Pre-Open Data

Key Data for the Week

- Tuesday – US – Consumer Confidence

- Wednesday – AUS – Consumer Price Index

- Wednesday – US – Interest Rate Decision

- Thursday – EUR – Consumer Confidence

- Thursday – EUR – Gross Domestic Product

- Friday – EUR – Gross Domestic Product

- Friday – EUR – Unemployment

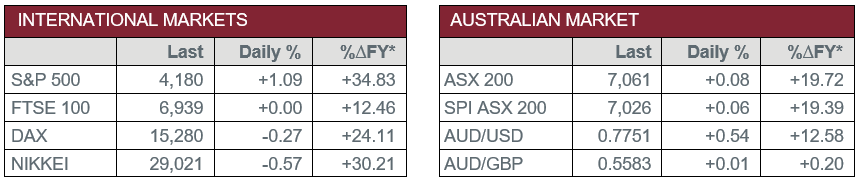

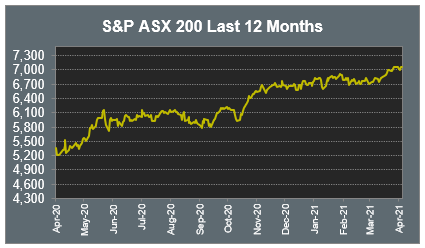

Australian Market

The Australian sharemarket rose 0.1% on Friday, however, was flat for the week. The Consumer Discretionary sector underperformed amid heavy losses from retailers; Kogan.com slumped 14.3% after the company announced Q3 earnings which saw customer demand drop below levels experienced from March last year and earnings fall 24% over the same period. JB Hi-Fi lost 5.0% and Harvey Norman was down 3.5%. Accent Group bucked the trend, up 11% after it announced the acquisition of youth apparel brand, Glue Store for $13 million.

The Financials sector outperformed as the big four banks all closed higher. AMP added 0.9% after it announced plans to demerge its AMP Capital Private Markets business instead of selling it to Ares Management. AMP fell to a 12-month low on Thursday after its quarterly update showed continued cash outflows from its AMP Capital and Wealth Management divisions.

Mining heavyweights were mixed; Fortescue Metals and Rio Tinto added 1.6% and 0.5% respectively, while BHP slipped 0.2%.

Coles is set to report quarterly earnings on Wednesday, while rival Woolworths will announce on Thursday.

The Australian futures market points to a 0.06% rise today.

Overseas Markets

European sharemarkets were weaker on Friday, to close lower for their first weekly loss following seven straight weeks of gains. Profit taking and US President Joe Biden’s plan to raise income taxes on the wealthy were attributed to the declines. Despite this, economic data saw strong UK retail sales and consumer confidence at a 13-month high.

US sharemarkets were stronger on Friday as strong economic data helped buoy investor confidence. All sectors closed higher except Consumer Staples and Utilities. Spotify outperformed, up 7.2%, while payment providers MasterCard, PayPal and Visa all added between 1.0% and 1.4%.

In a busy week of company announcements, Information Technology heavyweights Alphabet, Amazon, Apple and Microsoft are all due to report their quarterly earnings. These companies all rose between 1.0% and 2.1% on Friday.

By the close of trade, the Dow Jones rose 0.7%, the S&P 500 added 1.1% and the NASDAQ gained 1.4%. However, all indexes fell between 0.1% and 0.5% for the week.

CNIS Perspective

Global economies continue to recover on the back of stimulus, vaccines, positive macroeconomic data, company earnings surprises, investor inflows and a renewed pickup in corporate buybacks. However, this is not a normal recession-recovery cycle, which leads many economists to debate the ability for the market strength to continue.

There are more businesses in the world’s major economies today than there were a year ago. This unique situation makes it impossible to try to fit the economic bounce back into a traditional recession-recovery model. The business world has had two very unusual features over the last year. Firstly, business failure rates in advanced economies have fallen. In fact, liquidation rates and bankruptcies reached record lows in countries including the UK and Germany, in response to direct government support (furlough schemes, grants, and lending) and low interest rates. Secondly, there has been an explosion of business start-ups. The astonishing growth in business creation began around August 2020 and has more than offset the slowing during lockdowns. Start-ups have mainly been in retail, transport and hospitality, and seems to be as a result of individuals taking advantage of free time and technology to set up small businesses.

Some businesses that have survived the pandemic will include ‘zombie’ companies; businesses that would have gone bust were it not for government help. These companies cannot survive forever. However, overall, the world economy is bouncing back with more business capacity and competition than any previous economic recovery has had.

Should you wish to discuss this or any other investment related matter, please contact your Investment Services Team on (02) 4928 8500.

Disclaimer

The material contained in this publication is the nature of the general comment only, and neither purports, nor is intended to be advice on any particular matter. Persons should not act nor rely upon any information contained in or implied by this publication without seeking appropriate professional advice which relates specifically to his/her particular circumstances. Cutcher & Neale Investment Services Pty Limited expressly disclaim all and any liability to any person, whether a client of Cutcher & Neale Investment Services Pty Limited or not, who acts or fails to act as a consequence of reliance upon the whole or any part of this publication.

Cutcher & Neale Investment Services Pty Limited ABN 38 107 536 783 is a Corporate Authorised Representative of Cutcher & Neale Financial Services Pty Ltd ABN 22 160 682 879 AFSL 433814.

Cutcher's Investment Lens | 7 - 11 April 2025

The failed $3 million super tax: Division 296 is done… or is it?

Cutcher's Investment Lens - Update on Trump & Tariffs | 31 March - 4 April 2025

Liberation Day - April 2025 Snapshot

Smart investing for SMEs: The basics on how to get started and grow your business.