Pre-Open Data

Key Data for the Week

- Monday – EUR – Markit Manufacturing PMI edged down to 61.5 in August, from 62.8 in July.

- Tuesday – US – New Home Sales

Australian Market

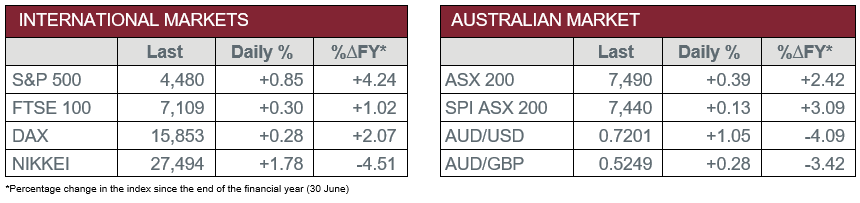

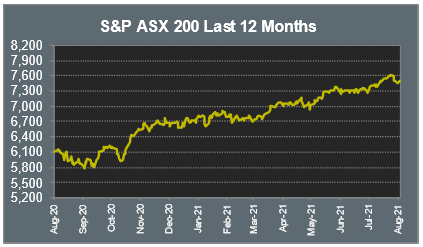

The Australian sharemarket gained 0.4% yesterday, to put a stop to a five-day losing streak. Despite the increase, concerns remain over the country’s economic growth given the current COVID-19 outbreaks in New South Wales and Victoria.

The Information Technology sector outperformed yesterday, up 1.7%, following a solid lead from the US in trading on Friday. Artificial intelligence provider, Appen, jumped 7.1%, while Xero added 1.2%. Buy-now-pay-later providers, Afterpay and Zip, both added 2.7%.

The big miners were mixed after being heavily affected by falling iron ore prices. BHP added 0.3%, while Rio Tinto and Fortescue Metals lost 0.5% and 4.3% respectively. Lithium miners soared; Vulcan Energy jumped 13.8% and Pilbara Minerals lifted 11.4%.

NIB announced their full-year earnings report. Despite full-year profit being up 84.0%, boosted by claims being lower than expected, the company’s share price fell 11.0%. Of the other insurers, QBE lost 2.8% and AMP added 1.4%.

The Australian futures point to a 0.13% rise today, driven by strong overseas markets.

Overseas Markets

European sharemarkets lifted overnight, aided by an increase in commodity prices. The Energy sector added 2.1% as a result, with BP up 3.2% and Royal Dutch Shell closing the session 2.3% higher. Sainsbury’s, Britain’s second-largest grocer, soared 15.4% following reports that private equity firms may be looking at a possible takeover bid.

By the close of trade, UK’s FTSE 100 and the German DAX both gained 0.3%, while the STOXX Europe 600 rose 0.7%.

US sharemarkets also lifted on Monday, as the NASDAQ reached an all-time closing high. The Information Technology sector soared; Spotify added 2.2%, Amazon lifted 2.1% and Alphabet gained 1.9%. Shares in Pfizer and BioNTech added 2.5% and 9.6% respectively as their joint COVID vaccine received full FDA approval.

By the close of trade, the Dow Jones and S&P 500 added 0.6% and 0.9% respectively, while the NASDAQ gained 1.6%.

CNIS Perspective

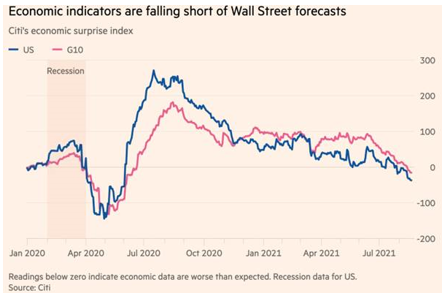

US and international data releases have been missing forecasts in recent weeks, highlighted by the spread of the Delta coronavirus variant beginning to slow the pace of the global economic recovery.

Several closely watched economic measures published in recent weeks, including PMI results overnight, a key monthly survey of private businesses, have come in well below expectations across a range of countries including the US, Australia, and the UK.

The deceleration in these economic gauges comes at a time when the Federal Reserve has signalled it would likely begin tapering its COVID recovery bond-buying programme later this year.

The next comments we hear from the Fed on US tapering are to be made at the annual Jackson Hole Symposium later this week. Looking at the most recent data, it may be an appropriate move by the Fed to appease the market by dialling back, or delaying, their tapering policy strategy.

Should you wish to discuss this or any other investment related matter, please contact your Investment Services Team on (02) 4928 8500.

Disclaimer

The material contained in this publication is the nature of the general comment only, and neither purports, nor is intended to be advice on any particular matter. Persons should not act nor rely upon any information contained in or implied by this publication without seeking appropriate professional advice which relates specifically to his/her particular circumstances. Cutcher & Neale Investment Services Pty Limited expressly disclaim all and any liability to any person, whether a client of Cutcher & Neale Investment Services Pty Limited or not, who acts or fails to act as a consequence of reliance upon the whole or any part of this publication.

Cutcher & Neale Investment Services Pty Limited ABN 38 107 536 783 is a Corporate Authorised Representative of Cutcher & Neale Financial Services Pty Ltd ABN 22 160 682 879 AFSL 433814.

Cutcher's Investment Lens | 7 - 11 April 2025

The failed $3 million super tax: Division 296 is done… or is it?

Cutcher's Investment Lens - Update on Trump & Tariffs | 31 March - 4 April 2025

Liberation Day - April 2025 Snapshot

Smart investing for SMEs: The basics on how to get started and grow your business.