Pre-Open Data

Key Data for the Week

- Thursday – AUS – Trade Balance narrowed to $11.2 billion in October, in line with expectations.

- Thursday – EUR – Unemployment Rate fell to 7.3% in October, down from 7.4%.

- Friday – US – Unemployment Rate

- Friday – EUR – Retail Sales

Australian Market

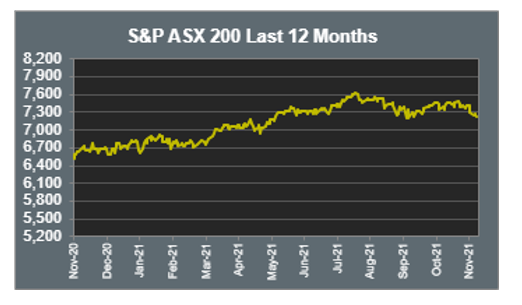

The Australian sharemarket inched 0.2% lower on Thursday, as early losses were offset by a mid-session rally by the more defensive Utilities (1.5%) and Industrials (0.8%) sectors. These, coupled with the Consumer Discretionary (0.6%) sector, prevented the market from sinking lower.

The Information Technology sector slumped 3.2%, impacted by poor sentiment set by the NASDAQ on Wednesday night. Afterpay dragged the sector lower, down 6.1%, after it announced the postponement of its shareholder meeting to approve Square’s acquisition of the company, due to regulatory delays.

The Financials sector made a turnaround in the session, as it closed up 0.6%, led by strong performances from Commonwealth Bank (2.2%) and Macquarie Group (1.5%). NAB (0.8%) and ANZ (0.2%) also rose, while Westpac lost 0.8%.

In other news, Woolworths entered into a proposed acquisition for Australian Pharmaceutical Industries, which is already under a takeover offer from Wesfarmers. API’s most well-known subsidiary is Priceline Pharmacy. Woolworths offered $1.75 per share for API, a significant premium to Wesfarmers’ $1.55 per share bid. Consequently, API’s share price spiked 16.1%.

The Australian futures point to a 0.72% rise today, bolstered by a rebound in US equities overnight.

Overseas Markets

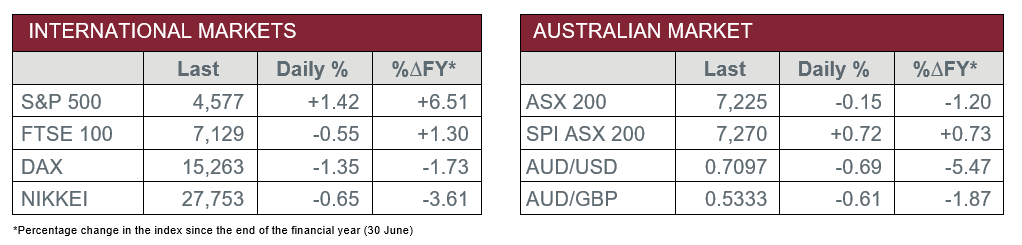

European sharemarkets fell on Thursday, as social and travel restrictions ramp up to prevent the spread of Omicron. Travel and leisure stocks were the obvious losers, down 2.6%. Technology stocks, particularly chipmakers, also lost ground after a report from Apple which indicated reduced demand for its iPhone 13. By the close of trade, the STOXX Europe 600 and German DAX gave up between 1.3-1.7%, while the UK FTSE 100 lost 0.6%.

US sharemarkets rebounded on Thursday, led by the Industrials, Energy and Financials sectors, which all rose between 2.8-2.9%. The American Association of Individual Investors noted market participants were buying the dip, despite elevated volatility and a 21.3% reduction in optimism. By the close of trade, the Dow Jones (1.8%), S&P 500 (1.4%) and NASDAQ (0.8%) all advanced.

CNIS Perspective

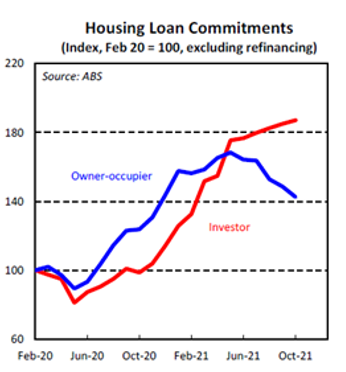

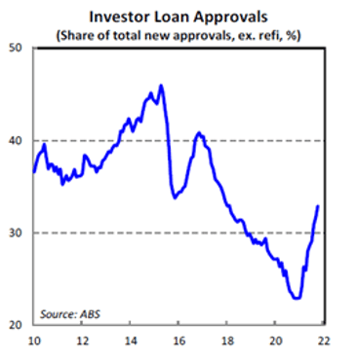

An interesting trend in housing finance continues in Australia, with new owner-occupier lending falling five consecutive months to its lowest level since November 2020. In contrast, new lending to investors has grown twelve consecutive months and has almost doubled from a year ago.

The current housing boom was initially characterised by strong lending to owner-occupiers and first-home buyers. However, over recent months, lending to investors has accelerated and has approached an all-time high.

Overall new lending continues to be supported by low interest rates, housing demand and a recovering economy. However, a growing number of headwinds should start impacting lending.

The Australian Prudential Regulation Authority (APRA) recently tightened macroprudential rules to increase the loan serviceability buffer from 2.5 percentage points to 3.0 percentage points. APRA stated that the impact of the higher serviceability buffer is likely to be larger for investors than owner-occupiers. This is because the buffer applies to all loans, not just the loan that is being applied for, and investors tend to borrow at higher leverage ratios.

It will be interesting see whether this plays out or not. Affordability pressures and rising fixed interest rates have impacted demand for new loans, although, investors appear less sensitive to these hurdles.

Should you wish to discuss this or any other investment related matter, please contact your Investment Services Team on (02) 4928 8500.

Disclaimer

The material contained in this publication is the nature of the general comment only, and neither purports, nor is intended to be advice on any particular matter. Persons should not act nor rely upon any information contained in or implied by this publication without seeking appropriate professional advice which relates specifically to his/her particular circumstances. Cutcher & Neale Investment Services Pty Limited expressly disclaim all and any liability to any person, whether a client of Cutcher & Neale Investment Services Pty Limited or not, who acts or fails to act as a consequence of reliance upon the whole or any part of this publication.

Cutcher & Neale Investment Services Pty Limited ABN 38 107 536 783 is a Corporate Authorised Representative of Cutcher & Neale Financial Services Pty Ltd ABN 22 160 682 879 AFSL 433814.

Cutcher's Investment Lens | 7 - 11 April 2025

The failed $3 million super tax: Division 296 is done… or is it?

Cutcher's Investment Lens - Update on Trump & Tariffs | 31 March - 4 April 2025

Liberation Day - April 2025 Snapshot

Smart investing for SMEs: The basics on how to get started and grow your business.