Pre-Open Data

Key Data for the Week

Key economic data released this week:

- Tuesday – AUS – RBA Interest Rate Decision – the RBA announced the Cash Rate would be kept at 0.1%.

- Tuesday – EUR – Gross Domestic Product fell 0.7% in the December quarter.

- Wednesday – AUS – Building Permits

- Wednesday – EUR – Consumer Price Index

Australian Market

The Australian sharemarket closed higher for its second consecutive session, up 1.5%. Market improvements continued after the RBA extended forecasts of a cash rate increase until 2024, when it is estimated actual inflation will be sustainably within the 2-3% target range. Gains were broad based, with the Information Technology and Industrials sectors the strongest performers, up 4.0% and 2.5% respectively.

The Materials sector was lifted by gains among mining heavyweights; Rio Tinto climbed 3.4% and BHP added 2.2%, while Fortescue Metals rose 2.0%. Gold miners were mixed on Monday; Saracen Mineral and Northern Star gained 0.6% and 0.7% respectively, while Evolution Mining fell 1.0% and Newcrest Mining slipped 0.5%.

Gains in the Information Technology sector were led by buy-now-pay-later companies. Afterpay jumped 7.9% and Sezzle climbed 5.6%, while Splitit and Zip Co added 4.0% and 3.9% respectively.

The Consumer Discretionary sector rose 1.7% on Monday. Super Retail Group, owner of retail brands such as Macpac, Rebel Sport, Super Cheap Auto and BCF, closed up 5.0%, while Webjet lifted 7.5% after the company received broker upgrades and price target increases. However, online furniture retailer Temple & Webster fell 4.6% despite reporting a 556% surge in EBITDA in 1H21.

The Australian futures market points to a 0.85% rise today, driven by stronger international markets.

Overseas Markets

European sharemarkets advanced on Monday following optimistic economic growth data, with the STOXX Europe 600 closing up 1.3%. European plane manufacturer Airbus rose 6.6% after a broker upgrade. The Financials sector saw gains overnight; Barclays added 4.0% and HSBC lifted 1.7%, while Lloyds Bank rose 1.4%.

US sharemarkets rallied overnight with all sectors closing stronger. The surge in heavily shorted shares continued to ease on Monday, as GameStop tumbled 60.0% and AMC Entertainment sunk 41.2%. The Financials sector was the strongest performer; Morgan Stanley climbed 4.8% and Goldman Sachs lifted 4.5%, while JP Morgan jumped 3.1%. Financial services also enjoyed gains; MasterCard rose 4.0% and PayPal gained 3.0%, while Visa closed up 2.1%.

By the close of trade, the Dow Jones and NASDAQ both lifted 1.6%, while the S&P 500 gained 1.4%.

CNIS Perspective

The work from home trend brought on by the events of 2020 continues to develop and looks set to stay with us for some time to come, as Australians rethink the way they work and lifestyle they live.

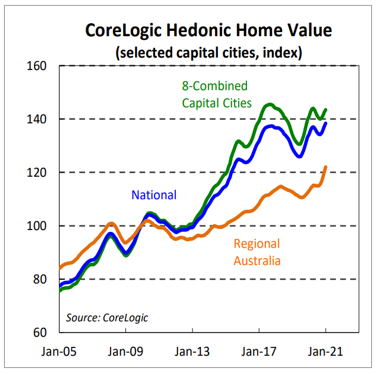

This has proven beneficial for regional Australia’s property valuations based on recent CoreLogic property data, where prices grew more than twice as fast as capital cities in January alone, with NSW and Victoria witnessing the strongest shift in demand to regional areas.

Since the property price falls of the first half of last year, regional Australia’s valuations have lifted 6.2% on average since June. In contrast, capital cities bottomed in September and have recovered just 2.4% since then.

While it is of little doubt the uplift in pricing has been fuelled by accommodative ultra-low interest rates, and terminology from the RBA stating interest rates aren’t going higher for a number of years, the bigger beneficiary so far has been regional Australia.

Should you wish to discuss this or any other investment related matter, please contact your Investment Services Team on (02) 4928 8500.

Disclaimer

The material contained in this publication is the nature of the general comment only, and neither purports, nor is intended to be advice on any particular matter. Persons should not act nor rely upon any information contained in or implied by this publication without seeking appropriate professional advice which relates specifically to his/her particular circumstances. Cutcher & Neale Investment Services Pty Limited expressly disclaim all and any liability to any person, whether a client of Cutcher & Neale Investment Services Pty Limited or not, who acts or fails to act as a consequence of reliance upon the whole or any part of this publication.

Cutcher & Neale Investment Services Pty Limited ABN 38 107 536 783 is a Corporate Authorised Representative of Cutcher & Neale Financial Services Pty Ltd ABN 22 160 682 879 AFSL 433814.

Smart investing for SMEs: The basics on how to get started and grow your business.

ATO updates: A quick guide on what business owners need to know.

Cutcher's Investment Lens | 24 - 28 March 2025

Is your current super fund holding you back? It might be time for an SMSF.

Cutcher's Investment Lens | 17 - 21 March 2025