Pre-Open Data

Key Data for the Week

- Tuesday – US – Building Permits

- Tuesday – AUS – RBA Board Meeting Minutes provided insight into the decision to taper their bond buying program in September.

- Wednesday – AUS – Westpac Lending Index

Australian Market

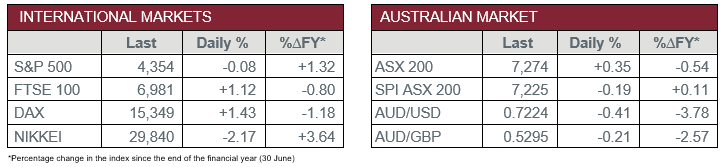

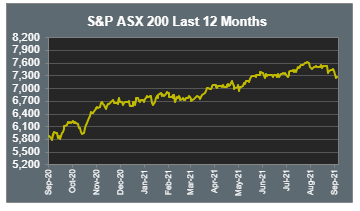

The Australian sharemarket swiftly rebounded on Tuesday, up 0.4%, as most sectors closed ahead. The recovery was welcomed by investors, subsequent to Monday’s 2.1% loss. Recent market activity seems to support analyst predictions for an economic slowdown and market adjustment, as regulators across the globe seek to begin tapering their expansionary policies.

The Energy (1.5%), Information Technology (1.3%) and Telecommunications (1.1%) sectors led gains made yesterday. Origin Energy and Woodside Petroleum both pushed ~1.6% higher. Afterpay and Xero both advanced 0.9%, while WiseTech Global surged 5.0%. Meanwhile telecom giant, Telstra, gained 1.3%.

Commodity prices weakened further, as the price of iron ore slumped another 6.7% to US$94 per tonne. However, this did not seem to affect its major miners yesterday as BHP, Rio Tinto and Fortescue Metals were ahead 0.6%, 0.5% and 0.3% respectively. It should be noted that all three are trading near their lowest levels of the year.

The Financials sector was the worst performer, down 0.4%, with all but one of the major banks in the red. Commonwealth Bank and Westpac both conceded ~0.4% and NAB lost 0.9%, while ANZ closed flat. Other key movers included Magellan Financial Group (-3.4%), Macquarie Group (-1.0%) and Liberty Financial Group (-1.2%). A notable gainer was Australian Ethical Investment, ahead 1.0%.

The Australian futures point to a 0.19% decrease today.

Overseas Markets

European sharemarkets also recovered on Tuesday, as the STOXX Europe 600, the German DAX and the UK FTSE 100 rose 1.0%, 1.4% and 1.1% respectively. This rebound came after the biggest fall in two months during the previous session. The Energy sector was a strong performer, alongside travel and leisure stocks, on news of the relaxation on US travel curbs. Universal Music Group, the business behind singers like Lady Gaga, Taylor Swift and The Weeknd, made its market debut and surged 35.7%.

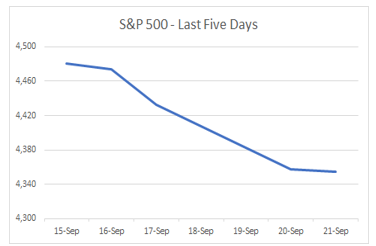

US sharemarkets were mixed on Tuesday, as investors considered the global contagion effect of a crippled Chinese property market, and its effect on credit, as its largest developer, Evergrande, looks to be unable to meet its debt obligations. The S&P 500 and Dow Jones both lost 0.1% and 0.2%, while the NASDAQ added 0.2%. The Energy sector, again, was the strongest performer, up 0.4%, while Industrials was the weakest sector, down 0.7%.

CNIS Perspective

We like to think financial markets are always focussed on data, whether that be company earnings, retail sales, unemployment etc. However, there are times when no matter how strong or weak the data is, it’s the overarching sentiment of the broader macroeconomic background that dominates and directs the market.

Last week the US recorded stronger retail sales and lower CPI, but neither elicited a positive market response. Instead US stocks slumped 1% on Friday, 2% on Monday, and were flat last night.

It appears the market is more focussed on this week’s impending Federal Reserve meeting and the still high rate of US COVID vaccinations and hospitalisations. Around 2,000 Americans are dying each day from COVID, which equates on a per capita basis, to 200 Australians dying each day, or 20 times our current rate.

It’s feared the Federal Reserve meeting will announce the commencement of bond tapering and the commencement of interest rate hikes in 2022, instead of 2023, which is contrary to Federal Reserve Chair Jerome Powell’s pledge to keep interest rates lower for longer and not move till 2023.

It’s this overarching macro concern and uncertainty over China’s Evergrande collapse that’s driving the market, not strong data.

Should you wish to discuss this or any other investment related matter, please contact your Investment Services Team on (02) 4928 8500.

Disclaimer

The material contained in this publication is the nature of the general comment only, and neither purports, nor is intended to be advice on any particular matter. Persons should not act nor rely upon any information contained in or implied by this publication without seeking appropriate professional advice which relates specifically to his/her particular circumstances. Cutcher & Neale Investment Services Pty Limited expressly disclaim all and any liability to any person, whether a client of Cutcher & Neale Investment Services Pty Limited or not, who acts or fails to act as a consequence of reliance upon the whole or any part of this publication.

Cutcher & Neale Investment Services Pty Limited ABN 38 107 536 783 is a Corporate Authorised Representative of Cutcher & Neale Financial Services Pty Ltd ABN 22 160 682 879 AFSL 433814.

Cutcher's Investment Lens | 7 - 11 April 2025

The failed $3 million super tax: Division 296 is done… or is it?

Cutcher's Investment Lens - Update on Trump & Tariffs | 31 March - 4 April 2025

Liberation Day - April 2025 Snapshot

Smart investing for SMEs: The basics on how to get started and grow your business.