Pre-Open Data

Key Data for the Week

- Tuesday – EUR – Markit Services PMI edged lower to 58.6 in November, from 59.1.

- Tuesday – US – Markit Manufacturing PMI was 59.1 in November, up from 58.4 in October.

- Wednesday – AUS – Construction Work Done

- Wednesday – US – Gross Domestic Product

Australian Market

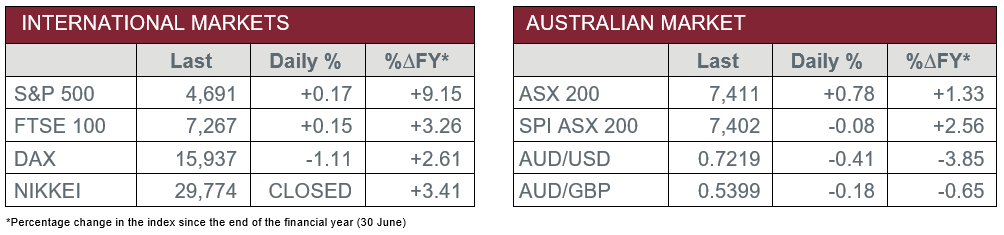

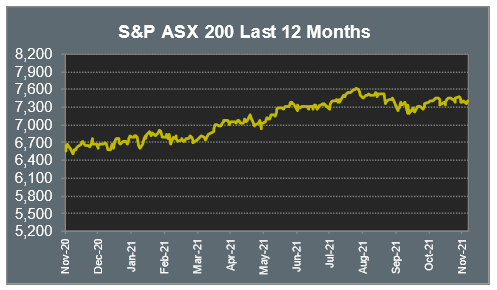

The Australian sharemarket closed 0.8% higher yesterday, as the prospect of added stimulus to the Chinese economy boosted the Materials sector.

Fortescue Metals soared 9.8% as the price of iron ore jumped. BHP and Rio Tinto added 4.0% and 3.6% respectively, while Mineral Resources jumped 5.0%. Steel production is tipped to increase as a result of the increased stimulus in China.

Woodside Petroleum increased 3.5% after the company confirmed it would continue with a share sale to buy BHP’s oil and gas business. The other oil majors also rose; Santos added 2.1%, while Oil Search closed the session 1.5% higher.

The Information Technology sector was the worst performer on the market, as it followed a weak lead from the US given the possibility of interest rate increases. Buy-now-pay-later providers, Afterpay and Zip, led the losses and dropped 5.4% and 3.1% respectively. WiseTech Global shed 5.6%, while accounting software provider, Xero, lost 4.5%.

The Australian futures market points to a 0.1% fall today.

Overseas Markets

European sharemarkets weakened on Tuesday as increased COVID cases and the possibility of added restrictions overshadowed increased business growth. Technology stocks weakened as a result; ASML Holdings shed 5.5% and Infineon Technologies lost 3.1%. The Financials sector continued its recent run of strength, as Deutsche Bank lifted 2.9% and BNP Paribas rose 0.4%. By the close of trade, the STOXX Europe 600 and the German DAX both slipped 1.1%, while the UK FTSE 100 rose 0.2%.

US sharemarkets were mixed overnight, as the possibility of increased interest rates weighed on the NASDAQ. As a result, Microsoft and Tesla dropped 0.6% and 4.1% respectively, while PayPal conceded 0.8%. Gains among the major banks helped limit further losses; Goldman Sachs lifted 2.5% and JP Morgan added 2.4%.

By the close of trade, the Dow Jones added 0.6% and the S&P 500 rose 0.2%, while the NASDAQ lost 0.5%.

CNIS Perspective

There are two major issues confronting financial markets right now. Higher interest rates in the US and to what extent a new wave of COVID sweeping through Europe will be replicated in the US.

Increasing COVID cases has the potential to suppress inflation, interest rates and economic growth.

The nationwide lockdown in Austria and the surge in cases in the Netherlands, highlights the seasonal element of COVID as the northern hemisphere heads into winter. The key will be whether countries such as Germany and the US, follows a UK-like path, where cases are at moderately high levels, but hospital numbers are manageable.

However, economic policy will remain supportive. Japan’s recently announced US$500 billion stimulus package and Biden’s US$1.2 trillion infrastructure bill emphasise this.

US Federal Reserve Chair Powell’s reselection for a further term reinforces the need for consistency when applying monetary policy.

The more likely outcome over coming months will be a shift in equity positions to more defensive positions, as opposed to causing a sustained equity market sell-down.

The US labour market participation rate and the preparedness of central banks to control inflation will be key issues to monitor.

Should you wish to discuss this or any other investment related matter, please contact your Investment Services Team on (02) 4928 8500.

Disclaimer

The material contained in this publication is the nature of the general comment only, and neither purports, nor is intended to be advice on any particular matter. Persons should not act nor rely upon any information contained in or implied by this publication without seeking appropriate professional advice which relates specifically to his/her particular circumstances. Cutcher & Neale Investment Services Pty Limited expressly disclaim all and any liability to any person, whether a client of Cutcher & Neale Investment Services Pty Limited or not, who acts or fails to act as a consequence of reliance upon the whole or any part of this publication.

Cutcher & Neale Investment Services Pty Limited ABN 38 107 536 783 is a Corporate Authorised Representative of Cutcher & Neale Financial Services Pty Ltd ABN 22 160 682 879 AFSL 433814.

Cutcher's Investment Lens | 7 - 11 April 2025

The failed $3 million super tax: Division 296 is done… or is it?

Cutcher's Investment Lens - Update on Trump & Tariffs | 31 March - 4 April 2025

Liberation Day - April 2025 Snapshot

Smart investing for SMEs: The basics on how to get started and grow your business.