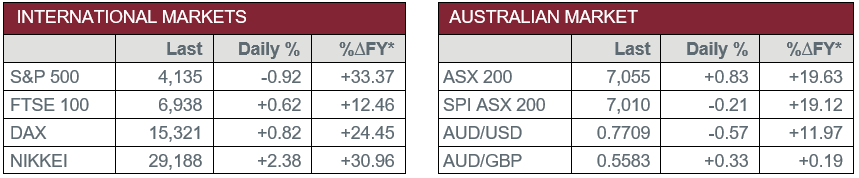

Pre-Open Data

Key Data for the Week

- Thursday – EUR – ECB Interest Rate Decision – Rates remained unchanged as expected.

- Thursday – US – Existing Home Sales fell 3.7% in March, the second straight month of declines.

- Friday – UK – Retail Sales

- Friday – US – Markit Manufacturing PMI

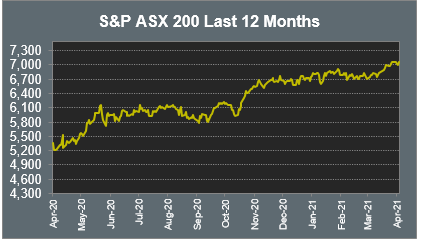

Australian Market

The Australian sharemarket rebounded from two consecutive days of losses to add 0.8% yesterday. The Health Care sector led the gains; CSL rose 1.8%, Ramsay Health Care gained 1.9% and Sonic Healthcare added 2.1%.

The REITs sector also outperformed, with shopping centres leading the gains; Stockland lifted 4.1%, GPT Group added 1.3% and Ingenia Communities rose 1.2%.

The big four banks all rose between 0.5% and 1.1%, led by Commonwealth Bank. Fund managers were mixed; Magellan Financial Group added 1.4%, while Australian Ethical Investment slipped 0.5%.

Information Technology stocks rallied. Megaport added 9.7% after the company reported stronger than expected Q3 revenue of $19.6 million. Afterpay rose 2.6% as speculation grows that it will list on the US NASDAQ, while WiseTech Global and Xero both added 1.0%.

The Consumer Staples sector was lifted by supermarket giants Coles and Woolworths, which added 1.7% and 1.5% respectively, while Wesfarmers rose 0.5%.

The Australian futures market points to a 0.21% fall today, driven by weaker US markets overnight.

Overseas Markets

European sharemarkets rose on Thursday, with the broad based STOXX Europe 600 up 0.7%. Vestas Wind Systems and Siemens Gamesa rallied 10.2% and 6.7% respectively after US President Joe Biden’s administration pledged to slash US greenhouse emissions in half by 2030. Vestas also sold a 118MW wind farm in Oklahoma to US company Southern Power, with Vestas to provide long term service for the project.

US sharemarkets were weaker overnight amid mixed economic data and renewed concern the pandemic is worsening. All sectors closed lower with technology heavyweights Alphabet, Amazon, Apple and Microsoft all down between 1.1% and 1.6%. The Financials sector was dragged lower by investment banks JPMorgan and Goldman Sachs, down 2.1% and 1.3% respectively. Renewable energy companies bucked the trend on the announcement the US plans to cut greenhouse emissions in half by 2030; SolarEdge lifted 7.7% and Enphase Energy added 3.7%. AT&T rose 4.2% after the company reported Q1 revenue and profit above expectations.

By the close of trade, the Dow Jones, S&P 500 and the NASDAQ all slipped 0.9%.

CNIS Perspective

Speculation is mounting that President Joe Biden is preparing to announce a string of tax increases on wealthy Americans to fund his latest ‘American Families Plan’, which focuses on education and childcare, and is expected to cost US$1 trillion.

The ‘American Families Plan’ is one of three major economic packages proposed by Biden since he took office in November. In March, the US$1.9 trillion fiscal stimulus plan was passed, while the current US$2 trillion infrastructure bill is still up for debate.

It is expected the individual income tax rate for the US’s highest earners could increase to 39.6%, from 37% currently. Capital gains are taxed separately to income in the US, typically at a rate of 20%, with the rate expected to increase to 39.6% for people who earn over US$1 million.

Given the significant increase to capital gains (almost double), one would expect some profit taking prior to the changes being legislated.

Biden is expected to release formal details next week and it comes amid a series of recent corporate tax reforms aimed at overhauling the US economy to strengthen the middle class.

If approved by Congress, it would be expected the changes would come into effect in 2022.

Should you wish to discuss this or any other investment related matter, please contact your Investment Services Team on (02) 4928 8500.

Disclaimer

The material contained in this publication is the nature of the general comment only, and neither purports, nor is intended to be advice on any particular matter. Persons should not act nor rely upon any information contained in or implied by this publication without seeking appropriate professional advice which relates specifically to his/her particular circumstances. Cutcher & Neale Investment Services Pty Limited expressly disclaim all and any liability to any person, whether a client of Cutcher & Neale Investment Services Pty Limited or not, who acts or fails to act as a consequence of reliance upon the whole or any part of this publication.

Cutcher & Neale Investment Services Pty Limited ABN 38 107 536 783 is a Corporate Authorised Representative of Cutcher & Neale Financial Services Pty Ltd ABN 22 160 682 879 AFSL 433814.

Cutcher's Investment Lens | 7 - 11 April 2025

The failed $3 million super tax: Division 296 is done… or is it?

Cutcher's Investment Lens - Update on Trump & Tariffs | 31 March - 4 April 2025

Liberation Day - April 2025 Snapshot

Smart investing for SMEs: The basics on how to get started and grow your business.