Pre-Open Data

Key Data for the Week

- Thursday – AUS – NAB Business Confidence Index – Business Conditions added 12 points to 32, while Confidence eased to 17 in the June quarter.

- Thursday – EUR – ECB Monetary Policy was left unchanged.

- Friday – UK – Retail Sales

Australian Market

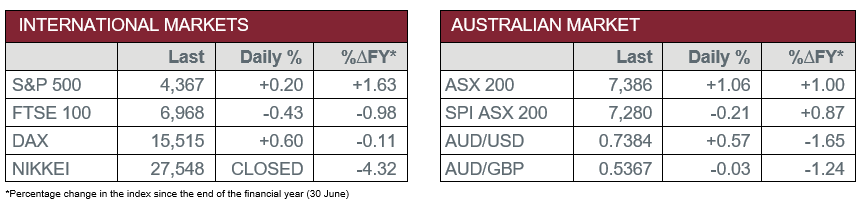

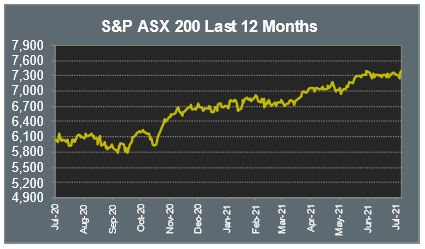

The Australian sharemarket jumped 1.1% to end the session at a record closing high. The Materials sector led the gains, up 2.2%, aided by an increase in commodity prices.

BHP was the best of the major miners, after the company announced they will supply nickel from Western Australia that will be used in Tesla’s electric cars. Shares were up 3.1% to close at $51.45. As for the other miners, Rio Tinto gained 1.2%, while Galaxy Resources soared 9.5%.

A significant jump in the price of oil led to gains across the Energy sector. Woodside Petroleum added 3.2% and Santos lifted 2.6%, while Beach Energy climbed 5.0%.

The Financials sector closed the session 1.1% higher, aided by gains from the big four banks. Commonwealth Bank gained 1.5% and ANZ lifted 1.3%, while Westpac and NAB added 0.7% and 1.2% respectively.

Gains in the Information Technology sector were limited as buy-now-pay-later provider, Zip, fell 7.8%, despite releasing positive year-on-year growth.

The Australian futures point to a 0.21% fall today.

Overseas Markets

European sharemarkets continued their recent run of strength overnight as the European Central Bank agreed to keep interest rates at a record low. Travel and leisure stocks led the gains, despite being heavily sold-off in the past week due to rising concerns over the Delta COVID variant. Air France added 0.4% and easyJet lifted 0.9%, while Ryanair jumped 3.5%.

US sharemarkets also closed higher overnight, helped by gains in the Information Technology sector. Sector giants Apple and Microsoft added 1.0% and 1.7% respectively, while Amazon finished the session 1.7% higher. All ‘big tech’ companies are set to report their quarterly reports next week. By the close of the session, the Dow Jones added 0.1% and the S&P 500 lifted 0.2%, while the NASDAQ gained 0.4%.

CNIS Perspective

It has not been spoken of much over the last few years, however, the US Treasury debt ceiling will be back in focus over the coming weeks and months, with the US Government most likely running out of money to pay its debt obligations by the fourth quarter, unless Congress chooses to continue suspending the debt ceiling or increases the borrowing limit.

Congress voted in 2019 to suspend the debt ceiling until 31 July of this year. Since then, the Government has added US$6.5 trillion in debt, bringing the total amount owed to US$28.5 trillion.

If lawmakers cannot reach another agreement before the end of this month, the borrowing limit would automatically be reinstated at the current level of debt and the US Treasury would not be able to raise additional cash from the sale of government securities.

If it cannot raise new money, the Treasury has said it would implement measures to keep paying the Government’s debt obligations in full and on time, as it has in the past. Those measures, such as redeeming certain investments in federal pension programs and suspending new investments in those programs, have previously freed up enough cash to last several months.

While US Government debt has been on an upward trajectory for over 20 years, spending measures implemented last year to combat the economic toll of COVID-19 have caused it to jump significantly.

Democrats chose not to include a debt ceiling increase in President Biden’s US$1.9 trillion coronavirus relief package, which was passed in March. That means lawmakers will have to include a debt ceiling increase or suspension in other legislation.

A full default by the US Government has never occurred, however, fights over the debt ceiling have occasionally rattled financial markets.

Should you wish to discuss this or any other investment related matter, please contact your Investment Services Team on (02) 4928 8500.

Disclaimer

The material contained in this publication is the nature of the general comment only, and neither purports, nor is intended to be advice on any particular matter. Persons should not act nor rely upon any information contained in or implied by this publication without seeking appropriate professional advice which relates specifically to his/her particular circumstances. Cutcher & Neale Investment Services Pty Limited expressly disclaim all and any liability to any person, whether a client of Cutcher & Neale Investment Services Pty Limited or not, who acts or fails to act as a consequence of reliance upon the whole or any part of this publication.

Cutcher & Neale Investment Services Pty Limited ABN 38 107 536 783 is a Corporate Authorised Representative of Cutcher & Neale Financial Services Pty Ltd ABN 22 160 682 879 AFSL 433814.

Cutcher's Investment Lens | 7 - 11 April 2025

The failed $3 million super tax: Division 296 is done… or is it?

Cutcher's Investment Lens - Update on Trump & Tariffs | 31 March - 4 April 2025

Liberation Day - April 2025 Snapshot

Smart investing for SMEs: The basics on how to get started and grow your business.