Pre-Open Data

Key Data for the Week

- Wednesday – AUS – Construction Work Done rose 0.8% in the June quarter.

- Thursday – US – Initial Jobless Claims

- Friday – AUS – Retail Sales

- Friday – UK – Nationwide House Prices

Australian Market

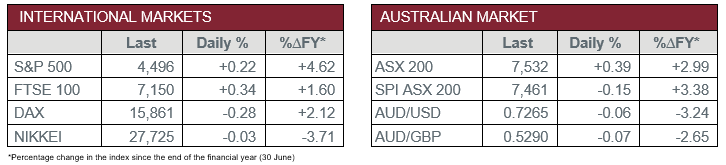

The Australian sharemarket rose 0.4% on Wednesday as it continues to regain losses made last week. The rebound was partly due to a rally in the price of iron ore (6.8%). Like US markets on Tuesday, Technology was a strong performer, up 1.9%. Joined by the major miners, as they recovered alongside commodity prices, with BHP up 1.3%, along with both Rio Tinto and Fortescue Metals Group, ahead 2.6%. Despite this, the Mining & Metals sector has had a rough month-to-date, down 7.9%.

Travel stocks also performed well yesterday, despite Queensland’s border restrictions and ongoing COVID-19 lockdowns. An indication of investor optimism as vaccine supplies and those immunized increase. Qantas, Flight Centre and Webjet climbed between 5-7%.

The Health Care sector closed higher, up 0.6%. Heavyweight, CSL Limited, dragged the sector up as it closed 1.3% higher. Sonic Healthcare also gained 0.3%.

The Financials sector performed modestly yesterday, ahead 0.4%, in line with overall market performance. NAB led the big banks, up 1.0%, closely followed by Westpac (0.9%). Meanwhile Commonwealth Bank and ANZ edged up 0.4% and 0.3% respectively.

The Australian futures point to a 0.15% decline today.

Overseas Markets

European sharemarkets were mixed yesterday as the STOXX 600 closed flat, the German DAX lost 0.3% and the UK FTSE 100 gained 0.3%. The varied result came as losses in the Utilities sector offset gains made by bank and travel stocks. Previous investor optimism seemed to have softened in the Eurozone as a survey from the IFO Institute indicated lower business morale, in the wake of more COVID-19 cases.

US sharemarkets edged higher overnight, to record highs, with the S&P 500 and NASDAQ ahead 0.2%, while the Dow Jones rose 0.1%. Banks performed well as bond yields rose. The Technology sector was another standout as NVIDIA steamed ahead 1.9%, Fortinet added 2.1%, and CrowdStrike closed 1.7% higher.

CNIS Perspective

Talk about emerging markets is generally focused on China, with India often being overlooked. With the worst of the deadly Delta wave behind them, India is looking ahead. India’s case numbers are dropping, and so far about 46% of the eligible Indian population have had their first dose, and 13% are fully vaccinated. Not bad given the size and scale of India and the logistics involved in this roll out.

In a 2019 report by the World Economic Forum, they identified domestic consumption as the key driver of India’s economy, powering 60% of GDP. The report outlines five significant contributors to India’s growing consumption, which should underpin ongoing economic growth:

Income Growth - It was projected that 25 million households will be lifted out of poverty by 2030, reducing the percentage of households in poverty from 15% today to less than 5%. This is introducing a huge expansion of the middle class and uptick in consumption of everyday items.

Urbanisation - 40% of Indians will live in urban areas by 2030.

Demographic Change - India has a median age of just 28 years. This young and, comparatively, highly educated work force will persist through to 2030, with an expected median age of 31 years. Compare this to the expected median age in Australia of 40 years and China at 42 years.

Technology and Innovation - Indians have embraced the new digital age, and in many cases, they have leap-frogged many of those technologies that emerged during the dot-com bubble. 80% of Indians use their mobile as the primary platform for accessing the internet, with the desktop computer bypassed completely. Projections suggest there will be 1.1 billion internet users in India by 2030, with each representing further opportunities to extend consumption and engage with the new service-based economy.

Changing Consumer Attitudes - The growing middle class has led to the emergence of sectors in the market that were previously very small, including dining out, personal hygiene, organic food, health, and fitness.

Should you wish to discuss this or any other investment related matter, please contact your Investment Services Team on (02) 4928 8500.

Disclaimer

The material contained in this publication is the nature of the general comment only, and neither purports, nor is intended to be advice on any particular matter. Persons should not act nor rely upon any information contained in or implied by this publication without seeking appropriate professional advice which relates specifically to his/her particular circumstances. Cutcher & Neale Investment Services Pty Limited expressly disclaim all and any liability to any person, whether a client of Cutcher & Neale Investment Services Pty Limited or not, who acts or fails to act as a consequence of reliance upon the whole or any part of this publication.

Cutcher & Neale Investment Services Pty Limited ABN 38 107 536 783 is a Corporate Authorised Representative of Cutcher & Neale Financial Services Pty Ltd ABN 22 160 682 879 AFSL 433814.

Cutcher's Investment Lens | 7 - 11 April 2025

The failed $3 million super tax: Division 296 is done… or is it?

Cutcher's Investment Lens - Update on Trump & Tariffs | 31 March - 4 April 2025

Liberation Day - April 2025 Snapshot

Smart investing for SMEs: The basics on how to get started and grow your business.