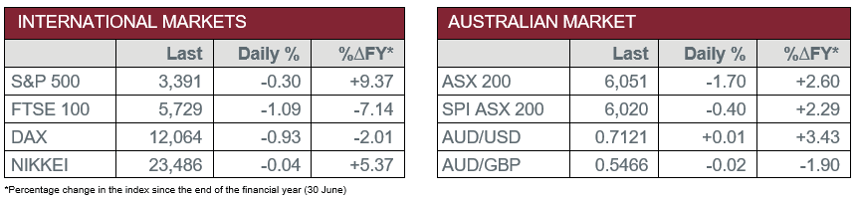

Pre-Open Data

Key Data for the Week

Key economic data released this week:

- Tuesday – US – Consumer Confidence fell to 100.9 in September, from 101.3 in August.

- Tuesday – US – Durable Goods Orders rose 1.9% in September for the fifth consecutive month, up from 0.4% in August.

- Wednesday – AUS – Consumer Price Index

- Wednesday – US – Goods Trade Balance

Australian Market

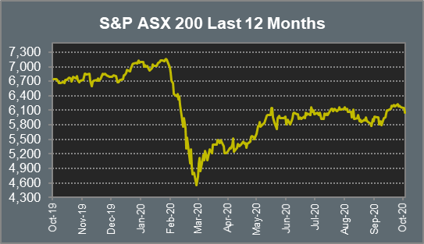

The Australian sharemarket fell to a three-week low yesterday after tumbling 1.7%. Losses were broad based, with most sectors slipping more than 1.0%. The Information Technology sector was the weakest performer, down 3.3%. Buy-now-pay-later companies, Afterpay and Zip Co, fell 4.7% and 5.3% respectively. Accounting software platform, Xero, slipped 1.4%, while Appen lost 3.8%.

The Energy sector dropped 2.9% after oil prices fell to three-week lows. Beach Energy tumbled 4.1% and Woodside Petroleum slumped 3.3%, while Oil Search and Santos both lost around 3.5%.

The Materials sector underperformed, dragged lower by the mining heavyweights; Rio Tinto and Fortescue Metals slipped 2.5% and 2.4% respectively, while BHP fell 2.2%. Goldminers were also weaker; Saracen Mineral and Northern Star both lost 1.9%, while Evolution Mining fell 1.1% and Newcrest Mining slipped 0.6%.

The Consumer Staples sector was the strongest performer, despite slipping 0.9%. Bega Cheese lost 4.3%, and Woolworths dropped 1.2%, while Coles bucked the trend to add 0.6%. Health supplements company, Blackmores, gained 0.7% after the company announced the sale of its Global Therapeutics business to health products supplier McPherson’s for $27 million.

The Australian futures market points to a 0.4% fall today, driven by weaker overseas markets.

Overseas Markets

European sharemarkets extended losses on Tuesday as the broad based STOXX Europe 600 fell 1.0% to a one-month low. The Financials sector closed lower; Barclays and Lloyds Bank fell 3.6% and 2.5% respectively, while Deutsche Bank lost 1.6%. However, Europe’s largest bank, HSBC, gained 3.4% after the company reported third quarter earnings that exceeded expectations. The Energy sector was also weaker, dragged lower by BP, which closed down 2.1% after it warned of pandemic-related uncertainties.

US sharemarkets were mixed overnight, with sentiment weakened by rising COVID-19 cases. The Information Technology sector closed higher; Zoom added 4.1% and Facebook gained 2.2%, while Microsoft and Apple rose 1.5% and 0.9% respectively. The Financials sector closed weaker; JP Morgan Chase slipped 1.8%, Bank of America lost 2.8% and Citigroup fell 3.2%. Financial services were mixed; Visa and MasterCard gave up 1.6% and 0.3% respectively, while PayPal added 1.6%. By the close of trade, the Dow Jones and the S&P 500 fell 0.8% and 0.3% respectively, while the NASDAQ rose 0.6%.

CNIS Perspective

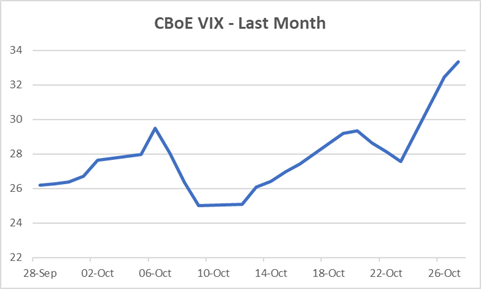

This time next week the US will have submitted their votes for a President for the upcoming four years. It is a major event on the economic calendar, and one to be treated with caution prior to a result, as elections do tend to generate a lot of short-term noise and volatility.

The VIX Index, a measure of fear and volatility within markets, was already trading higher than normal since the onset of the COVID-19 crisis. It has traded above 20, a level deemed high, since the end of February. However, the VIX has increased significantly leading into the election, surging to 33.35, or 27%, in the past month.

While the US market is prepared for a Biden victory, results are often unpredictable. This is reflected in the higher levels of volatility seen in equity markets in this final week of the campaign and is likely to maintain elevated in the weeks after the votes are counted.

However, looking back historically, despite the increased short-term risk, election results tend not to have a lasting impact on financial markets, with this election likely to prove no different.

Should you wish to discuss this or any other investment related matter, please contact your Investment Services Team on (02) 4928 8500.

Disclaimer

The material contained in this publication is the nature of the general comment only, and neither purports, nor is intended to be advice on any particular matter. Persons should not act nor rely upon any information contained in or implied by this publication without seeking appropriate professional advice which relates specifically to his/her particular circumstances. Cutcher & Neale Investment Services Pty Limited expressly disclaim all and any liability to any person, whether a client of Cutcher & Neale Investment Services Pty Limited or not, who acts or fails to act as a consequence of reliance upon the whole or any part of this publication.

Cutcher & Neale Investment Services Pty Limited ABN 38 107 536 783 is a Corporate Authorised Representative of Cutcher & Neale Financial Services Pty Ltd ABN 22 160 682 879 AFSL 433814.

Cutcher's Investment Lens | 17 - 21 March 2025

Put your hard-earned dollars to work: Smart investing for doctors.

Fringe Benefits Tax year-end: Important updates and insights.

Cutcher's Investment Lens | 10 - 14 March 2025

Cutcher's Investment Lens | 3 - 7 March 2025