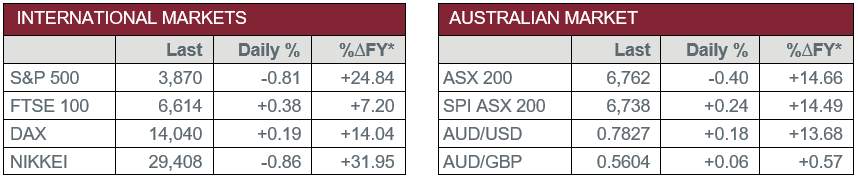

Pre-Open Data

Key Data for the Week

Key economic data released this week:

- Tuesday – AUS – RBA Interest Rate Decision – The RBA decided to keep the Cash Rate on hold at 0.1%, with no expectations to lift the Cash Rate until at least 2024.

- Tuesday – EUR – Consumer Price Index rose 0.2% in February to an annual rate of 0.9%.

- Wednesday – AUS – Gross Domestic Product

- Wednesday – EUR – Producer Price Index

Australian Market

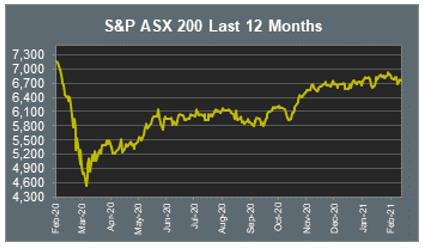

The Australian sharemarket retreated from intraday highs to close 0.4% lower on Tuesday. The local ASX 200 was dragged lower by the Energy and Materials sectors, which lost 1.9% and 1.0% respectively, while Financials and Consumer Staples were the only sectors to improve. The RBA held its monthly meeting yesterday and as the market widely anticipated, the Cash Rate was kept on hold at 0.1%.

The Materials sector was weighed down by mining heavyweights; Rio Tinto and BHP gave up 0.4% and 1.9% respectively, while Fortescue Metals shed 4.7%. Goldminers also declined; Northern Star tumbled 4.3% and Evolution Mining lost 2.9%, while Newcrest Mining slipped 2.5%.

The Energy sector also underperformed on Tuesday. Beach Energy lost 3.0% and Oil Search fell 1.9%, while Woodside Petroleum and Santos both slipped 1.8%.

The Consumer Staples sector lifted 0.8% yesterday. A2 Milk climbed 7.6% and Coles Group added 1.4%, while Woolworths lifted 0.5%.

The Australian futures market points to a 0.24% rise today.

Overseas Markets

European sharemarkets advanced on Tuesday as bond markets stabilised. The Materials sector led the gains, up 1.4%, as copper prices steadied near 10-year highs. Renewable energy stocks eased; Siemens Gamesa fell 2.4% and Vesta Wind Systems slipped 2.1%. HelloFresh fell 6.5% after the company said it expects most of its markets to normalise in 2021, following a boom in 2020. The Financials sector enjoyed gains; British investment bank HSBC lifted 0.9%, Barclays rose 0.6% and Deutsche Bank added 0.4%, however, Lloyds Bank slipped 0.3%.

By the close of trade, the UK FTSE 100 lifted 0.4%, while the German DAX and STOXX Europe 600 both gained 0.2%.

US sharemarkets eased overnight as all sectors, except Materials, closed lower. The Information Technology sector was the weakest performer; NVIDIA lost 3.2% and Facebook slipped 2.2%, while Apple and Microsoft fell 2.1% and 1.3% respectively. However, Fortinet gained 0.1% and Spotify rose 0.5%. The Financials sector also declined; Goldman Sachs gave up 0.9% and Bank of America fell 0.8%, while JP Morgan Chase lost 0.3%. Financial services reversed Monday’s gains; PagSeguro slipped 2.6% and PayPal fell 1.6%, while Visa eased 1.3% and MasterCard closed flat.

By the close of trade, the Dow Jones lost 0.5% and the S&P 500 closed 0.8% lower, while the NASDAQ slid 1.7%.

CNIS Perspective

Inflation is the major talking point on financial markets at the moment, with the RBA entering the fray yesterday, talking down the likelihood of a significant uplift in inflation in their monetary policy statement.

The Board reiterated that they will not raise interest rates until actual inflation is sustainably within their 2-3% target range (currently 0.9%). The emphasis on ‘actual’ rather than ‘expected’ inflation is most notable.

Despite these comments, earlier this week the RBA took a position to calm the market’s inflation fears, purchasing $4 billion of longer-dated government bonds, those most effected by rising inflation expectations, spurring the biggest drop in yields in a year.

The RBA yesterday refrained from increasing its Australian Federal and State Government bond buying program from $200 billion. However, if the expectations of inflation continue to rise, a bigger bond buying program, as ammunition to cap long-term rising bond yields, will be required in coming months.

Should you wish to discuss this or any other investment related matter, please contact your Investment Services Team on (02) 4928 8500.

Disclaimer

The material contained in this publication is the nature of the general comment only, and neither purports, nor is intended to be advice on any particular matter. Persons should not act nor rely upon any information contained in or implied by this publication without seeking appropriate professional advice which relates specifically to his/her particular circumstances. Cutcher & Neale Investment Services Pty Limited expressly disclaim all and any liability to any person, whether a client of Cutcher & Neale Investment Services Pty Limited or not, who acts or fails to act as a consequence of reliance upon the whole or any part of this publication.

Cutcher & Neale Investment Services Pty Limited ABN 38 107 536 783 is a Corporate Authorised Representative of Cutcher & Neale Financial Services Pty Ltd ABN 22 160 682 879 AFSL 433814.

Smart investing for SMEs: The basics on how to get started and grow your business.

ATO updates: A quick guide on what business owners need to know.

Cutcher's Investment Lens | 24 - 28 March 2025

Is your current super fund holding you back? It might be time for an SMSF.

Cutcher's Investment Lens | 17 - 21 March 2025