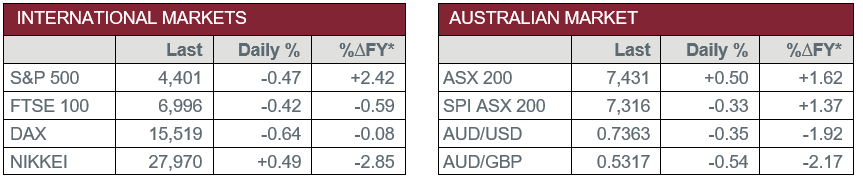

Pre-Open Data

Key Data for the Week

- Tuesday – CHINA – Industrial Profits growth slowed to 20% year on year from 36.4% in May.

- Tuesday – US – House Price Index rose 1.8% in May.

- Wednesday – AUS – Consumer Price Index

- Wednesday – US – FOMC Meeting Decision

Australian Market

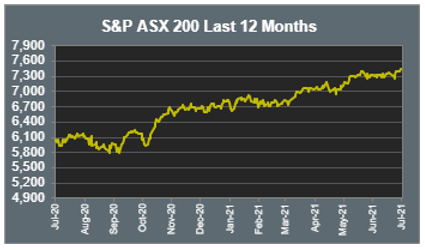

The Australian sharemarket hit a record high for the second consecutive session yesterday to close up 0.5%. The Materials sector was again in favour as the major miners produced stellar performances; BHP rose 2.8% and Rio Tinto added 1.8%, while Fortescue Metals lifted 1.6%.

Copper miners rose as OZ Minerals was up 6.5% and Sandfire Resources gained 2.3%. However, gold miners detracted from the Materials sectors gains; Northern Star lost 1.4% and Regis Resources shed 1.6%, while Evolution Mining conceded 0.5%.

The Energy sector was the second-best performer on the market as a result of increased oil prices. Woodside Petroleum added 1.8% and Santos lifted 1.4%. Oil Search slipped 0.5% despite announcing that it is on track to meet full-year production and capital spending targets.

The big four banks led the Financials sector higher, as all four finished in the green. Fund managers underperformed; Australian Ethical Investment lost 0.1% and Magellan Financial Group shed 1.9%.

The Information Technology sector was the main detractor yesterday, as it fell 1.0%. Artificial Intelligence producer, Appen, fell 2.9%, while Afterpay lost 1.7%.

The Australian futures point to a 0.33% fall today, driven by weaker overseas markets.

Overseas Markets

European sharemarkets fell overnight as the pan-European STOXX 600 fell 0.5%. Investors showed signs of caution as tighter regulation of Chinese technology companies prompted a wider sell-off among global markets. As a result, Dutch technology company, Prosus, fell a further 7.2%, as the increased regulations are set to impact their stake in Chinese technology giant, Tencent. This led to a weakening of the European Technology index that was further impacted by Logitech, which slumped 9.9%, despite reporting better-than-expected quarterly results.

By the close of the session, the German DAX lost 0.6% and the UK FTSE 100 slipped 0.4%.

US sharemarkets also fell on Tuesday, as investors await the Federal Reserve announcement and the quarterly results from ‘big tech’ companies, Alphabet, Amazon, and Apple. These companies weighed on the NASDAQ to all close down between 1.5% and 2.0%. Tesla also weighed on the index and fell 2.0% despite better-than-expected results, with a global chip shortage set to slow production. Renewable energy companies posted mixed performances; NextEra Energy lifted 1.2%, while Enphase Energy closed the session 2.2% lower.

By the close of trade, the Dow Jones lost 0.2%, the S&P 500 conceded 0.5% and the NASDAQ slumped 1.2%.

CNIS Perspective

US technology stocks are not cheap by many methods of valuation. However, they continue to exhibit incredibly strong fundamentals that are reflected in their consistent outperformance of expected earnings (e.g. Apple, Alphabet (Google) and Microsoft Q2 results overnight). This was made apparent in June’s industrial production report.

The US data on the output of computer-related business equipment has increased 29.6% year on year to a record high. Also hitting new record highs were communications equipment and semiconductors. In addition, industrial production of electronic equipment for consumers (i.e., computers, video, and audio equipment) rose 25% year on year during June, to another new record high.

As the world shifts towards digitalisation within a low interest rate world, technological innovations will boost productivity-led growth while keeping a lid on inflation. This continues to indicate a bullish outlook for technology stocks.

Should you wish to discuss this or any other investment related matter, please contact your Investment Services Team on (02) 4928 8500.

Disclaimer

The material contained in this publication is the nature of the general comment only, and neither purports, nor is intended to be advice on any particular matter. Persons should not act nor rely upon any information contained in or implied by this publication without seeking appropriate professional advice which relates specifically to his/her particular circumstances. Cutcher & Neale Investment Services Pty Limited expressly disclaim all and any liability to any person, whether a client of Cutcher & Neale Investment Services Pty Limited or not, who acts or fails to act as a consequence of reliance upon the whole or any part of this publication.

Cutcher & Neale Investment Services Pty Limited ABN 38 107 536 783 is a Corporate Authorised Representative of Cutcher & Neale Financial Services Pty Ltd ABN 22 160 682 879 AFSL 433814.

Cutcher's Investment Lens | 7 - 11 April 2025

The failed $3 million super tax: Division 296 is done… or is it?

Cutcher's Investment Lens - Update on Trump & Tariffs | 31 March - 4 April 2025

Liberation Day - April 2025 Snapshot

Smart investing for SMEs: The basics on how to get started and grow your business.