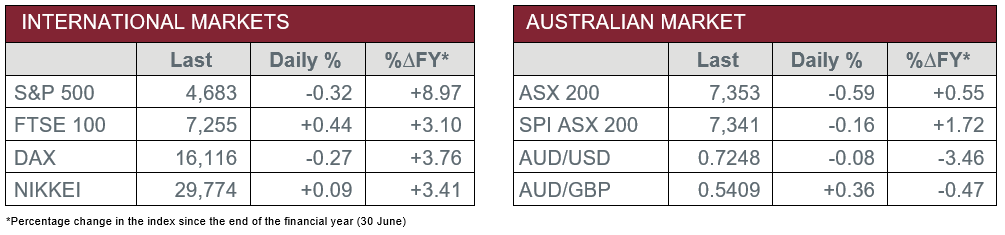

Pre-Open Data

Key Data for the Week

- Monday – EUR – Consumer Confidence dropped to -6.8 in November, from -4.8 in October.

- Monday – US – Existing Home Sales increased 0.8% in October.

- Tuesday – EUR – Markit Services PMI

- Tuesday – US – Markit Manufacturing PMI

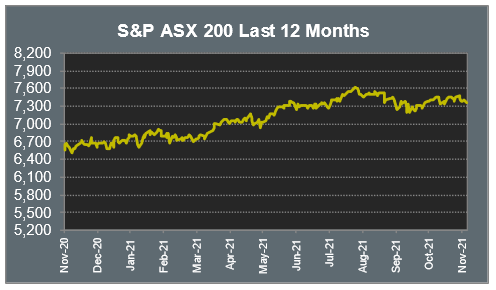

Australian Market

The Australian sharemarket lost 0.6% as investors exercised caution as some European countries re-introduce lockdowns following recent COVID outbreaks.

As a result of the increased COVID cases in Europe, travel stocks weakened. Qantas shed 4.0%, while Flight Centre and Webjet lost 7.1% and 3.7% respectively. Corporate Travel Management also closed the session in the red, as it dropped 6.0%.

The Information Technology sector was sold off, as investors moved away from growth stocks into more defensive categories. Buy-now-pay-later providers, Afterpay and Zip, both conceded 2.5%, while artificial intelligence provider, Appen, lost 2.0%. Accounting software provider, Xero, closed the session 3.1% lower, while NEXTDC shed 1.7%.

Commonwealth Bank continued its recent run of weakness, as the company lost a further 2.1%. Westpac also lost 2.1%, while ANZ and NAB dropped 2.0% and 1.2% respectively. Fund managers also lost ground; Australian Ethical Investment shed 2.6% and Magellan Financial Group closed the session 0.6% lower.

The Australian futures market points to a 0.16% fall today.

Overseas Markets

European sharemarkets were mixed on Monday, as tighter lockdowns were proposed in Germany. The Financials sector outperformed; ING Groep added 2.2% and Barclays lifted 2.0%, while Deutsche Bank was up 0.4%. By the close of trade, the STOXX Europe 600 slipped 0.1% and the German DAX fell 0.3%, while the UK FTSE 100 gained 0.4%.

US sharemarkets were also mixed overnight, as investors enjoyed the news Federal Chair Jerome Powell was nominated to serve a second term. Higher yields helped the Financials sector; Bank of America lifted 2.0% and Goldman Sachs added 2.3%. The ‘big tech’ companies were mixed, Amazon and Alphabet lost 2.8% and 1.8% respectively, while Apple lifted 0.3%. By the close of trade, the Dow Jones added 0.1%, while the S&P 500 slipped 0.3% and the NASDAQ slumped 1.3%.

CNIS Perspective

There are many discussions around the heights of the market and whether it has accelerated too far. As we head towards the final month of 2021, the US S&P 500 (in US Dollar terms) has risen 26.5% so far this calendar year, an extremely strong performance so far.

Interestingly, and somewhat surprisingly, if we look back historically, most of the time when the market closed 20%+ for the year, the following year was also positive, 84% of the time!

Higher US equity returns for calendar year 2022 will come down to three key criteria:

- Company earnings will need to continue to surge higher, to justify share price advances;

- The Technology sector will require another strong year, given it makes up 28% of the index returns, and;

- The Federal Reserve will be required to gently massage stimulus out of the economy, to avoid any shock to the market.

Should you wish to discuss this or any other investment related matter, please contact your Investment Services Team on (02) 4928 8500.

Disclaimer

The material contained in this publication is the nature of the general comment only, and neither purports, nor is intended to be advice on any particular matter. Persons should not act nor rely upon any information contained in or implied by this publication without seeking appropriate professional advice which relates specifically to his/her particular circumstances. Cutcher & Neale Investment Services Pty Limited expressly disclaim all and any liability to any person, whether a client of Cutcher & Neale Investment Services Pty Limited or not, who acts or fails to act as a consequence of reliance upon the whole or any part of this publication.

Cutcher & Neale Investment Services Pty Limited ABN 38 107 536 783 is a Corporate Authorised Representative of Cutcher & Neale Financial Services Pty Ltd ABN 22 160 682 879 AFSL 433814.

Cutcher's Investment Lens | 7 - 11 April 2025

The failed $3 million super tax: Division 296 is done… or is it?

Cutcher's Investment Lens - Update on Trump & Tariffs | 31 March - 4 April 2025

Liberation Day - April 2025 Snapshot

Smart investing for SMEs: The basics on how to get started and grow your business.