering their worst fall since May. The Information Technology sector was heavily weakened by the ‘big tech’ companies. Amazon slumped 3.1%, while Apple and Alphabet dropped 2.1% and 1.7% respectively. The Energy sector also lost ground; Chevron slipped 2.1% and ExxonMobil lost 2.7%.

By the close of trade, the Dow Jones lost 1.8%, while the S&P 500 fell 1.7% and the NASDAQ dropped 2.2%.

CNIS Perspective

Concerns about the world’s most-indebted property developer, Chinese-based Evergrande, is spreading as senior policy makers stay silent on whether the Chinese Government will step in to prevent a messy collapse. It has sparked the biggest sell-off in Hong Kong property stocks in more than a year, with the Hang Seng Property index closing down almost 7% overnight, to its lowest level since 2016.

The critical question for investors is how and when do leaders in Beijing handle the situation, and whether they launch a restructuring of the Evergrande Group. Investors have worried that Beijing may let the company fail, adversely impacting shareholders and bondholders. Evergrande faces a debt payment on its bonds this coming Thursday, after it said last week, it was facing unprecedented difficulties.

The risk is if there is trouble within other property companies, property values will suffer and there could be turmoil in the housing market. The consumer is a large factor in the Chinese economy, and a hit on housing could hurt consumption. This would also flow into other regional and global markets through a weakening in the Chinese imports market, as well as a slowing of demand for all sorts of raw materials. We have already been witnessing the significant weakening in the iron ore price over the past few weeks.

This is a critical moment for the Chinese Government, which has been carrying out numerous regulatory crackdowns on companies ranging from technology, to education, gaming, and other industries.

Evergrande is unlikely to lead to the next financial crisis, but it could lead to more market volatility in the short-term.

Should you wish to discuss this or any other investment related matter, please contact your Investment Services Team on (02) 4928 8500.

Disclaimer

The material contained in this publication is the nature of the general comment only, and neither purports, nor is intended to be advice on any particular matter. Persons should not act nor rely upon any information contained in or implied by this publication without seeking appropriate professional advice which relates specifically to his/her particular circumstances. Cutcher & Neale Investment Services Pty Limited expressly disclaim all and any liability to any person, whether a client of Cutcher & Neale Investment Services Pty Limited or not, who acts or fails to act as a consequence of reliance upon the whole or any part of this publication.

Cutcher & Neale Investment Services Pty Limited ABN 38 107 536 783 is a Corporate Authorised Representative of Cutcher & Neale Financial Services Pty Ltd ABN 22 160 682 879 AFSL 433814.

Cutcher's Investment Lens | 7 - 11 April 2025

The failed $3 million super tax: Division 296 is done… or is it?

Cutcher's Investment Lens - Update on Trump & Tariffs | 31 March - 4 April 2025

Liberation Day - April 2025 Snapshot

Smart investing for SMEs: The basics on how to get started and grow your business.