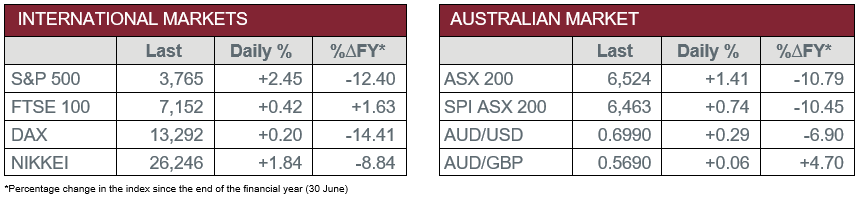

Pre-Open Data

Key Data for the Week

- Wednesday – EUR – Consumer Confidence

- Wednesday – UK – Consumer Price Index

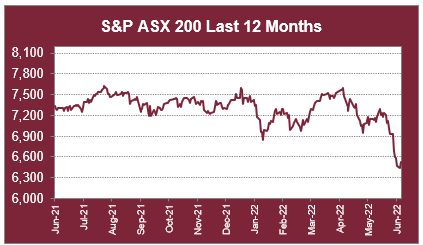

Australian Market

The Australian sharemarket rebounded 1.4% on Tuesday to end a seven-day losing streak. Sentiment was boosted by Reserve Bank Governor Philip Lowe, where he reassured investors he “doesn’t see a recession on the horizon” and reiterated that Australians should be prepared for further rate hikes.

Stronger iron ore prices lifted the Materials sector, which closed up 1.6%. Fortescue Metals gained 3.5% and Rio Tinto rose 2.3%, while Mineral Resources lifted 2.1% and BHP closed up 1.7%. Gold miners were mixed; Northern Star Resources and Newcrest Mining eked out gains of 0.5% and 0.4% respectively, while Evolution Mining slipped 0.6%.

The Financials sector posted a 2.7% gain. NAB was the main outperformer, up 3.8%, followed by Westpac, which added 2.7%, while ANZ and Commonwealth Bank rose 2.6% and 2.4% respectively. Fund managers also enjoyed gains; Challenger climbed 4.4% and Australian Ethical Investment advanced 4.3%, while Magellan Financial Group lifted 3.7%.

The REITs sector weakened; Stockland slipped 1.1% and GPT Group fell 1.4%, while Dexus gave up 1.7% despite its announcement that 177 of its assets have been revalued externally, which has resulted in an increase of approximately $374 million on prior book values for the six months to 30 June 2022.

Health Care was one of three sectors to finish in the red. Sonic Healthcare retreated 2.1% and Cochlear slid 1.6%, while biotechnology heavyweight CSL slipped 1.2%. However, Ramsay Health Care bucked the trend to add 0.2.%.

The Australian futures market points to a 0.74% rise today, driven by stronger overseas markets.

Overseas Markets

European sharemarkets advanced overnight. A rally in the price of oil boosted the Energy sector; BP rose 0.9%, while Royal Dutch Shell lifted 1.9%. Banking stocks also closed higher; Deutsche Bank lifted 0.5%, while Barclays Bank and HSBC both added 0.2%. By the close of trade, the STOXX Europe 600 and UK FTSE 100 both closed up 0.4%, while the German DAX rose 0.2%.

US sharemarkets also closed higher on Tuesday, as all sectors posted gains of over 1.5%. The Energy sector rallied 5.1%; ExxonMobil climbed 6.2%, while Chevron jumped 4.2%. Technology majors also advanced; Fortinet added 4.5% and NVIDIA gained 4.3%, while Alphabet and Apple gained 3.9% and 3.2% respectively. By the close of trade, the NASDAQ, S&P 500 and Dow Jones all lifted between 2.2% and 2.5%.

CNIS Perspective

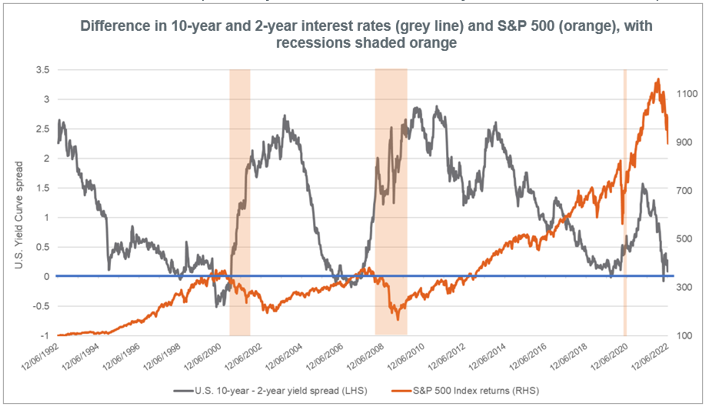

A meaningful reduction in US inflation seems unlikely with wages growth at current levels, so it is likely the Federal Reserve will have to manufacture an increase in unemployment with further aggressive rate hikes and ultimately a recession.

It is important to note that in the United States there has never been a jump in unemployment of more than 0.5% without a forthcoming recession.

One of the most historically accurate leading indicators of a recession has been inverted yield curves. The below chart shows that over the past 30 years, each time the US yield curve has inverted (below the blue horizontal line), a US recession (shown by the orange bars) has tended to follow, along with a significant drawdown in equities. This includes 2001, the Global Financial Crisis (GFC) and the COVID-19 crisis.

The yield curve inverted in April this year and currently sits very close to that zero bound again.

The funny thing about recessions is that you don’t officially know you are in one, until months after it has set in.

Should you wish to discuss this or any other investment related matter, please contact your Wealth Management Team on (02) 4928 8500.

Disclaimer

The material contained in this publication is the nature of the general comment only, and neither purports, nor is intended to be advice on any particular matter. Persons should not act nor rely upon any information contained in or implied by this publication without seeking appropriate professional advice which relates specifically to his/her particular circumstances. Cutcher & Neale Investment Services Pty Limited expressly disclaim all and any liability to any person, whether a client of Cutcher & Neale Investment Services Pty Limited or not, who acts or fails to act as a consequence of reliance upon the whole or any part of this publication.

Cutcher & Neale Investment Services Pty Limited ABN 38 107 536 783 is a Corporate Authorised Representative of Cutcher & Neale Financial Services Pty Ltd ABN 22 160 682 879 AFSL 433814.

Smart investing for SMEs: The basics on how to get started and grow your business.

ATO updates: A quick guide on what business owners need to know.

Cutcher's Investment Lens | 24 - 28 March 2025

Is your current super fund holding you back? It might be time for an SMSF.

Cutcher's Investment Lens | 17 - 21 March 2025