Pre-Open Data

Key Data for the Week

- Tuesday – EUR – Markit Manufacturing PMI

- Tuesday – UK – Markit Manufacturing PMI

- Tuesday – US – New Home Sales

- Tuesday – US – Markit Manufacturing PMI

- Wednesday – US – FOMC Meeting

Australian Market

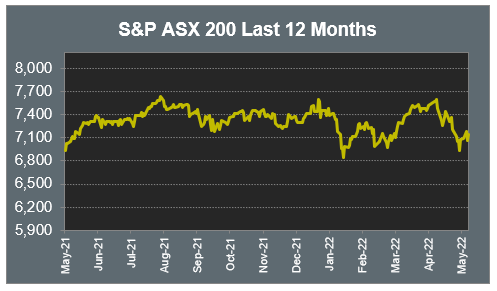

The Australian sharemarket started positively on Monday in the first trading session post the Federal election, however ended relatively flat as COVID cases returned in Beijing.

The Materials sector was the best performer on the market yesterday, up 0.8%. Fortescue Metals led the gains, as it rose 2.8%, while BHP and Rio Tinto added 1.4% and 1.1% respectively. Lithium miners lost ground; Allkem conceded 0.5% and Pilbara Minerals dropped 1.4%.

Codan, a metal detector manufacturer, soared 14.5% yesterday, as the company announced it expects to achieve a $100 million profit in the 2022 fiscal year. Among the remainder of the Information Technology sector, Xero added 2.2% and Appen lifted 1.8%, while Afterpay’s parent company, Block, closed the session 2.4% lower.

All four major banks lost ground yesterday, as the Financials sector dropped 0.4%. NAB shed 0.9% and ANZ lost 0.8%, while Westpac and Commonwealth Bank slipped 0.7% and 0.1% respectively. Australian Ethical Investment bucked the downward trend to add 3.5%, while Magellan closed 3.0% higher.

The Australian futures market points to a 0.26% gain today, driven by stronger overseas markets.

Overseas Markets

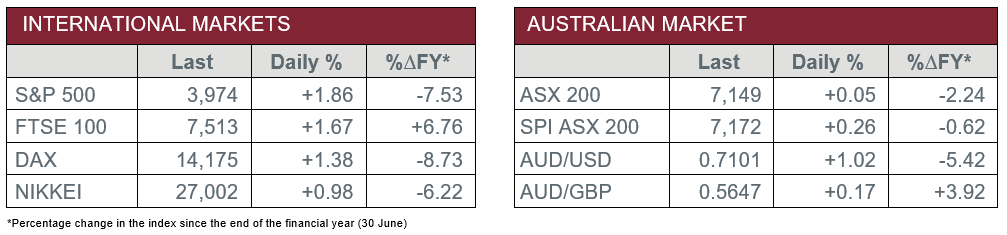

European sharemarkets advanced overnight, as the Financials and Materials sectors outperformed. The major banks rose; Banco Santander lifted 3.9%, while BNP Paribas and Barclays added 4.2% and 1.7% respectively. By the close of trade, the STOXX Europe 600 rose 1.3% and the German DAX lifted 1.4%, while the UK’s FTSE 100 added 1.7%.

US sharemarkets also rose on Monday, as the Information Technology sector rebounded after recent weakness. Payment services provider, Visa, added 4.3% and Apple lifted 4.0%, while Microsoft gained 3.2%. By the close of trade, the Dow Jones added 2.0% and the S&P 500 was up 1.9%, while the NASDAQ gained 1.6%.

CNIS Perspective

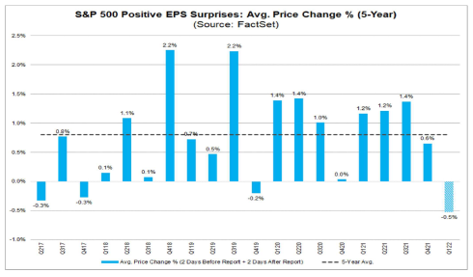

We are coming to the conclusion of US quarterly reporting season, with just the remaining 5% of S&P 500 businesses yet to release first quarter earnings. So far, it has been a season that has taken a back seat to central bank interest rate policy and inflation data.

However, despite all the macroeconomic noise taking place, from a company standpoint, earnings have been quite solid, 4.7% better than original expectations and an average quarterly earnings growth rate of 9.1%, which is holding above the 10-year average of 8.8%.

Interestingly though, companies that have reported positive earnings per share (EPS) surprises have seen an abnormal reaction. Across the board, share price movements have been negative in the four trading sessions surrounding their earnings release, with an average move of -0.5%. This compares to an average increase of +0.8% during this same window for companies reporting positive earnings surprises over the past five years.

In fact, it marks the largest average negative price reaction to positive EPS surprises reported by S&P 500 companies for a quarter since Q2 2011 (which saw a -2.1% average retracement).

It shows that the fundamentals of positive corporate earnings news have been unusually lost in the macroeconomic changes at hand at present.

Should you wish to discuss this or any other investment related matter, please contact your Wealth Management Team on (02) 4928 8500.

Disclaimer

The material contained in this publication is the nature of the general comment only, and neither purports, nor is intended to be advice on any particular matter. Persons should not act nor rely upon any information contained in or implied by this publication without seeking appropriate professional advice which relates specifically to his/her particular circumstances. Cutcher & Neale Investment Services Pty Limited expressly disclaim all and any liability to any person, whether a client of Cutcher & Neale Investment Services Pty Limited or not, who acts or fails to act as a consequence of reliance upon the whole or any part of this publication.

Cutcher & Neale Investment Services Pty Limited ABN 38 107 536 783 is a Corporate Authorised Representative of Cutcher & Neale Financial Services Pty Ltd ABN 22 160 682 879 AFSL 433814.

Smart investing for SMEs: The basics on how to get started and grow your business.

ATO updates: A quick guide on what business owners need to know.

Cutcher's Investment Lens | 24 - 28 March 2025

Is your current super fund holding you back? It might be time for an SMSF.

Cutcher's Investment Lens | 17 - 21 March 2025