Pre-Open Data

Key Data for the Week

Key economic data released this week:

- Monday – AUS – Trade Balance – Preliminary September figures reveal a trade surplus of $5.1 billion. Exports rose to $28.9 billion, up 3% over August, while imports fell to $23.8 billion, down 1%.

- Monday – US – New Home Sales declined 3.5% in September to 959,000 units.

- Tuesday – US – Consumer Confidence

- Tuesday – US – Durable Goods Orders

Australian Market

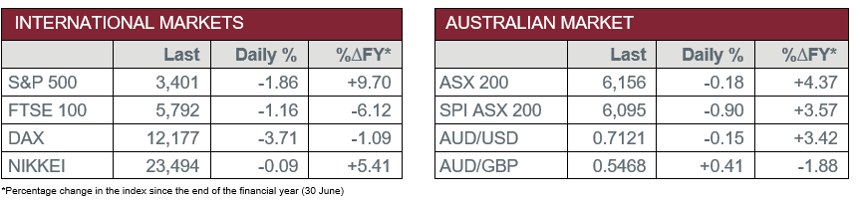

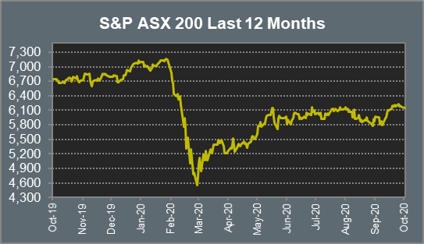

The Australian sharemarket fell 0.2% yesterday in a mixed session of trade. Consumer Discretionary, Information Technology and Materials weighed on the market, while gains from Consumer Staples and REITs kept losses to a minimum.

The Financials sector closed weaker on Monday as all four big banks finished in the red. NAB fell 1.0%, ANZ slipped 0.5% and Commonwealth Bank dropped 0.3%, while Westpac slipped 0.4% after the company warned of a $1.22 billion hit to earnings ahead of the release of its full-year results next week. Insurers were mixed; Suncorp and NIB lost 0.9% and 0.5% respectively, while Insurance Australia Group gained 2.1%.

The Materials sector also underperformed, with losses among the mining heavyweights; BHP and Rio Tinto both slipped 0.8%, while Fortescue Metals lost 0.7%. Goldminers also closed lower; Saracen Mineral fell 1.4%, Northern Star slipped 1.0% and Evolution Mining dropped 0.9%.

The Consumer Staples sector was the strongest performer yesterday, closing up 0.8%. Coca-Cola Amatil jumped 16.3% after the company received a $9.3 billion takeover offer from Coca-Cola European Partners. Bega Cheese added 0.6% and Blackmores rose 1.2%, while Coles fell 0.5%.

The Australian futures market points to a 0.9% fall today, driven by weaker overseas markets.

Overseas Markets

European sharemarkets fell on Monday, as all sectors closed weaker. The STOXX Europe 600 closed at a one-month low after falling 1.8%, while the German DAX slumped 3.7% weighed down by German software manufacturer, SAP. SAP lost 21.9% after the company cut medium-term profit targets and warned the company would take longer than expected to recover from the COVID-19 pandemic. In the Health Care sector, biopharmaceutical company, AstraZeneca, added 1.7% after the company resumed the US trial of its experimental COVID-19 vaccine.

US sharemarkets fell sharply yesterday, with all sectors closing lower, as COVID-19 cases continue to rise. Cruiseliner stocks slumped; Royal Caribbean Cruises fell 9.7% and Carnival dropped 8.7%, while Norwegian Cruise Line slipped 8.5%. Financials closed 2.2% lower; Morgan Stanley slumped 3.0% and JP Morgan Chase lost 2.5%, while Goldman Sachs fell 1.9%.

The Information Technology sector underperformed. Alphabet fell 3.1%, Microsoft slipped 2.8% and Facebook lost 2.7%. However, Spotify and Apple bucked the trend to closed up 0.5% and 0.1% respectively.

By the close of trade, the Dow Jones fell 2.3% and the S&P 500 slipped 1.9%, while the NASDAQ lost 1.6%.

CNIS Perspective

Investment themes sometimes take time to prove they are worthy of consideration for the serious investor.

Bitcoin and cryptocurrencies are an example of a new product that a few years back were considered ‘pie in the sky’, and just as likely to fail as they were likely to succeed.

However, time is proving crypto may well be a legitimate investment vehicle.

Last week, PayPal announced it would allow customers to use cryptocurrencies, not just Bitcoin, on its platform. Similarly, Square has recently purchased equity in Bitcoin after they established Square Crypto last year.

A few months back Fidelity Investments announced a Bitcoin managed fund.

Last week, Bitcoin rose 10%, Litecoin rose 13% and Bitcoin cash 9%. Shares in PayPal also rose 5.5%, its biggest increase since May.

Should you wish to discuss this or any other investment related matter, please contact your Investment Services Team on (02) 4928 8500.

Disclaimer

The material contained in this publication is the nature of the general comment only, and neither purports, nor is intended to be advice on any particular matter. Persons should not act nor rely upon any information contained in or implied by this publication without seeking appropriate professional advice which relates specifically to his/her particular circumstances. Cutcher & Neale Investment Services Pty Limited expressly disclaim all and any liability to any person, whether a client of Cutcher & Neale Investment Services Pty Limited or not, who acts or fails to act as a consequence of reliance upon the whole or any part of this publication.

Cutcher & Neale Investment Services Pty Limited ABN 38 107 536 783 is a Corporate Authorised Representative of Cutcher & Neale Financial Services Pty Ltd ABN 22 160 682 879 AFSL 433814.

Cutcher's Investment Lens | 17 - 21 March 2025

Put your hard-earned dollars to work: Smart investing for doctors.

Fringe Benefits Tax year-end: Important updates and insights.

Cutcher's Investment Lens | 10 - 14 March 2025

Cutcher's Investment Lens | 3 - 7 March 2025