Pre-Open Data

Key Data for the Week

Key economic data released this week:

- Monday – CHINA – PBoC Interest Rate Decision – The benchmark interest rate remained unchanged at 3.85%.

- Monday – EUR – Consumer Confidence rose from -17.6 in November to -13.9 in December.

- Tuesday – AUS – Retail Sales

- Tuesday – UK – Gross Domestic Product

- Tuesday – US – Gross Domestic Product

Australian Market

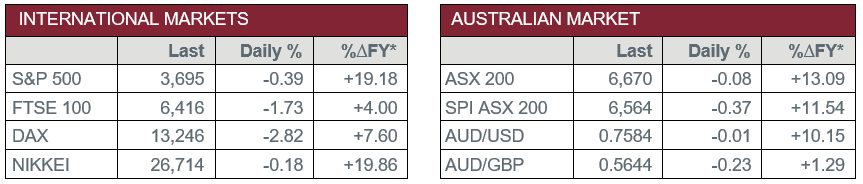

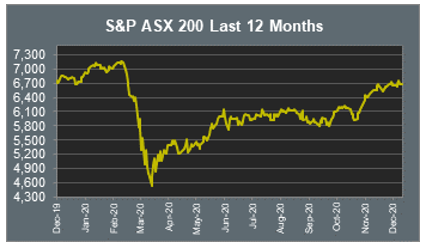

The Australian sharemarket lost 0.1% yesterday, weighed down by further COVID-19 restrictions imposed in NSW. Losses were broad based, as the Utilities and Information Technology sectors fell 2.2% and 1.0% respectively. The Materials sector was the only sector to improve, closing up 1.4%.

The Materials sector outperformed as iron ore prices continued to rally. Fortescue Metals gained 4.9%, while BHP and Rio Tinto added 1.2% and 0.9% respectively. Goldminers saw modest gains; Saracen Mineral lifted 1.0% and Northern Star rose 0.7%, while Newcrest Mining added 0.1%.

Stocks in the Financials sector were mixed on Monday. Westpac lost 0.1%, Commonwealth Bank slipped 0.2% and NAB gave up 0.3%, while ANZ gained 0.3%. Health insurers enjoyed gains following the approval by the Federal Government to increase premiums. The 2.74% annual increase is due to take effect from 1 April 2021. NIB jumped 3.2%, while Medibank Private climbed 3.8%.

Power and gas provider AGL sunk 5.1% yesterday after the company lowered earnings guidance due to a fire which will keep its Liddell power station in NSW out of operation until March.

The Australian futures market points to a 0.37% fall today.

Overseas Markets

European sharemarkets fell overnight in their worst session of trade in almost two months, as the spread of a new strain of COVID-19 has forced new travel restrictions to be imposed, with numerous countries closing their borders to the UK. The broad-based STOXX Europe 600 sunk 2.3%, its lowest close since mid-November. Travel and leisure stocks slumped; International Airlines Group gave up 7.9% and Lufthansa lost 4.3%.

US sharemarkets were mixed on Monday. Most sectors lost ground, with Financials and Information Technology the only sectors to close higher. Microsoft rose 1.8% and Apple added 1.2%, while Alphabet and NVIDIA both gained 0.5%. By the close of trade, the S&P 500 slipped 0.4% and the NASDAQ fell 0.1%, while the Dow Jones rose 0.1%.

CNIS Perspective

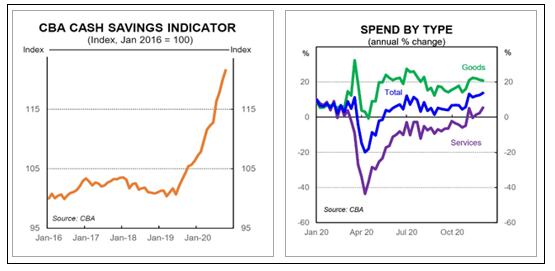

The latest wave of COVID-19 threatens to knock the wind out of the sails of consumers, particularly those in NSW, just as they were showing signs of consolidated growth.

Cash savings have skyrocketed this year as consumer spending dried up in response to lockdowns and business closures. The rate at which these savings are spent, will be a key indicator for the all-important Consumer Discretionary sector that drives GDP growth.

The graphs below show the effect of COVID-19 on cash savings and spending during 2020. The last thing the economy needs now is another round of lockdowns and consumer hibernation.

While financial markets have been challenging during the year, the team at Cutcher & Neale Investment Services battled through it, in what can be generally regarded as business as usual.

Today is our last Morning Market Update for 2020 and we’d like to take this opportunity to thank you for your continued support.

We trust you will have a wonderful Christmas break and safe and healthy 2021.

If we can get through 2020 with smiles on our faces, we are well prepared for the challenges of 2021! Here’s hoping anyway!

Thanks again. See you next year.

Should you wish to discuss this or any other investment related matter, please contact your Investment Services Team on (02) 4928 8500.

Disclaimer

The material contained in this publication is the nature of the general comment only, and neither purports, nor is intended to be advice on any particular matter. Persons should not act nor rely upon any information contained in or implied by this publication without seeking appropriate professional advice which relates specifically to his/her particular circumstances. Cutcher & Neale Investment Services Pty Limited expressly disclaim all and any liability to any person, whether a client of Cutcher & Neale Investment Services Pty Limited or not, who acts or fails to act as a consequence of reliance upon the whole or any part of this publication.

Cutcher & Neale Investment Services Pty Limited ABN 38 107 536 783 is a Corporate Authorised Representative of Cutcher & Neale Financial Services Pty Ltd ABN 22 160 682 879 AFSL 433814.

Smart investing for SMEs: The basics on how to get started and grow your business.

ATO updates: A quick guide on what business owners need to know.

Cutcher's Investment Lens | 24 - 28 March 2025

Is your current super fund holding you back? It might be time for an SMSF.

Cutcher's Investment Lens | 17 - 21 March 2025