Pre-Open Data

Key Data for the Week

- Monday – EUR – Consumer Confidence

- Tuesday – EUR – Consumer Price Index

- Tuesday – AUS – Building Approvals

- Tuesday – AUS – Current Account

- Wednesday – AUS – Gross Domestic Product

- Wednesday – EUR – Unemployment Rate

- Thursday – US – Initial Jobless Claims

- Thursday – AUS – Trade Balance

- Friday – US – Unemployment Rate

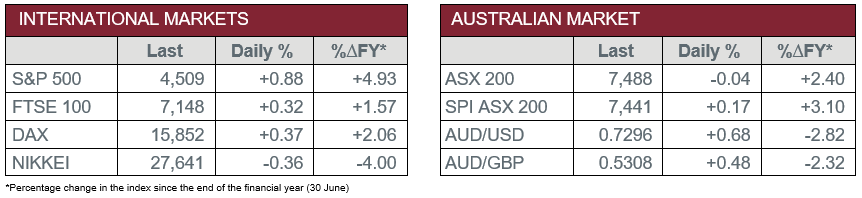

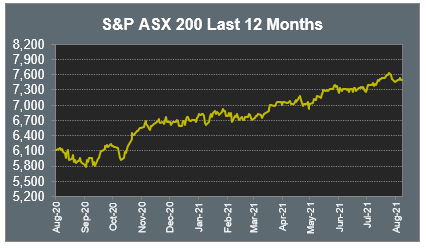

Australian Market

The Australian sharemarket eased 0.1% on Friday in a mixed session of trade. The Consumer Discretionary sector was the main laggard, down 1.6%, followed by the Information Technology sector, which gave up 1.2%. Over the week, the local ASX 200 rose 0.4%.

The Financials sector eked out a 0.2% gain on Friday. The major banks were mixed; Commonwealth Bank and NAB lifted 0.5% and 0.4% respectively, while Westpac fell 0.1% and ANZ lost 0.5%. Insurers were also mixed; Insurance Australia Group rose 0.6% and QBE Insurance gained 0.3%, while NIB slipped 0.5%.

The Consumer Discretionary sector was weighed down by Wesfarmers, which shed 2.8% despite reporting a 40% rise in net profit from continuing operations and a 10% lift in revenue to $33.9 billion. Online furniture and homewares retailer Temple & Webster slid 2.6% and Super Retail Group slipped 1.6%, while JB Hi-Fi fell 1.1%.

The Australian futures point to a 0.17% rise today.

Overseas Markets

European sharemarkets advanced on Friday. Mining stocks were the strongest performers; Anglo American closed up 3.0% and BHP rose 2.2%, while Rio Tinto gained 1.7%. Property stocks also outperformed; Norwegian real estate company Entra added 4.6%, while German real estate company Vonovia rose 1.3%. By the close of trade, the UK FTSE 100 lifted 0.3%, while the German DAX and STOXX Europe 600 both closed up 0.4%.

US sharemarkets also closed higher. Financial stocks outperformed; PagSeguro Digital climbed 5.5% and ICICI Bank added 2.4%, while BlackRock and PayPal gained 2.0% and 1.7% respectively. By the close of trade, the Dow Jones rose 0.7%, while the S&P 500 and NASDAQ added 0.9% and 1.2% respectively.

CNIS Perspective

This week, fifty years ago, US President Nixon completely severed the country’s US Dollar gold convertibility to become a fiat currency. Fiat money is a medium of exchange established by government regulation. Unlike gold, it does not have any intrinsic value, it has value only because a government maintains its value, or because others agree on its worth.

The value is controlled or centralised by the government, who decide how much money is printed. When economies are slow a country can increase the money supply, or when the economy is overheating, they can restrict it. Modern Monetary Theory suggests countries that borrow in their own currency should not worry about government deficits because they can always create money to finance their debt. This ‘theory’ has never been truly tested.

Over the weekend US Fed Chairman Jerome Powell, who is a lawyer, not an economist, spoke at the Jackson Hole Symposium, an annual meeting of central bankers, policymakers, academics and economists from around the world. The speech was analysed for clues of when the Fed would taper the current money printing of US$120 billion per month, which is used to purchase government bonds to pump money into the system and keep interest rates at their extreme lows. No clear time frame was provided, with the Fed balance sheet expected to reach close to US$9 trillion by the end of the year. That’s up more than 10-fold from the start of the GFC.

Borrowing off your own money printing machine is a huge temptation, and many predict it will not end well. Whilst the US stock market is at all-time highs, there is some concern this great experiment with monetary theory may eventually unravel, taking with it the value of the US Dollar burdened by extreme amounts of debt. This certainly adds to the arguments for proponents of digital assets like Bitcoin, who suggest it will be a safe haven as a store of wealth offering a hedge in a median of exchange unburdened by any debt. The safe haven asset of choice has historically been gold, but the future might be ‘digital gold’ in the form of Bitcoin.

Should you wish to discuss this or any other investment related matter, please contact your Investment Services Team on (02) 4928 8500.

Disclaimer

The material contained in this publication is the nature of the general comment only, and neither purports, nor is intended to be advice on any particular matter. Persons should not act nor rely upon any information contained in or implied by this publication without seeking appropriate professional advice which relates specifically to his/her particular circumstances. Cutcher & Neale Investment Services Pty Limited expressly disclaim all and any liability to any person, whether a client of Cutcher & Neale Investment Services Pty Limited or not, who acts or fails to act as a consequence of reliance upon the whole or any part of this publication.

Cutcher & Neale Investment Services Pty Limited ABN 38 107 536 783 is a Corporate Authorised Representative of Cutcher & Neale Financial Services Pty Ltd ABN 22 160 682 879 AFSL 433814.

Cutcher's Investment Lens | 7 - 11 April 2025

The failed $3 million super tax: Division 296 is done… or is it?

Cutcher's Investment Lens - Update on Trump & Tariffs | 31 March - 4 April 2025

Liberation Day - April 2025 Snapshot

Smart investing for SMEs: The basics on how to get started and grow your business.