Pre-Open Data

Key Data for the Week

- Monday – EUR – Markit Manufacturing PMI

- Tuesday – US – New Home Sales

- Wednesday – AUS – Construction Work Done

- Thursday – US – Initial Jobless Claims

- Friday – AUS – Retail Sales

- Friday – UK – Nationwide House Prices

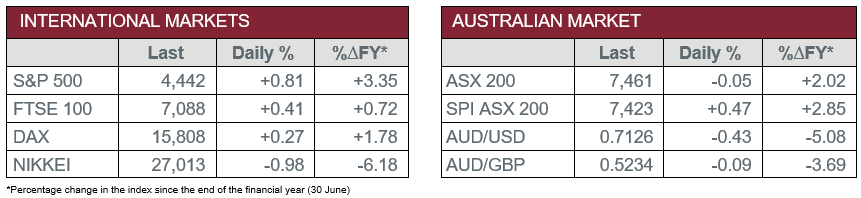

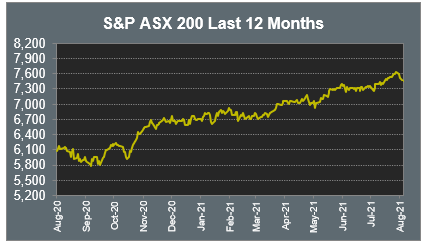

Australian Market

The Australian sharemarket fell less than 0.1% last Friday, with mixed sector performances. The losses follow the announcement that Sydney’s COVID-19 lockdown will be extended to the end of September, after 644 new daily cases were announced for NSW on Friday. Over the week, the local ASX 200 weakened 2.2%, its worst week since January, as rising Delta variant COVID-19 cases and falling commodity prices fuel investor uncertainty.

The Materials sector led losses, following a slump in the price of iron ore. Mining heavyweights were mixed; BHP lost 0.7%, while Rio Tinto and Fortescue Metals added 0.1% and 1.1% respectively. However, over the week, BHP shed 16.0%, Rio Tinto tumbled 10.9% and Fortescue Metals gave up 8.7%. Gold miners were weaker; Newcrest Mining slid 3.3% and Evolution Mining fell 0.8%, while Northern Star Resources slipped 0.5%.

The Industrials sector outperformed; Cleanaway Waste Management lifted 3.9% and Auckland Airport rose 2.7%, while Transurban added 0.5%. However, Sydney Airport slipped 0.3% after the company reported a first half loss after tax of $97 million and decided against paying an interim distribution.

The Australian futures point to a 0.47% rise today.

Overseas Markets

European sharemarkets advanced on Friday. Retail stocks were the key outperformers; British retailer Marks & Spencer climbed 14.1% after the company rose its profit outlook, while UK supermarket Morrisons added 4.2% after the company agreed to a takeover offer worth £7.0 billion. Banking stocks were mixed; Lloyds Bank rose 0.4% and Barclays added 0.2%, while Deutsche Bank and Credit Suisse both fell 0.3%. By the close of trade, UK FTSE 100 gained 0.4%, while the German DAX and STOXX Europe 600 both rose 0.3%.

US sharemarkets also lifted on Friday, as all sectors finished higher. The Information Technology sector was the strongest performer, up 1.3%; Spotify jumped 5.6%, NVIDIA added 5.1% and Microsoft rose 2.6%, while Alphabet and Apple gained 1.1% and 1.0% respectively. Financial services stocks advanced; BlackRock added 1.5% and PagSeguro Digital rose 1.4%, while PayPal gained 0.9%. Renewable Energy stocks enjoyed gains; SolarEdge Technologies lifted 2.9% and NextEra Energy rose 2.1%, while Enphase Energy closed up 1.9%. By the close of trade, the Dow Jones and S&P 500 added 0.7% and 0.8% respectively, while the NASDAQ gained 1.2%. Over the week, the S&P 500 slipped 0.6%, the NASDAQ lost 0.7% and the Dow Jones fell 1.1%.

CNIS Perspective

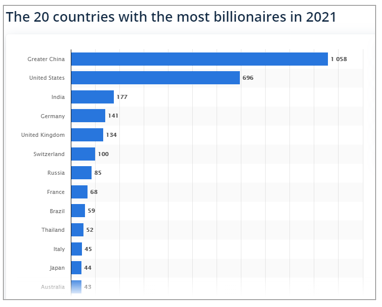

“To get rich is glorious”, was a famous quote by Deng Xiaoping, the Chinese leader who set his country on a path in the late 70’s of an accelerated process of economic development. Although in 1990, China’s GDP was roughly US$400 billion in today’s terms, it now stands at US$15 trillion after an annual growth rate of 13%. This economic miracle has seen 750 million Chinese that in 1990 were living below the international poverty line (US$1.90 per day), drop to less than 10 million today. Despite this enormous growth rate, Australia’s GDP per capita is 2.7x that of China’s, which indicates to investors there is still much more growth to come from its huge near 2 billion population rise in its middle class.

The Chinese Communist Party has now decided the economic elite have gone too far, with Premier Xi last week calling for the regulation of "excessively high incomes". These gross inequalities can be seen by the number of Chinese billionaires reaching 1,058 last year, far exceeding the 696 in the US or the 43 here in Australia. This is despite approximately 600 million Chinese still living off US$154 per month.

How Beijing plans to address this economic divide is not clear, but what is, is that national interests will not cede to private ones and China’s tech tycoons are in the cross hairs.

Should you wish to discuss this or any other investment related matter, please contact your Investment Services Team on (02) 4928 8500.

Disclaimer

The material contained in this publication is the nature of the general comment only, and neither purports, nor is intended to be advice on any particular matter. Persons should not act nor rely upon any information contained in or implied by this publication without seeking appropriate professional advice which relates specifically to his/her particular circumstances. Cutcher & Neale Investment Services Pty Limited expressly disclaim all and any liability to any person, whether a client of Cutcher & Neale Investment Services Pty Limited or not, who acts or fails to act as a consequence of reliance upon the whole or any part of this publication.

Cutcher & Neale Investment Services Pty Limited ABN 38 107 536 783 is a Corporate Authorised Representative of Cutcher & Neale Financial Services Pty Ltd ABN 22 160 682 879 AFSL 433814.

Cutcher's Investment Lens | 7 - 11 April 2025

The failed $3 million super tax: Division 296 is done… or is it?

Cutcher's Investment Lens - Update on Trump & Tariffs | 31 March - 4 April 2025

Liberation Day - April 2025 Snapshot

Smart investing for SMEs: The basics on how to get started and grow your business.