Pre-Open Data

Key Data for the Week

- Monday – EUR – Consumer Confidence

- Monday – US – Existing Home Sales

- Tuesday – EUR – Markit Services PMI

- Tuesday – US – Markit Manufacturing PMI

- Wednesday – AUS – Construction Work Done

- Wednesday – US – Gross Domestic Product

- Thursday – AUS – Private Capital Expenditure

- Friday – AUS – Retail Sales

- Friday – UK – Nationwide House Prices

- Friday – CHINA – Industrial Profits

Australian Market

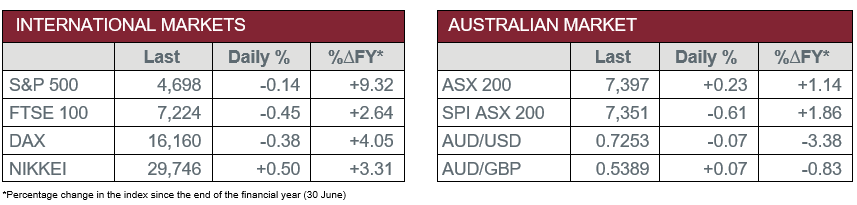

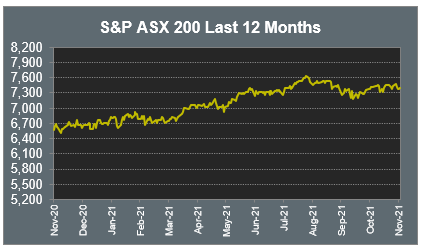

The Australian sharemarket added 0.2% on Friday, lifted by gains from the Consumer Staples and Health Care sectors. The Industrials sector was the weakest performer, down 0.6%, followed by the Information Technology, Utilities and Consumer Discretionary sectors, which all fell 0.2%. Over the week, the local ASX 200 gave up 0.6%, its second consecutive week of losses.

The major banks were mixed on Friday; Commonwealth Bank added 0.4% and Westpac finished the session flat, while NAB and ANZ lost 0.5% and 0.7% respectively. Fund managers were weaker, as Challenger fell 0.2% and Magellan Financial Group slipped less than 0.1%, however, Australian Ethical Investment bucked the trend to gain 0.9%.

The Health Care sector posted a 0.9% gain, lifted by Sonic Healthcare, which rallied 3.2%. Biotechnology heavyweight CSL and healthcare provider Ramsey Health Care also contributed to the gains, up 1.0% and 0.2% respectively.

The Australian futures market points to a 0.61% fall today.

Overseas Markets

European sharemarkets weakened on Friday after countries reimposed COVID-19 restrictions and Austria announced a nationwide lockdown amid rising cases. As a result, travel stocks declined; International Airlines Group gave up 2.8% and easyJet fell 2.7%, while German airline Lufthansa lost 2.2%. Banking stocks posted losses following a fall in bond yields; Deutsche Bank shed 4.9% and Barclays Bank eased 2.2%, while Lloyds Bank lost 1.7%.

By the close of trade, the STOXX Europe 600 slipped 0.3% and the German DAX fell 0.4%, while the UK FTSE 100 lost 0.5%.

US sharemarkets were mixed on Friday. The Energy sector was the worst performer, down 3.9%; ExxonMobil tumbled 4.6%, while Chevron shed 2.2%. The Financials sector also declined; PayPal gave up 3.4% and PagSeguro Digital fell 3.3%, while MasterCard and Visa lost 2.4% and 1.2% respectively. The Information Technology sector posted gains; NVIDIA rallied 4.1% and Meta Platforms (Facebook) rose 2.0%, while Apple and Microsoft gained 1.7% and 0.5% respectively.

By the close of trade, the Dow Jones closed down 0.8% and the S&P 500 slipped 0.1%, while the NASDAQ rose 0.4%. Over the week, the Dow Jones fell 1.4%, while the S&P 500 and NASDAQ added 0.3% and 1.2% respectively.

CNIS Perspective

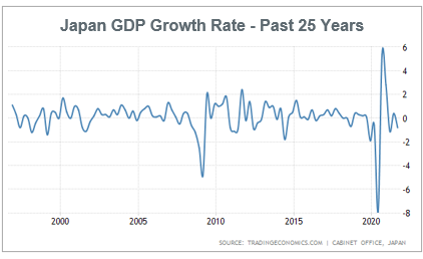

Japan’s new Prime Minister Fumio Kishida unveiled a big stimulus package on Friday that he hopes to jump-start an economy that has stalled due to the pandemic. Japan’s GDP contracted by 3% at an annualised rate in the third quarter, amid disruptions to global supply chains and a summer wave of COVID-19.

The new package, worth ¥56 trillion (US$490 billion), defies the global trend of unwinding stimulus, as concerns grow that economies are overheating. Most of the stimulus will go to struggling households and businesses, including cash handouts of ¥100,000 yen per child to families and wage increases for care workers and nurses. Japan has already spent ¥88 trillion in fiscal stimulus, or nearly 17% of GDP, since the start of the outbreak in 2020.

This generosity might do less than hoped, with around 70% of a previous round of cash handouts saved, rather than spent. This is a long-term issue for Japan’s economic recovery, which has suffered periodic bouts of deflation.

Should you wish to discuss this or any other investment related matter, please contact your Investment Services Team on (02) 4928 8500.

Disclaimer

The material contained in this publication is the nature of the general comment only, and neither purports, nor is intended to be advice on any particular matter. Persons should not act nor rely upon any information contained in or implied by this publication without seeking appropriate professional advice which relates specifically to his/her particular circumstances. Cutcher & Neale Investment Services Pty Limited expressly disclaim all and any liability to any person, whether a client of Cutcher & Neale Investment Services Pty Limited or not, who acts or fails to act as a consequence of reliance upon the whole or any part of this publication.

Cutcher & Neale Investment Services Pty Limited ABN 38 107 536 783 is a Corporate Authorised Representative of Cutcher & Neale Financial Services Pty Ltd ABN 22 160 682 879 AFSL 433814.

Cutcher's Investment Lens | 7 - 11 April 2025

The failed $3 million super tax: Division 296 is done… or is it?

Cutcher's Investment Lens - Update on Trump & Tariffs | 31 March - 4 April 2025

Liberation Day - April 2025 Snapshot

Smart investing for SMEs: The basics on how to get started and grow your business.