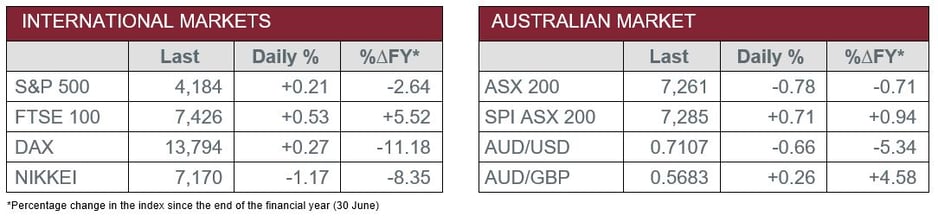

Pre-Open Data

Key Data for the Week

- Wednesday – AUS – Consumer Price Index surged 2.1% in the March quarter, ahead of expectations, which represented a 5.1% increase year on year.

- Thursday – EUR – Economic Confidence

- Thursday – UK – Nationwide House Prices

Australian Market

The Australian sharemarket declined for a third straight session on Wednesday, after inflation data exceeded expectations. The Consumer Price Index surged by 2.1% in 1Q 2022, which represented the highest movement recorded in over 20 years. Consequently, market participants brought forward their monetary policy expectations, predicting the Reserve Bank of Australia will increase its cash rate target in May. Furthermore, the inflationary data confirmed ongoing price pressure concerns and caused investors to reconsider company earnings and valuations.

By the close of trade, the ASX 200 dropped 0.8%, after most sectors closed in the red. Notably, while the Energy (1.0%) and Materials (0.2%) sectors advanced, this came on the back of losses made in the prior session.

Unsurprisingly, the main detractor on Wednesday was the interest rate sensitive Information Technology (-2.4%) sector. Key movers included index heavyweights Block (-5.9%) and Xero (-1.8%). Additionally, family tracking software provider, Life360, plunged 29.4% after it halted plans to dual-list in the US.

The Financials sector also closed lower, down 1.6%, after all major banks lost ground. Losses were led by ANZ (-2.6%), followed by Westpac (-1.9%), Commonwealth Bank (-1.7%) and NAB (-1.7%). On the other hand, a notable gainer in the sector was insurance provider, NIB Holdings, which rose 3.3%.

The Australian futures market points to a 0.71% increase today.

Overseas Markets

European sharemarkets broke a three-day losing streak on Wednesday, after the Materials sector broadly advanced 2.8%. Important movers included Rio Tinto (3.6%) and Glencore (2.7%). In other news, Russia’s gas producer, Gazprom (5.0%), halted gas supply to Bulgaria and Poland for failure to pay for gas in Roubles. This will likely further extend the energy supply shock experienced in the Eurozone and added to geopolitical tensions. By the close of trade, the STOXX Europe 600 rose 0.7%, the UK FTSE 100 lifted 0.5% and the German DAX inched up 0.3%.

US sharemarkets edged higher on Wednesday, after mixed company earnings reports. Microsoft advanced 4.8% based on positive earnings results, which were supported by robust growth experienced in its cloud services product line. Meanwhile, Visa rose 6.5%, after it delivered on earnings and provided forward guidance above pre-pandemic levels. However, Alphabet bucked the trend and fell 3.8%, as it reported lower than expected earnings results. The company cited cost pressures experienced by its customers, alongside increased competition from TikTok regarding its YouTube viewership, as reasons for the shortfall. By the close of trade, the S&P 500 and Dow Jones both inched 0.2% higher, while the NASDAQ closed relatively flat.

CNIS Perspective

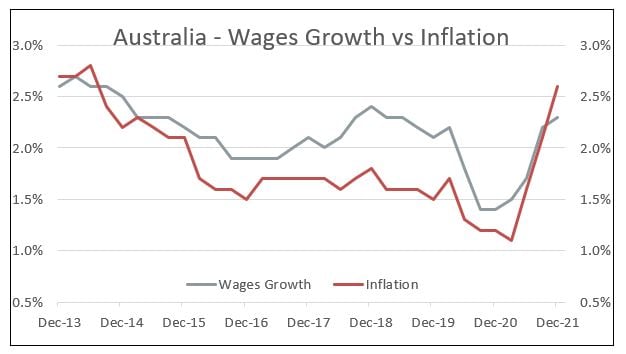

Yesterday’s CPI announcement is dominating headlines, but its significant rise really shouldn’t have come as any surprise to anyone. Inflation had started its upward spiral last year and by 3Q 2021 was already on a steady ascendency.

When Victoria came out of its prolonged lockdown late last year, the subsequent surge in spending meant inflation was only headed in one direction, and that was upward.

Another key correlation with inflation is wages growth and the graph below shows how tight that correlation has become over the past few quarters.

The only uncertainty surrounding the immediate economic environment is whether the RBA, in an attempt to slow inflation, raises the Official Cash Rate next Tuesday. Memories of 2007 will come flooding back to the Federal Government if they do raise.

Should you wish to discuss this or any other investment related matter, please contact your Wealth Management Team on (02) 4928 8500.

Disclaimer

The material contained in this publication is the nature of the general comment only, and neither purports, nor is intended to be advice on any particular matter. Persons should not act nor rely upon any information contained in or implied by this publication without seeking appropriate professional advice which relates specifically to his/her particular circumstances. Cutcher & Neale Investment Services Pty Limited expressly disclaim all and any liability to any person, whether a client of Cutcher & Neale Investment Services Pty Limited or not, who acts or fails to act as a consequence of reliance upon the whole or any part of this publication.

Cutcher & Neale Investment Services Pty Limited ABN 38 107 536 783 is a Corporate Authorised Representative of Cutcher & Neale Financial Services Pty Ltd ABN 22 160 682 879 AFSL 433814.

Smart investing for SMEs: The basics on how to get started and grow your business.

ATO updates: A quick guide on what business owners need to know.

Cutcher's Investment Lens | 24 - 28 March 2025

Is your current super fund holding you back? It might be time for an SMSF.

Cutcher's Investment Lens | 17 - 21 March 2025