Pre-Open Data

Key Data for the Week

- Tuesday – EUR – Economic Confidence rose to a 21-year high of 117.9 in June, from 114.5 in May.

- Tuesday – US – Consumer Confidence jumped 7.3 points to 127.3 in June.

- Wednesday – CHINA – Manufacturing PMI

- Wednesday – EUR – Consumer Price Index

Australian Market

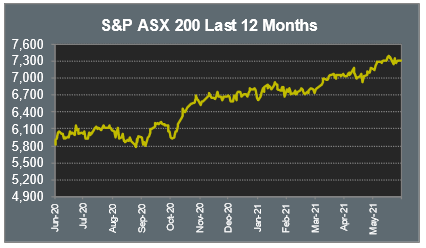

The Australian sharemarket fell as much as 0.9% throughout yesterday’s trade, although a late rally helped the market to close only 0.1% lower. The reason for the fall coincides with the announcement of a new three-day lockdown for parts of Brisbane, as the Delta variant of COVID continues to spread.

The Materials sector was weakened by mixed performances among the major miners; BHP lost 0.7% and Rio Tinto conceded 0.8%, while Fortescue Metals lifted 0.4%. Gold miners continued their recent run of weakness as inflationary fears have eased; Northern Star Resources dropped 1.2%, Evolution Mining fell 0.4% and Gold Road Resources closed 2.7% lower.

Insurance companies also felt the effects of market-wide weakness as QBE and Insurance Australia Group both lost 1.4%. Genworth Mortgage Insurance slipped 15.8% after news they may not be able to secure future contracts with Commonwealth Bank. The companies currently have an exclusive agreement, although Commonwealth Bank will look to other lender mortgage insurance providers once their contract ends.

The Information Technology sector was the best performer on the market, up 0.7%. Artificial Intelligence provider Appen, lifted 1.1%, while accounting software provider Xero, gained 0.8%.

The Australian futures market points to a 0.45% rise today, driven by stronger overseas markets.

Overseas Markets

European sharemarkets closed higher on Tuesday, aided by an increase in economic confidence. Financial stocks were among the best performers; ING Groep lifted 2.2% and Barclays added 1.0%. The announcement of a share buyback plan from Adidas resulted in a 2.5% gain and helped lift the German DAX 0.9%. By the close of the session, the pan-European STOXX 600 closed 0.3% higher, while the UK FTSE 100 was up 0.2%.

The NASDAQ and S&P 500 both closed at record highs overnight as technology stocks were buoyed by a positive consumer confidence report. The Information Technology sector was the best performer on the market, up 0.7%, aided by market-leader Apple, which added 1.2%. Shares in Morgan Stanley gained 3.4% as they announced they will double their dividend to US$0.70 per share in the third quarter. Before the close of trade, JP Morgan, Bank of America, and Goldman Sachs also increased their expected dividend.

By the close of trade, the NASDAQ rose 0.2%, while the Dow Jones and the S&P 500 both eked out a less than 0.1% gain.

CNIS Perspective

It appears as though the debate about whether Bitcoin will become a more common and readily accepted form of currency will continue for some time yet.

Certainly, the latest scam out of South Africa won’t help its cause.

A pair of brothers from Cape Town, formerly running a cryptocurrency investment platform, have made off with 69,000 Bitcoins held in their custody.

The value of the scam is roughly US$3 billion (that’s real currency!) and is the largest ever dollar loss in a crypto scam to date.

If you believe Nassim Taleb, author of Black Swan, it doesn’t matter because he suggests that blockchain shows no evidence of being a useful technology and that Bitcoin is worth “exactly zero”.

The jury is still out over Bitcoin, but we are seeing evidence that blockchain technology may have some application in providing efficiencies in some financial transactions.

Time will tell.

Should you wish to discuss this or any other investment related matter, please contact your Investment Services Team on (02) 4928 8500.

Disclaimer

The material contained in this publication is the nature of the general comment only, and neither purports, nor is intended to be advice on any particular matter. Persons should not act nor rely upon any information contained in or implied by this publication without seeking appropriate professional advice which relates specifically to his/her particular circumstances. Cutcher & Neale Investment Services Pty Limited expressly disclaim all and any liability to any person, whether a client of Cutcher & Neale Investment Services Pty Limited or not, who acts or fails to act as a consequence of reliance upon the whole or any part of this publication.

Cutcher & Neale Investment Services Pty Limited ABN 38 107 536 783 is a Corporate Authorised Representative of Cutcher & Neale Financial Services Pty Ltd ABN 22 160 682 879 AFSL 433814.

Cutcher's Investment Lens | 7 - 11 April 2025

The failed $3 million super tax: Division 296 is done… or is it?

Cutcher's Investment Lens - Update on Trump & Tariffs | 31 March - 4 April 2025

Liberation Day - April 2025 Snapshot

Smart investing for SMEs: The basics on how to get started and grow your business.