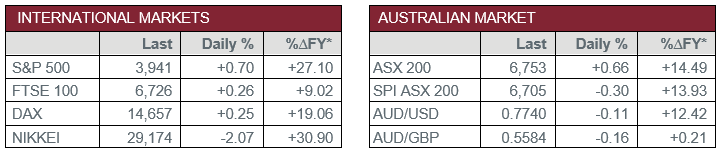

Pre-Open Data

Key Data for the Week

- Monday – US – Existing Home Sales fell more than anticipated to 6.22 million in February, from 6.66 million in January.

- Tuesday – UK – ILO Unemployment Rate

- Tuesday – US – New Home Sales

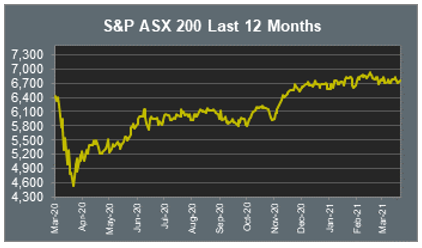

Australian Market

The Australian sharemarket advanced on Monday to close 0.7% higher. All sectors, except Materials, were stronger, with Energy, Utilities and Health Care the top performers, all up over 2.0%.

Losses among mining heavyweights weighed on the Materials sector, which closed 0.5% weaker. Fortescue Metals shed 4.3% and Rio Tinto lost 1.1%, while BHP fell 0.9%. However, goldminers enjoyed gains; Evolution Mining added 3.6% and Newcrest Mining lifted 2.0%, while Northern Star gained 1.4%.

Energy stocks outperformed; Oil Search closed up 3.3% and Woodside Petroleum gained 2.5%, while Santos rose 2.4%. The Utilities sector also lifted; AGL Energy added 3.2% and Mercury NZ gained 2.6%, while APA Group and AusNet Services closed up 1.8% and 1.4% respectively.

The Financials sector added 0.3% yesterday, as all major banks closed higher. NAB led the gains, up 0.7%, and Westpac lifted 0.6%, while ANZ and Commonwealth Bank added 0.5% and 0.4% respectively. Insurance companies have reported an increase in claims as a result of the NSW floods, as Insurance Group Australia noted more than 2,100 claims have been lodged since Sunday 21 March. QBE Insurance Group lost 3.0% and Insurance Group Australia slipped 2.2%, while NIB lost 2.0%.

The Australian futures market points to a 0.3% fall today.

Overseas Markets

European sharemarkets lifted overnight. Automaker stocks continued to rally; Porsche jumped 8.9% and Volkswagen Group climbed 7.3%. The Financials sector closed weaker after the Turkish lira slumped to a near record low. Barclays lost 1.5% and Deutsche Bank slipped 0.7%, while HSBC closed down 0.6%. Travel and leisure stocks were weaker after Germany announced plans to extend COVID-19 lockdowns. British Airways owner International Airlines Group shed 8.1% and easyJet lost 5.4%, while Lufthansa and Ryanair fell 3.1% and 2.9% respectively.

By the close of trade, the broad based STOXX Europe 600 rose 0.2%, while the UK FTSE 100 and German DAX both added 0.3%.

US sharemarkets also saw gains on Monday. The Information Technology sector outperformed; Apple lifted 2.8% and Fortinet rose 2.7%, while Microsoft and Spotify closed up 2.5% and 1.2% respectively. Financials was the weakest sector, down 1.3%. Citigroup slipped 1.4% and Bank of America dropped 2.3%, while JP Morgan Chase fell 2.7%. However, financial services were stronger; PayPal added 1.3%, while Visa and MasterCard both lifted 0.5%. Renewable energy stocks enjoyed gains; ChargePoint Holdings climbed 5.2% and Enphase Energy added 4.0%, while SolarEdge Technologies gained 2.9%.

By the close of trade, the Dow Jones and S&P 500 rose 0.3% and 0.7% respectively, while the NASDAQ lifted 1.2%.

CNIS Perspective

Last week’s employment data was obviously very encouraging, but like so much economic data, the devil is in the detail.

The economy is recovering, and some sectors are improving, however, stimulus in the form of JobKeeper is ending in the near future, while some COVID related restrictions still remain in place.

Some pockets of the economy will remain in pain for now and probably show no signs of improvement for some time. Restrictions on international travel will suppress tourism, education, agriculture (fruit pickers), while social distancing will keep a lid on employment growth in arts and recreation, hospitality and events.

While the recovery in employment was encouraging, we need to remind ourselves that in the months prior to the pandemic being declared, the unemployment rate average was 5.1%, which is far from full employment, in a period that failed to generate substantial wages growth or inflation.

On the surface it looks like a recovery is underway, but to what extent is the big question.

Should you wish to discuss this or any other investment related matter, please contact your Investment Services Team on (02) 4928 8500.

Disclaimer

The material contained in this publication is the nature of the general comment only, and neither purports, nor is intended to be advice on any particular matter. Persons should not act nor rely upon any information contained in or implied by this publication without seeking appropriate professional advice which relates specifically to his/her particular circumstances. Cutcher & Neale Investment Services Pty Limited expressly disclaim all and any liability to any person, whether a client of Cutcher & Neale Investment Services Pty Limited or not, who acts or fails to act as a consequence of reliance upon the whole or any part of this publication.

Cutcher & Neale Investment Services Pty Limited ABN 38 107 536 783 is a Corporate Authorised Representative of Cutcher & Neale Financial Services Pty Ltd ABN 22 160 682 879 AFSL 433814.

Cutcher's Investment Lens - Update on Trump & Tariffs | 31 March - 4 April 2025

Liberation Day - April 2025 Snapshot

Smart investing for SMEs: The basics on how to get started and grow your business.

ATO updates: A quick guide on what business owners need to know.

Cutcher's Investment Lens | 24 - 28 March 2025