Pre-Open Data

Key Data for the Week

- Tuesday – US – New Home Sales

- Tuesday – US – Consumer Confidence Index

- Wednesday – AUS – Consumer Price Index

- Thursday – AUS – Trade Price Indices

- Thursday – EUR – Consumer Confidence

- Thursday – UK – Nationwide House Prices

- Thursday – US – Gross Domestic Product

- Friday – AUS – Retail Sales

- Friday – EUR – Gross Domestic Product

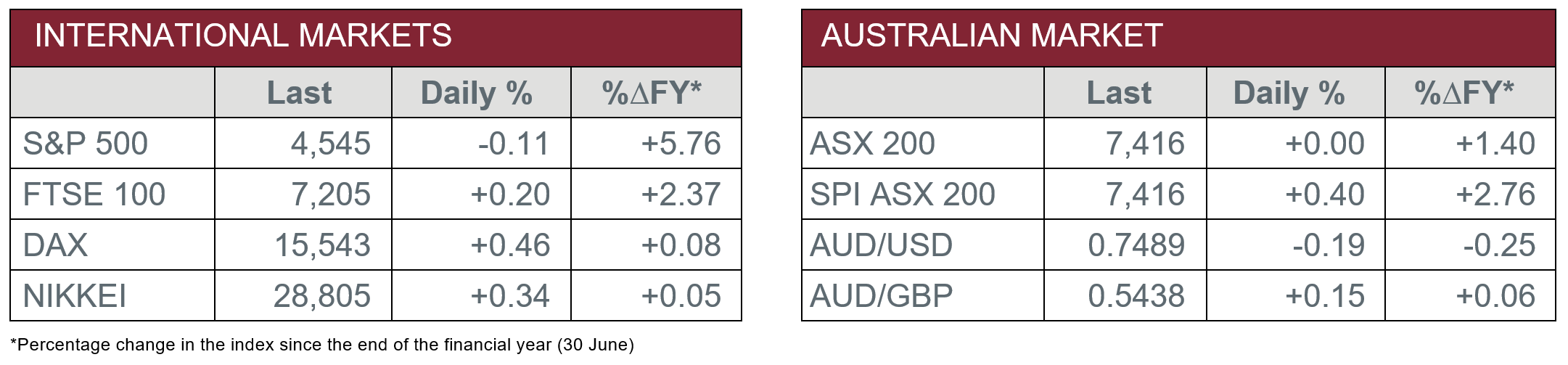

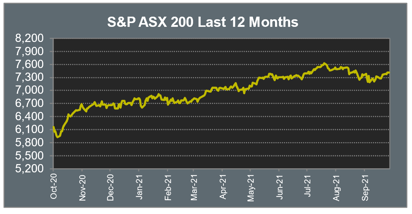

Australian Market

The Australian sharemarket finished Friday’s session flat. The Consumer Discretionary sector was the top performer, up 1.3%, while the Energy and Materials sectors weighed on the market, following a decline in commodity prices. The local ASX 200 enjoyed its third consecutive week of gains, up 0.5% for the week.

Mining heavyweights were weaker on Friday; BHP gave up 2.2% and Rio Tinto fell 1.8%, while Fortescue Metals lost 0.7%. However, gold miners closed higher; Northern Star Resources gained 0.5% and Evolution Mining rose 0.3%.

The Consumer Discretionary sector was boosted by Wesfarmers, which rose 3.2% after the company announced sales improvements for Bunnings, Officeworks and Catch.com.au. JB Hi-Fi added 1.4%, while Super Retail Group, owner of brands such as BCF, Rebel Sport and Macpac, closed up 1.3%.

All four major banks closed lower; Commonwealth Bank, NAB and ANZ all slipped 0.1%, while Westpac fell 0.3%.

The Australian futures market points to a 0.4% rise today.

Overseas Markets

European sharemarkets advanced on Friday as market sentiment was boosted by news that Chinese property developer Evergrande made a bond payment to avoid default. Semiconductor stocks enjoyed gains; Infineon Technologies lifted 1.8%, while ASML Holding rose 1.7%. Renewable energy stocks were mixed; Siemens Gamesa Renewable Energy fell 0.7%, while Vestas Wind Systems rose 0.9%.

By the close of trade, the UK FTSE 100 gained 0.2%, while the German DAX and STOXX Europe 600 both rose 0.5%.

US sharemarkets were mixed on Friday. Semiconductor manufacturer Intel shed 11.7% as the company’s third quarter earnings update fell short of expectations. The Health Care sector closed 0.4% higher; UnitedHealth Group lifted 1.6% and Danaher gained 0.9%, while Johnson & Johnson rose 0.3%. Financial services stocks were mixed; PagSeguro Digital gave up 3.6% and PayPal slipped 1.2%, while Visa lifted 0.4% and BlackRock gained 1.2%.

By the close of trade, the Dow Jones closed up 0.2%, while the S&P 500 and NASDAQ fell 0.1% and 0.8% respectively.

Over the week, the Dow Jones rose 1.1% and the NASDAQ gained 1.3%, while the S&P 500 lifted 1.6%.

CNIS Perspective

The Australian Government has finally made the pledge last week to reduce emissions to ‘net zero’ by 2050, in-line with other Western country commitments, just in time for the 26th UN Climate Change Conference of the Parties (COP26) in Glasgow starting next week. This is somewhat at odds with our thriving coal industry, by far the “dirtiest” of the three fossil fuel majors, with natural gas and oil being the other two.

Coal is a cheap and inefficient fuel source, yet still remains the second largest energy source in the world, of which Australia is the second largest exporter and is looking to expand its mines. Coal is an industry under fire, where its negative environmental externalities necessitate a transition to cleaner energy sources. Coal is considered the largest single source of global temperature increases by the International Energy Agency in 2019. However, this transition cannot take place overnight.

The largest consumers of coal are India and China, not only of thermal coal, which creates heat/energy, but also metallurgical coal, which is required for steelmaking, of which there are currently very little alternatives. Prime Minister Scott Morrison, who will be attending the Conference, famously brought a lump of coal to parliament in February 2017 when he was Treasurer in a stunt to ridicule those demanding for an energy transformation. The transition away from fossil fuels is not easy, yet the Morrison Government’s treatment of this issue as political and with no policy prepared may be in for a tough week in the UK.

Should you wish to discuss this or any other investment related matter, please contact your Investment Services Team on (02) 4928 8500.

Disclaimer

The material contained in this publication is the nature of the general comment only, and neither purports, nor is intended to be advice on any particular matter. Persons should not act nor rely upon any information contained in or implied by this publication without seeking appropriate professional advice which relates specifically to his/her particular circumstances. Cutcher & Neale Investment Services Pty Limited expressly disclaim all and any liability to any person, whether a client of Cutcher & Neale Investment Services Pty Limited or not, who acts or fails to act as a consequence of reliance upon the whole or any part of this publication.

Cutcher & Neale Investment Services Pty Limited ABN 38 107 536 783 is a Corporate Authorised Representative of Cutcher & Neale Financial Services Pty Ltd ABN 22 160 682 879 AFSL 433814.

Cutcher's Investment Lens | 7 - 11 April 2025

The failed $3 million super tax: Division 296 is done… or is it?

Cutcher's Investment Lens - Update on Trump & Tariffs | 31 March - 4 April 2025

Liberation Day - April 2025 Snapshot

Smart investing for SMEs: The basics on how to get started and grow your business.