Pre-Open Data

Key Data for the Week

Key economic data released this week:

- Tuesday – EUR – Consumer Price Index was 0.2% in January, down from 0.3% in December.

- Tuesday – UK – ILO Unemployment Rate rose to 5.1% in the three months to December, up from 5.0% in November.

- Tuesday – US – Consumer Confidence rose to 91.3 in February, up from 89.3 in January.

- Wednesday – AUS – Construction Work Done

- Wednesday – US – New Home Sales

Australian Market

The Australian sharemarket sunk to a two-week low during mid-session trade yesterday, however the market staged a strong recovery to close 0.9% higher. Trading was mixed, with the Energy and REITs sectors the strongest performers, up 4.9% and 2.5% respectively. However, the Information Technology sector extended its losses to close down 4.1%.

A 4.0% rise in global oil prices and a 2.0% increase in iron ore prices led to strong gains in the Energy and Materials sectors on Tuesday. Woodside Petroleum jumped 5.7% and Santos climbed 5.9%, while Oil Search gained 6.4%, despite reporting a US$320.7 million net loss and a 32% decline in revenue. The mining heavyweights were also higher; BHP lifted 3.1%, while Rio Tinto and Fortescue Metals added 1.8% and 0.4% respectively.

Travel stocks rose for a second consecutive day as the rollout of the COVID-19 vaccine continued. Sydney Airport climbed 6.5% and Flight Centre jumped 6.2%, while Auckland Airport added 3.9% and Webjet gained 2.8%.

The Australian futures market points to a 0.37% fall today.

Overseas Markets

European sharemarkets were mixed overnight. Higher bond yields continued to place pressure on sectors such as Information Technology, which saw a loss of 1.8%. Travel and leisure stocks continued to rise after the British Government announced plans to lift all COVID-19 restrictions by 21 June 2021; easyJet jumped 4.5% and Airbus lifted 3.3%, while International Airlines Group gained 2.0%. By the close of trade, the broad based STOXX Europe 600 fell 0.4% and the German DAX slipped 0.6%, while the UK FTSE 100 rose 0.2%.

US sharemarkets were also mixed on Tuesday. The Consumer Discretionary and Information Technology sectors extended losses, down 0.5% and 0.3% respectively. Spotify fell 3.9% and Microsoft slipped 0.5%, while Alphabet and Facebook bucked the trend to added 0.3% and 2.1% respectively. The Energy sector was the strongest performer; Chevron lifted 1.3% and ExxonMobil added 1.4%.

By the close of trade, the Dow Jones and S&P 500 both gained 0.1%, while the NASDAQ gave up 0.5%.

CNIS Perspective

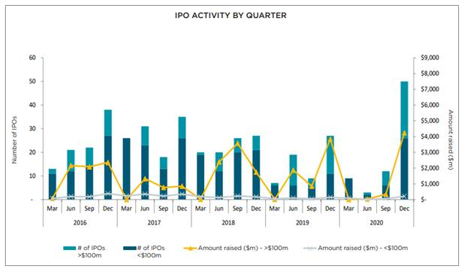

The second half of 2020 saw a major turnaround in Australia’s initial public offerings (IPOs) coming to market, as greater economic certainty led to a flurry of listings in the back half of the year.

74 companies hit the ASX in 2020, with 68% of these listing in the December quarter.

Since April last year, the most notable change in the IPO market was the lack of profitability, with just 27% of new debutants on the ASX making money at the operating earnings level at time of listing.

The demand for IPOs was significant, with 94% of all new listings receiving their targeted funds from investors, much higher than previous years, and 74% of all IPOs during 2020 ending their first day above their listing price.

With the success seen in 2020, we could be in for a bumper 2021 for the IPO market. Expect the continuation of new companies coming to market in the near future, as companies tend to be watchful when listing and strike while the iron is hot!

Should you wish to discuss this or any other investment related matter, please contact your Investment Services Team on (02) 4928 8500.

Disclaimer

The material contained in this publication is the nature of the general comment only, and neither purports, nor is intended to be advice on any particular matter. Persons should not act nor rely upon any information contained in or implied by this publication without seeking appropriate professional advice which relates specifically to his/her particular circumstances. Cutcher & Neale Investment Services Pty Limited expressly disclaim all and any liability to any person, whether a client of Cutcher & Neale Investment Services Pty Limited or not, who acts or fails to act as a consequence of reliance upon the whole or any part of this publication.

Cutcher & Neale Investment Services Pty Limited ABN 38 107 536 783 is a Corporate Authorised Representative of Cutcher & Neale Financial Services Pty Ltd ABN 22 160 682 879 AFSL 433814.

Smart investing for SMEs: The basics on how to get started and grow your business.

ATO updates: A quick guide on what business owners need to know.

Cutcher's Investment Lens | 24 - 28 March 2025

Is your current super fund holding you back? It might be time for an SMSF.

Cutcher's Investment Lens | 17 - 21 March 2025