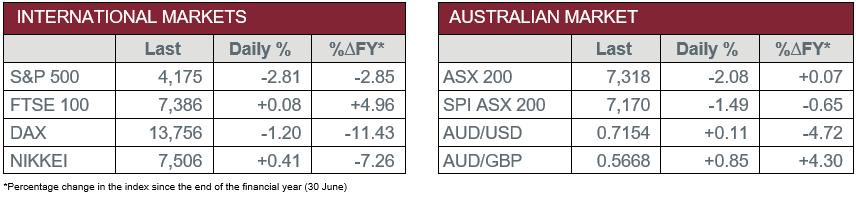

Pre-Open Data

Key Data for the Week

- Tuesday – US – Consumer Confidence was 107.3 in March, weaker than consensus forecasts of 108.2.

- Tuesday – US – New Home Sales fell 8.6% in March, compared to a 1.2% fall in February.

- Wednesday – AUS – Consumer Price Index

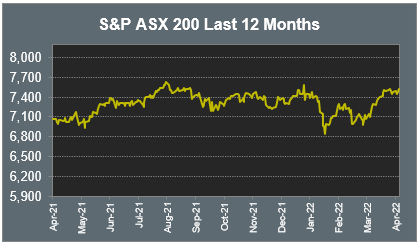

Australian Market

The Australian sharemarket weakened on Tuesday, down 2.1%. The local ASX 200 was weighed down by the Materials and Energy sectors, which slid 5.1% and 4.0% respectively, as commodity and oil prices declined. All sectors closed in the red, with Consumer Discretionary, Health Care, Industrials and REITs the main outperformers, all closing down 0.7%.

Oil majors eased as the price of oil fell 4.0%. Santos shed 4.3%, while Woodside Petroleum gave up 4.6% after the company reported a 17% decline in sales revenue in Q1 2022 on lower trading activity.

Mining heavyweights weighed on the broader market; Fortescue Metals slid 6.9% and BHP gave up 5.8%, while Rio Tinto retreated 4.3%. Gold miners were also weaker; Northern Star Resources closed down 4.9%, while Newcrest Mining and Evolution Mining eased 2.9% and 1.7% respectively.

The Financials sector closed 1.0% weaker as all major banks posted losses; Commonwealth Bank and ANZ both slipped 0.6%, while NAB fell 1.2% and Westpac closed down 1.3%. Fund managers also contributed losses; Magellan Financial Group slid 2.4% and Australian Ethical Investment gave up 1.2%, while Challenger lost 0.9%.

Electronic payments platform EML Payments tumbled 38.6% after the company reduced full year earnings guidance by 8.0% and reported European operational issues are expected to persist until mid-year.

The Australian futures market points to a 1.49% fall today.

Overseas Markets

European sharemarkets were mostly softer overnight. Banking stocks were mixed as banks reported their first quarter earnings. HSBC was the main laggard, down 5.5%, after the company stated it was unlikely further share buybacks will occur this year, while Santander lifted 6.2% after the company’s earnings exceeded expectations. Consumer Staples stocks were mixed; Nestlé gave up 1.7% and UK supermarket chain Sainsbury fell 1.3%, while Tesco gained 0.6% and Unilever added 1.0%.

By the close of trade, the STOXX Europe 600 slipped 0.9% and the German DAX fell 1.2%, while the UK FTSE 100 eked out a 0.1% gain.

US sharemarkets closed lower on Tuesday, weighed down by losses among technology heavyweights. Microsoft and Apple both gave up 3.7%, while Alphabet fell 3.0%. Tesla tumbled 12.2% amid investor concerns over Tesla founder Elon Musk’s US$44 billion deal to purchase social media platform Twitter.

In company news, Waste Management posted a 5.3% gain after the company reported a jump in profits and revenues, with first quarter revenue of US$4.66 billion, compared to US$4.11 billion in the same period a year earlier.

By the close of trade, the Dow Jones lost 2.4% and the S&P 500 eased 2.8%, while the NASDAQ closed 4.0% lower.

CNIS Perspective

China is in the grips of a major lockdown as President Xi focuses on COVID-19 elimination, with an estimated 44 Chinese cities under some form of lockdown at present.

The cities in lockdown, which currently excludes the majority of Beijing, equate to roughly 25% of the population and are responsible for 38% of Chinese GDP.

Despite Chinese officials yesterday announcing a promise for monetary support, the policy response so far has been very limited, with the ability to cut interest rates from a current level of 3.7% and loosen bank reserve requirements.

The lockdowns are going to slow Chinese growth and especially demand for raw materials in the short term, which the market is currently digesting. On the flip side, lockdowns threaten to cause another wave of supply-chain disruptions between Asia and the rest of the world.

The question the rest of the world is asking though, is why China is focused on a zero COVID policy, when the rest of the world has battled for so long to re-open and live with the virus? Are they behind the times, or have they learnt something the rest of the world hasn’t?

Should you wish to discuss this or any other investment related matter, please contact your Wealth Management Team on (02) 4928 8500.

Disclaimer

The material contained in this publication is the nature of the general comment only, and neither purports, nor is intended to be advice on any particular matter. Persons should not act nor rely upon any information contained in or implied by this publication without seeking appropriate professional advice which relates specifically to his/her particular circumstances. Cutcher & Neale Investment Services Pty Limited expressly disclaim all and any liability to any person, whether a client of Cutcher & Neale Investment Services Pty Limited or not, who acts or fails to act as a consequence of reliance upon the whole or any part of this publication.

Cutcher & Neale Investment Services Pty Limited ABN 38 107 536 783 is a Corporate Authorised Representative of Cutcher & Neale Financial Services Pty Ltd ABN 22 160 682 879 AFSL 433814.

Smart investing for SMEs: The basics on how to get started and grow your business.

ATO updates: A quick guide on what business owners need to know.

Cutcher's Investment Lens | 24 - 28 March 2025

Is your current super fund holding you back? It might be time for an SMSF.

Cutcher's Investment Lens | 17 - 21 March 2025