Pre-Open Data

Key Data for the Week

- Thursday – US – Markit Manufacturing PMI fell slightly, in line with expectations.

- Thursday – UK – BoE Interest Rate Decision – The BoE kept the bank rate unchanged at 0.10%, as expected.

- Thursday – US – Existing Home Sales fell 2.0% in August, below expectations.

- Friday – US – New Home Sales

Australian Market

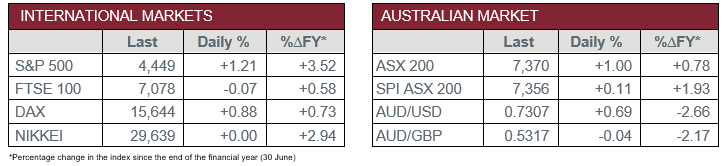

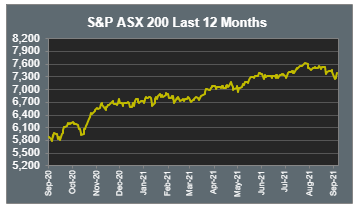

The Australian sharemarket jumped 1.0% on Thursday, as all sectors closed higher. The local market rode tailwinds created by global market sentiment, as major Chinese property developer, Evergrande, met its interest payment, and the US Federal Reserve outlined a hawkish approach to increase rates as early as next year.

The Information Technology and Energy sectors pushed the market ahead, as they closed up 3.0% and 2.8%. Digital payment providers, Afterpay (4.2%) and Zip Co. (4.9%), were key technology performers. Meanwhile, important energy stocks included Woodside Petroleum, Santos and Oil Search, which added 1.7%, 2.9% and 3.4% respectively. This came as crude oil prices rose 2.0%, as supply levels fell to their lowest in three years according to NAB.

The Materials, Consumer Staples and Health Care sectors were the weakest performers, as they all eased 0.2-0.3% higher. Standout stocks included Costa Group (2.5%) and Australian Clinical Labs (0.9%). The Financials sector added 1.3%, as all the major banks advanced. Commonwealth Bank and ANZ led gains, up 1.2% and 1.1%, while both Westpac and NAB closed ~0.6% higher. Macquarie Group was another key performer, as it steamed ahead 2.6%.

The Australian futures point to a 0.11% increase today.

Overseas Markets

European sharemarkets were mostly higher on Thursday, with the STOXX Europe 600 and the German DAX ahead 0.9%, while the UK FTSE 100 eased 0.1%. Banking stocks performed well, up 2.2%, after the Bank of England raised its inflation forecasts and supported the case for higher interest rates. This weighed on the UK’s blue-chip stocks, as investors considered the central bank’s commentary.

US sharemarkets strove ahead overnight, despite the US Federal Reserve’s similar commentary around potential interest rate increases as early as next year. The Dow Jones, S&P 500 and NASDAQ were up 1.5%, 1.2% and 1.0% respectively. Most sectors closed higher, with Utilities and Real Estate being the only detractors. The Energy (3.4%) and Financials (2.5%) sectors were key performers, as they pulled the market ahead.

CNIS Perspective

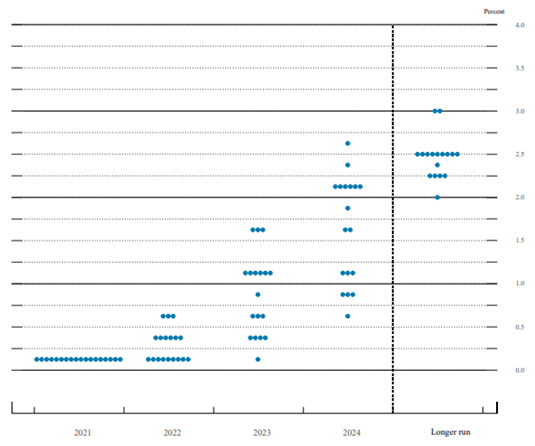

The US Federal Reserve will likely start to tiptoe into the unknown before the end of the year. Fed officials indicated on Wednesday they’re ready to begin ‘tapering’, the process of slowly pulling back the stimulus they’ve provided during the pandemic. This is likely to commence in November.

Whilst tapering is not new to the Federal Reserve, it has never had to pull back from such a dramatically accommodative position. For most of the past year and a half, it has been buying at least US$120 billion of bonds each month, providing unprecedented support to financial markets and the economy.

The purchases have helped keep interest rates low and provided support to markets that malfunctioned badly at the start of the pandemic.

Markets have taken the news well, but the real test is ahead. Tapering represents a teeing up of future interest rate hikes. 9 of the 18 Federal Reserve members now see the first interest rate hike in 2022. Additionally, 17 of the 18 members are expecting at least one rate hike by the end of 2023.

Every quarter, members of the committee forecast where interest rates will go in the short, medium, and long term. These projections are represented visually in a chart called a ‘dot plot’, as shown below.

Should you wish to discuss this or any other investment related matter, please contact your Investment Services Team on (02) 4928 8500.

Disclaimer

The material contained in this publication is the nature of the general comment only, and neither purports, nor is intended to be advice on any particular matter. Persons should not act nor rely upon any information contained in or implied by this publication without seeking appropriate professional advice which relates specifically to his/her particular circumstances. Cutcher & Neale Investment Services Pty Limited expressly disclaim all and any liability to any person, whether a client of Cutcher & Neale Investment Services Pty Limited or not, who acts or fails to act as a consequence of reliance upon the whole or any part of this publication.

Cutcher & Neale Investment Services Pty Limited ABN 38 107 536 783 is a Corporate Authorised Representative of Cutcher & Neale Financial Services Pty Ltd ABN 22 160 682 879 AFSL 433814.

Cutcher's Investment Lens | 7 - 11 April 2025

The failed $3 million super tax: Division 296 is done… or is it?

Cutcher's Investment Lens - Update on Trump & Tariffs | 31 March - 4 April 2025

Liberation Day - April 2025 Snapshot

Smart investing for SMEs: The basics on how to get started and grow your business.