Pre-Open Data

Key Data for the Week

Key economic data released this week:

- Monday – AUS – Trade Balance

- Monday – US – New Home Sales

- Tuesday – US – Consumer Confidence

- Tuesday – US – Durable Goods Orders

- Wednesday – AUS – Consumer Price Index

- Wednesday – US – Goods Trade Balance

- Thursday – EUR – ECB Interest Rate Decision

- Thursday – US – Gross Domestic Product

- Friday – EUR – Consumer Price Index

- Friday – EUR – Gross Domestic Product

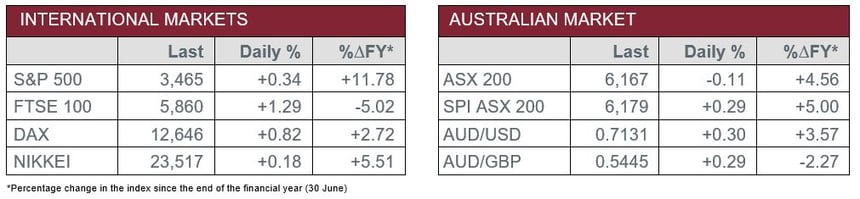

Australian Market

The Australian sharemarket closed slightly lower on Friday, in a quiet session of trade. Although the local ASX 200 was weaker, it recovered from its mid-session lows, following the final US Presidential debate and news that Australia’s national cabinet had agreed to a plan to re-open all the country’s internal borders with the exception of Western Australia by Christmas. Sector performance was mixed, with Energy the best performer, buoyed by Woodside Petroleum, which lifted 1.1%.

Materials stocks weighed on the broader market, dragged lower by mining heavyweights BHP and Rio Tinto, which closed down 1.3% and 0.9% respectively. BlueScope Steel bucked the trend to rise 10.9%, after the miner report it expected a 30% lift in 1H21 earnings before interest and tax.

The Financials sector was well supported by the big four banks, which all closed up between 0.6% and 1.4%, with ANZ the best performer. However, IAG fell 1.2%, after the insurer announced at its annual general meeting that it expects low single digit first quarter gross written premium growth.

The Australian futures market points to a 0.29% rise today.

Overseas Markets

European sharemarkets rebounded on Friday. Barclays rose 7.0% after the bank reported better than expected quarterly earnings results. The announcement boosted other regional banks, with the sector closing up 2.8%. Aerospace company Airbus rose 5.6% after it told suppliers to be ready for a lift in output once travel demand recovers. The broad based STOXX Europe 600 closed 0.6%, the German DAX rose 0.8% and the UK FTSE 100 added 1.3%.

US sharemarkets closed mostly higher on Friday, as investors continued to monitor development in stimulus package talks. Toymaker Mattel strengthened 9.6% after it announced better than expected Q3 Earnings Per Share, which was boosted by strong sales growth. Intel lost 10.6% after the company reported a drop in margins, while American Express fell 3.6% after third-quarter profit missed estimates. By the close of trade, the S&P 500 climbed 0.3% and the NASDAQ lifted 0.4%, however, the Dow Jones slipped 0.1%.

CNIS Perspective

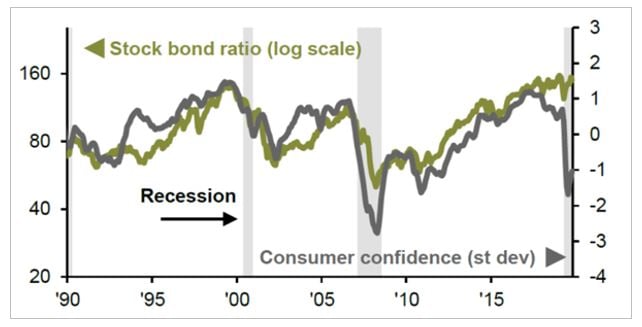

The spike in COVID-19 cases in the US has done little to dampen investor appetite in recent weeks.

The promise of further fiscal stimulus in the US has been too great a factor in an environment where the alternative, government bonds, have little appeal. However, you couldn’t be blamed for thinking the equity market has run ahead of economic fundamentals.

The chart below illustrates the gap between the market and consumer confidence, historically a rather close relationship. The stock bond ratio compares the total return of global equities to that of global government bonds. Given the very low yields, and the supportive nature of central banks and governments, it could be argued that the gap is warranted.

The alternative view is that the market has already priced in any good news to come, and it would take a big shift in earnings expectations to drive equities higher, while the stalling economic backdrop presents a material risk of a correction.

Should you wish to discuss this or any other investment related matter, please contact your Investment Services Team on (02) 4928 8500.

Disclaimer

The material contained in this publication is the nature of the general comment only, and neither purports, nor is intended to be advice on any particular matter. Persons should not act nor rely upon any information contained in or implied by this publication without seeking appropriate professional advice which relates specifically to his/her particular circumstances. Cutcher & Neale Investment Services Pty Limited expressly disclaim all and any liability to any person, whether a client of Cutcher & Neale Investment Services Pty Limited or not, who acts or fails to act as a consequence of reliance upon the whole or any part of this publication.

Cutcher & Neale Investment Services Pty Limited ABN 38 107 536 783 is a Corporate Authorised Representative of Cutcher & Neale Financial Services Pty Ltd ABN 22 160 682 879 AFSL 433814.

Cutcher's Investment Lens | 17 - 21 March 2025

Put your hard-earned dollars to work: Smart investing for doctors.

Fringe Benefits Tax year-end: Important updates and insights.

Cutcher's Investment Lens | 10 - 14 March 2025

Cutcher's Investment Lens | 3 - 7 March 2025