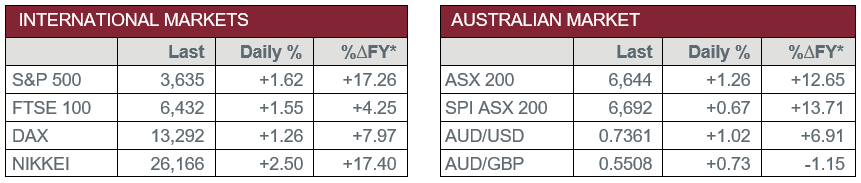

Pre-Open Data

Key Data for the Week

Key economic data released this week:

- Tuesday – US – Consumer Confidence slipped on coronavirus concerns, with the index falling to 96.1 in November, from 100.9 in October.

- Wednesday – AUS – Construction Work Done

- Wednesday – US – Gross Domestic Product

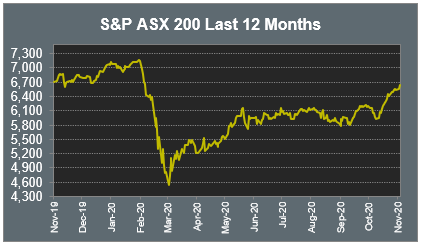

Australian Market

The Australian sharemarket rose 1.3% yesterday, as all sectors closed higher, with Energy the best performer. Oil Search, Santos and Woodside Petroleum all rose between 2.4% and 3.9%, as oil prices rose on hopes a coronavirus vaccine will reinvigorate travel demand. Travel stocks also rallied; Flight Centre, Qantas and Webjet all added between 3.0% and 4.7%.

The Financials sector performed strongly, boosted by the big four banks; ANZ led the gains up 3.1%, NAB and Westpac both added 2.6%, while Commonwealth Bank rose 2.0%.

The Materials sector was lifted by mining heavyweights BHP, Fortescue Metals and Rio Tinto, which all closed up between 2.2% and 3.4%. Goldminers underperformed as the price of the metal slid to four-month lows; Evolution Mining, Northern Star Resources and Newcrest Mining all fell between 6.1% and 8.9%.

Unibail-Rodamco-Westfield climbed 7.3% to help lift the REITs sector, while Telstra added 1.3% to add to the Telecommunications sector.

The Australian futures market points to a 0.67% rise today, driven by stronger overseas markets.

Overseas Markets

European sharemarkets closed higher on Tuesday. The potential easing of lockdowns in France, combined with optimism around the deployment of a coronavirus vaccine as early as the beginning of next year, lifted investor sentiment. Industrials stocks strengthened; Eiffage and Vinci rose 3.7% and 2.8% respectively, while CRH added 5.4% after the company provided a trading update. For the first nine months of 2020 EBITDA rose 2% compared to the same period last year and the company said it expects the full year figure to be over US$4.4 billion.

US sharemarkets also rose overnight, with the Dow Jones closing above 30,000 for the first time in history, while Donald Trump announced he is directing his team to co-operate on the transition of power to President-elect Joe Biden. Switchback Energy added 8.2% to continue its rally prior to its reverse merger with ChargePoint. Payment providers saw strong gains, with MasterCard, PayPal and Visa all up between 0.7% and 3.1%, while Technology stocks Alphabet, Apple, Facebook and Microsoft all rose between 1.2% and 3.2%.

By the close of trade, the NASDAQ rose 1.3%, the Dow Jones added 1.5% and the S&P 500 gained 1.6%.

CNIS Perspective

The third quarter US earnings season is all but over, with 84% of companies actual Earnings Per Share coming in above estimates, which is well above the five year average of 73%, which is near record levels.

In aggregate, companies reported earnings that were 19.5% above estimates, which is well above the five year average of 5.6%. Arguably, this can in part be put down to extremely pessimistic and conservative expectations by those that elected to provide guidance at all, which was well down on normal.

This period of volatile and unknown earnings might be starting to come to an end, and while the focus this reporting season was clearly overshadowed by the US election result and vaccine trial outcomes, quarterly earnings from here on will be more heavily scrutinised. Free passes for companies not providing earnings guidance, or missing guidance, will not be as forgiven by investors.

One thing is clear, 2020 has changed the landscape of the way businesses operate, where industries have effectively had to reset and innovate in preparation for what is now a new normal, while those that haven’t, are likely to be left behind.

Should you wish to discuss this or any other investment related matter, please contact your Investment Services Team on (02) 4928 8500.

Disclaimer

The material contained in this publication is the nature of the general comment only, and neither purports, nor is intended to be advice on any particular matter. Persons should not act nor rely upon any information contained in or implied by this publication without seeking appropriate professional advice which relates specifically to his/her particular circumstances. Cutcher & Neale Investment Services Pty Limited expressly disclaim all and any liability to any person, whether a client of Cutcher & Neale Investment Services Pty Limited or not, who acts or fails to act as a consequence of reliance upon the whole or any part of this publication.

Cutcher & Neale Investment Services Pty Limited ABN 38 107 536 783 is a Corporate Authorised Representative of Cutcher & Neale Financial Services Pty Ltd ABN 22 160 682 879 AFSL 433814.

Smart investing for SMEs: The basics on how to get started and grow your business.

ATO updates: A quick guide on what business owners need to know.

Cutcher's Investment Lens | 24 - 28 March 2025

Is your current super fund holding you back? It might be time for an SMSF.

Cutcher's Investment Lens | 17 - 21 March 2025