Pre-Open Data

Key Data for the Week

- Monday – US – New Home Sales

- Tuesday – CHINA – Industrial Profits

- Tuesday – US – Building Permits

- Wednesday – AUS – Consumer Price Index

- Wednesday – US – FOMC Meeting Decision

- Thursday – AUS – Trade Balance

- Thursday – EUR – Economic Confidence

- Thursday – US – Gross Domestic Product

- Friday – EUR – Unemployment Rate

- Friday – EUR – Gross Domestic Product

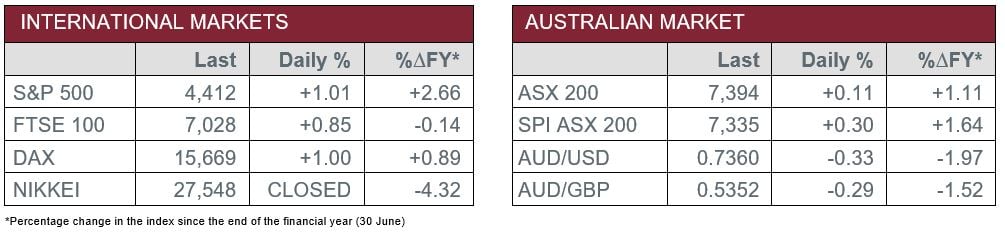

Australian Market

The Australian sharemarket rose 0.1% on Friday, to close at a record high, despite half the country being in hard lockdown. Over the course of the week, the local market added 0.6%, while NSW officials say it is unlikely their lockdown will end this Friday.

CSL was amongst the best performers, up 1.5%, while Sonic Healthcare added 1.4% and Australian Clinical Labs lifted 3.9% as it continues to benefit from record levels of testing due to the coronavirus.

Crown Resorts slumped 2.2% after a Royal Commission raised the prospect the company could lose the licence for its Melbourne casino. Star Entertainment withdrew its merger proposal for Crown Resorts.

The Financials sector underperformed as the big four banks were mostly weaker; ANZ slipped 1.1%, Westpac fell 0.9% and Commonwealth Bank lost 0.8%, while NAB was relatively flat.

The Australian futures point to a 0.3% rise today, driven by stronger overseas markets on Friday.

Overseas Markets

European sharemarkets closed higher on Friday, with the broad based STOXX Europe 600 up 1.1%, while over the course of the week, rose 1.5% to hit a new record high. Investors’ risk appetite remains high as central bank stimulus continues to outweigh the rapid increase of coronavirus cases across the continent.

US sharemarkets also rose on Friday, as the Dow Jones closed above 35,000 for the first time. Alphabet rallied 3.4%, while cybersecurity companies CrowdStrike and Fortinet lifted between 1.8% and 2.3%. Payment services giants were amongst the strongest performers; MasterCard rose 2.9%, Visa gained 2.0% and PayPal added 1.6%, while US listed Indian company ICICI Bank rallied 3.9%. Over the course of the week, the Dow Jones added 1.1%, the S&P 500 gained 2.0% and the NASDAQ rallied 2.8%.

In what will be a closely watched week of company reporting; Alphabet, Amazon, Apple, Facebook and Microsoft are all due to report. These companies are all expected to post double-digit revenue growth, with an increase of 50% for both Alphabet and Facebook forecasted. Of the S&P 500 companies that have already reported, 87% have had results above Wall Street estimates.

CNIS Perspective

Robinhood, the ‘free’ trading app, has forecasted its upcoming IPO on the NASDAQ could give the company a market valuation of US$33 billion. When trading begins this week, the company is looking to sell 52.4 million shares, with a further 2.6 million expected to be sold by stockholders for between US$38 and US$42 per share. This headline grabbing company claims to ‘democratise’ the ‘old-world’ share trading practices, with its largely younger demographic of self-proclaimed ‘Hooder’s’, who are notably behind the recent rallies of meme stocks AMC and GameStop.

Interestingly, the two founders own less than 20% of the firm and control 65% of the voting shares but are largely liquidating their holdings in the company. There are also questions around its business model as 81% of revenues are derived by selling order flows to market makers on the stock exchange. It is not giving away free brokerage because they are the good guys of Sherwood Forest. This practice of selling order flow, while common on Wall Street, violates Robinhood’s corporate propaganda which claims they seek to do good for their clients.

The US Securities and Exchange Commission has made it clear they would like payment for order flows to be banned, which would destroy Robinhood and many other similar free trading app business models. This is on top of more than 50 class action lawsuits filed against Robinhood on behalf of the millions of clients whose equity diminished during the meme stock meltdown in February.

It appears this Robinhood is closer to Bad King John and the Sheriff of Nottingham than the company’s namesake hero.

Should you wish to discuss this or any other investment related matter, please contact your Investment Services Team on (02) 4928 8500.

Disclaimer

The material contained in this publication is the nature of the general comment only, and neither purports, nor is intended to be advice on any particular matter. Persons should not act nor rely upon any information contained in or implied by this publication without seeking appropriate professional advice which relates specifically to his/her particular circumstances. Cutcher & Neale Investment Services Pty Limited expressly disclaim all and any liability to any person, whether a client of Cutcher & Neale Investment Services Pty Limited or not, who acts or fails to act as a consequence of reliance upon the whole or any part of this publication.

Cutcher & Neale Investment Services Pty Limited ABN 38 107 536 783 is a Corporate Authorised Representative of Cutcher & Neale Financial Services Pty Ltd ABN 22 160 682 879 AFSL 433814.

Cutcher's Investment Lens | 7 - 11 April 2025

The failed $3 million super tax: Division 296 is done… or is it?

Cutcher's Investment Lens - Update on Trump & Tariffs | 31 March - 4 April 2025

Liberation Day - April 2025 Snapshot

Smart investing for SMEs: The basics on how to get started and grow your business.