Pre-Open Data

Key Data for the Week

- Tuesday – US – Consumer Confidence

- Tuesday – US – Housing Prices

- Tuesday – CHINA – Industrial Profits

- Wednesday – AUS – Consumer Price Index

- Wednesday – US – FOMC Policy Decision

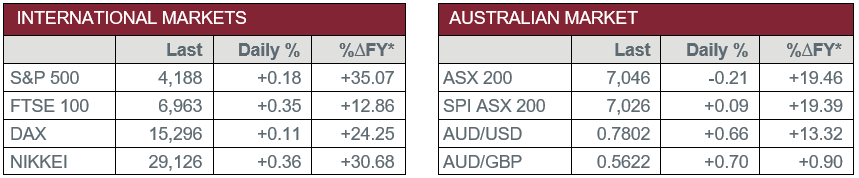

Australian Market

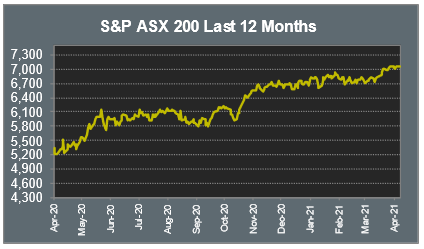

The Australian sharemarket closed 0.2% lower on Monday, weakened by the Utilities and Consumer Staples sectors. Supermarket heavyweights Coles and Woolworths fell 0.5% and 0.9% respectively and are both due to report their 3Q21 earnings later this week. The Consumer Staples sector was also weakened by the a2 Milk Company, which fell 3.1% and Bega Cheese, which shed 0.9%.

The Banking sector closed generally lower; Commonwealth Bank dropped 0.4% and Westpac lost 0.2%, while ANZ closed flat. NAB bucked the downward trend to close 0.8% higher.

The announcement of a three-day lockdown in Perth weakened travel stocks, with Corporate Travel Management (-3.3%), Qantas (-1.2%) and Webjet (-1.0%) all ending the session lower.

Health Insurer nib Holdings provided a business update and a full year outlook, which was well received by investors. The company gained 10.2% after stating it expects operating profit to fall within the $200m to $225m range, up $150m from the prior financial year.

The Materials sector posted the only notable gain of the session, adding 0.4%. Fortescue Metals gained 4.8%, Rio Tinto climbed 1.1% and BHP lifted 0.6%, all aided by the steady increase in the price of iron ore.

The Australian futures market points to a 0.09% rise today.

Overseas Markets

European sharemarkets were mostly stronger on Monday. The Banking sector was the top performer, aided by a slight increase in Eurozone bond yields. ING lifted 3.0%, Deutsche Bank gained 2.6% and Barclays PLC added 2.3%. The pan-European STOXX 600 gained 0.3%, following its first weekly loss in the past eight weeks.

US sharemarkets were mixed on Monday, in preparation of a key week of earnings announcements. This week will also bring to light the Federal Reserve rates decision, which is bound to have an impact on equity markets. Electric vehicle producer, Tesla, exceeded market expectations and finished the session 1.2% higher. The company also announced they reduced their Bitcoin position by 10%, which improved their financials report as the price of Bitcoin fell from a peak of US$64,000, to a low of US$48,000 in the past month. The Renewable Energy sector was also aided by gains in ChargePoint Holdings (8.4%), SolarEdge Technologies (3.6%) and Enphase Energy (3.4%).

By the close of trade, the Dow Jones fell 0.2%, while the S&P 500 added 0.2% and the NASDAQ gained 0.9%.

CNIS Perspective

‘Build Back Better’ are three words you will probably hear a lot more over the next four to eight years.

While UK Prime Minister, Boris Johnson, claims it is his latest slogan, Biden has “nicked” it from him, with the name being given to Biden’s US$2 trillion fiscal package, that will be spent on infrastructure over the next few years, depending on whether he serves a second term or not.

The policy is expected to be financed through increased corporate taxes that would offset the cost, but over a longer time period of 15 years.

Interestingly, the Republicans have given the policy broad support, with just the size, scope and scale up for negotiation.

Along with the vaccine, ‘Build Back Better’ suggests the remainder of 2021 will be full of dominant factors.

The next phase of the plan, the American Families Plan, provides even more stimulus and is set to be announced in the coming weeks.

Janet Yellen’s words of “the more relief the better” is ringing loud and clear.

Should you wish to discuss this or any other investment related matter, please contact your Investment Services Team on (02) 4928 8500.

Disclaimer

The material contained in this publication is the nature of the general comment only, and neither purports, nor is intended to be advice on any particular matter. Persons should not act nor rely upon any information contained in or implied by this publication without seeking appropriate professional advice which relates specifically to his/her particular circumstances. Cutcher & Neale Investment Services Pty Limited expressly disclaim all and any liability to any person, whether a client of Cutcher & Neale Investment Services Pty Limited or not, who acts or fails to act as a consequence of reliance upon the whole or any part of this publication.

Cutcher & Neale Investment Services Pty Limited ABN 38 107 536 783 is a Corporate Authorised Representative of Cutcher & Neale Financial Services Pty Ltd ABN 22 160 682 879 AFSL 433814.

Cutcher's Investment Lens | 7 - 11 April 2025

The failed $3 million super tax: Division 296 is done… or is it?

Cutcher's Investment Lens - Update on Trump & Tariffs | 31 March - 4 April 2025

Liberation Day - April 2025 Snapshot

Smart investing for SMEs: The basics on how to get started and grow your business.